Supply preview - Week of 8th November - Will & James at Astor Ridge

- More brutal moves this week, exacerbated by position unwinds

- Lagarde leading the dove-pack, saying that a move in the base rate is off the cards in 2022. BOE obviously wrong footed the market yesterday leaving rates unchanged. Message from the CBs is clear – they are going to do what they want. That said, who is going to buy all the bonds in Q1?

- Realistically, levels are pretty ambivalent right now. It's tempting to fade the rally in 30y Buxl, but with the supply drying up it's still going to be a wild ride into the Dec ECB meeting

- IK/Rx similarly not offering much here. With generic curves at 116 I don't think it's a fade until 110.00, and not least given the continued strength in credit and equities.

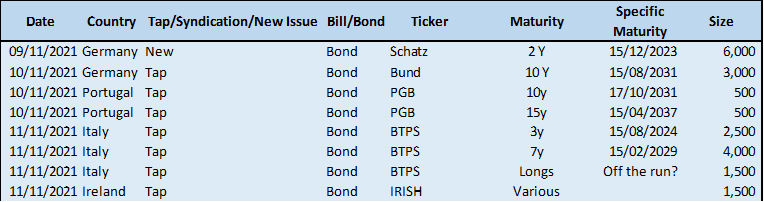

- So for now we will focus on supply:

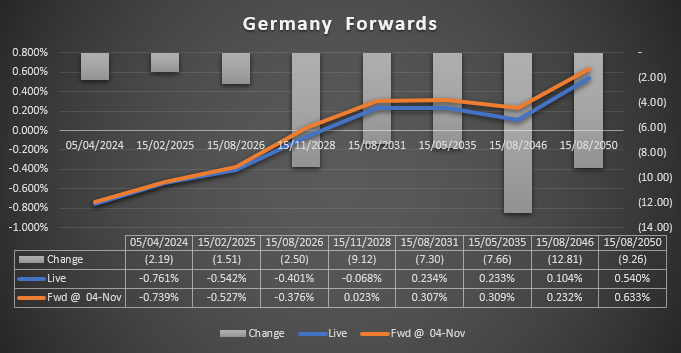

Germany tapping the 8/31 on Wednesday in 3bn

- It's a cheap bond, but at the margin the 2/31 are cheaper in terms of pure RV, so we would need a more localized cheapening to be more interested.

- There is an argument to say that 10y looks good value based on the levels of forward rates, but even vol weighted I think it is going to trade as a long end steepener, so not for the faint of heart.

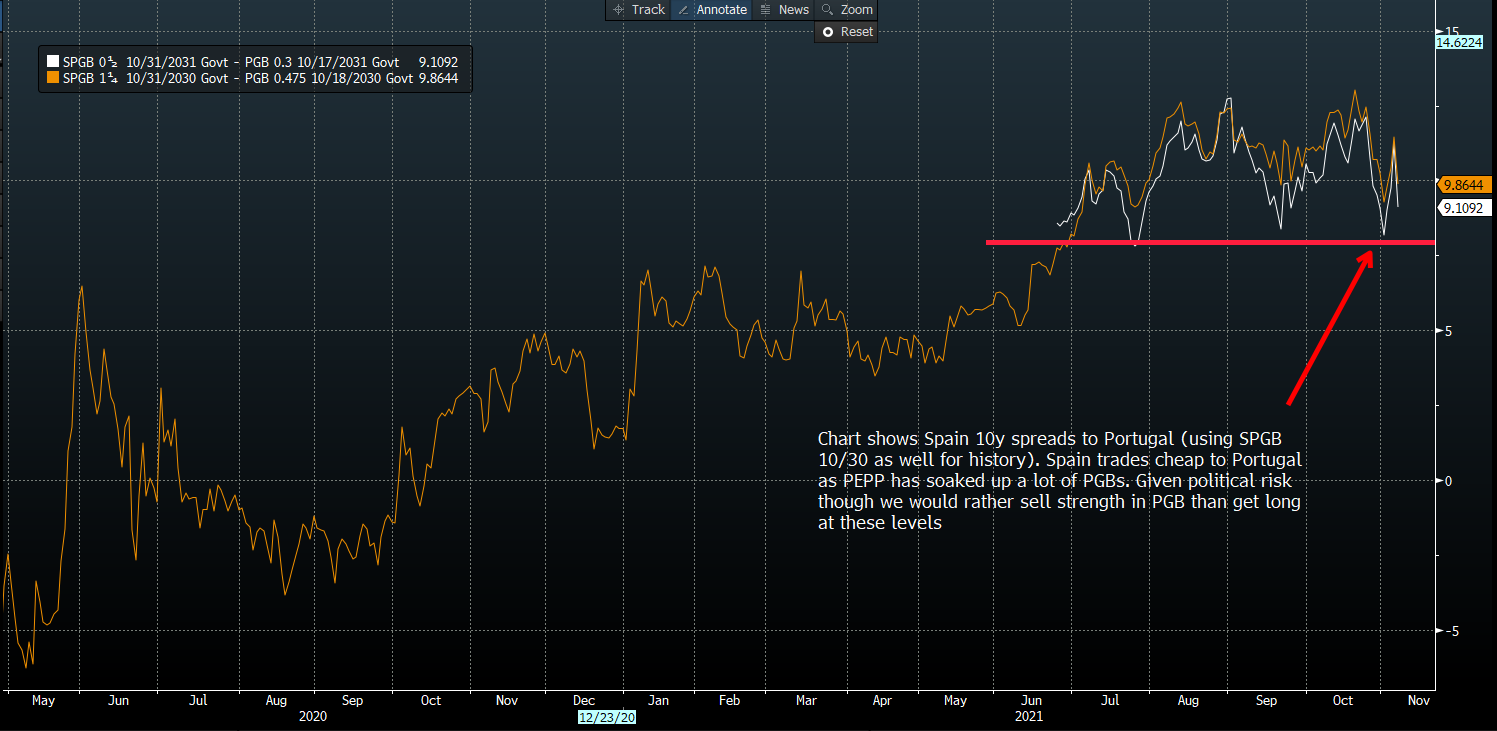

Portugal tapping 10/31 and 4/37 in 1bn

- Portuguese politics have left the issuer under pressure this week, and by all accounts this can continue into the new year (elections on 30th Jan 2022)

- BBG story here: https://blinks.bloomberg.com/news/stories/R1YFRRDWRGG0

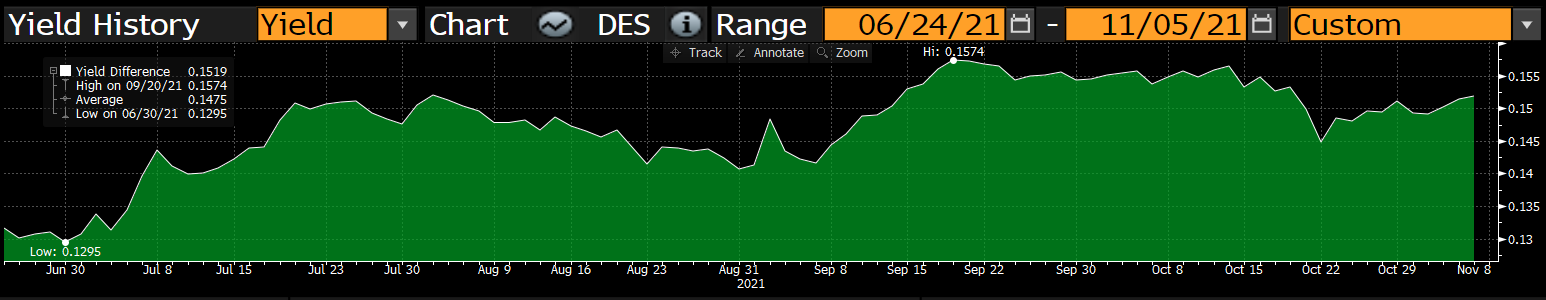

- Portuguese spreads to Spain remain rich, even if the have cheapened recently:

- On a more bond-specific basis the 34s are rich and off the run. No doubt there is a PEPP short to clear in the dealer market, but we see no value in them.

- The 31s on the other hand have had a decent cheapening. I would put the roll on above 15.5, but it would be for a quick correction as if we did get election related widening then it's most likely the 10/31 that would get sold

-

- Portugal 10y roll:

Ireland tapping bonds on Thursday

- Bonds TBA Monday morning. If I had to guess I'd say 5/35s and possible the Green 3/31s?

- Ireland had a fantastic cheapening into the last supply, so fingers crossed we see the same again on Thursday.

- In the meantime for anyone still looking at short French structures then the recent richening of FRTR 5/30 has left us this little amuse-bouche:

Sell FRTR 5/30 -> IRISH 10/30 – levels could get even better into supply on Thursday

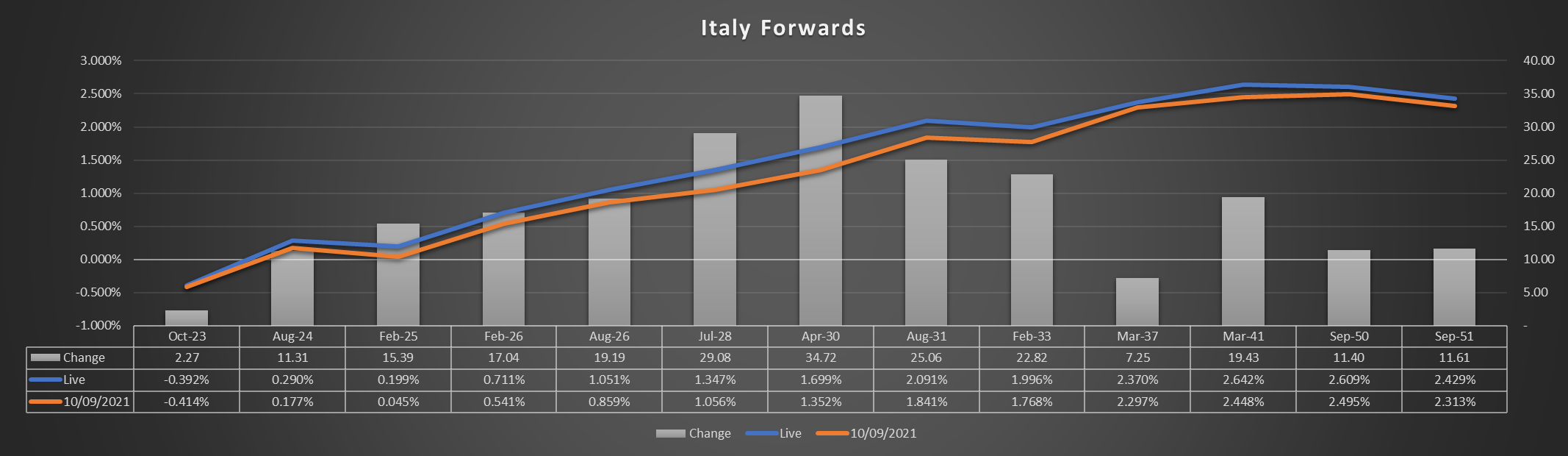

Last, but by no means least we have Italy on Thursday in 3y, 7y & longs

- As per the Q4 issuance program we will get a new 3y & 7y before year end. It makes sense given the outstandings that we will get the new 7y (2/29) next week, followed by the 3y in Dec.

- Best guess the size will be 4bn and assuming 2bn for the 8/24 (final tap) I think we probably only get an off-the-run long end bond

BTPS 2/29 pricing:

- Using a roll vs 7/28 of +10 basis points the 2/29 would appear pretty cheap in pure RV terms. Obviously all the on the run bonds have some discount, but I think this should put pressure on the 8/29 & 8/30 as we head into the pricing. IK also looks cheap here, so ahead of the auction I want to

- Sell 8/30 basis

- Sell 8/29 basis

- Then turn this trade into a fly closer to the auction. If the supply is sloppy then our shorts should steepen. If supply goes really well then even if we don't buy the new 7y we should see IK (Dec-28) correct richer. Obviously we need to see where the new 7y roll starts trading in WI anyway

BTPS 8/24

- It's cheap, and they are going to stop tapping it. Plus it should end up being a pretty small issue (sub15bn) I like the simple steepener 8/24 vs 2/25

- Granted the front end of Italy is a mess. The 23s distort everything and ALL the 24s are cheap.

- BUT the new 3y in Dec will be a 12/24 which will 1) Come with a discount like all the rest of the 3y paper and 2) Kinda has to pressue the 2/25 as the only low coupon bond in the area

Buy BTPS 8/24 vs BTPS 2/25

![]()

Will Scott

O: +44 (0) 203 - 143 - 4800

M: +44 (0) 789 – 441 -7709

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Will Scott. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

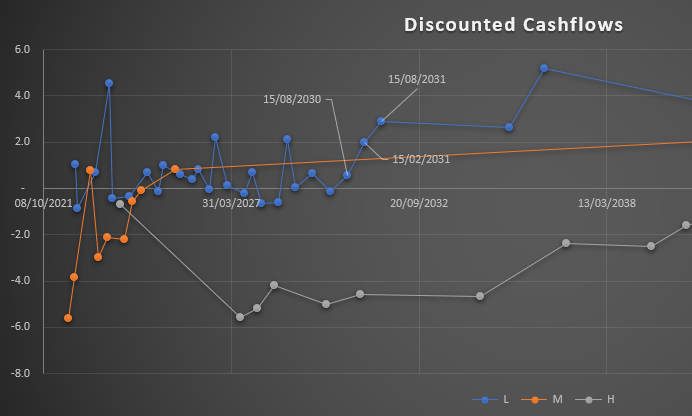

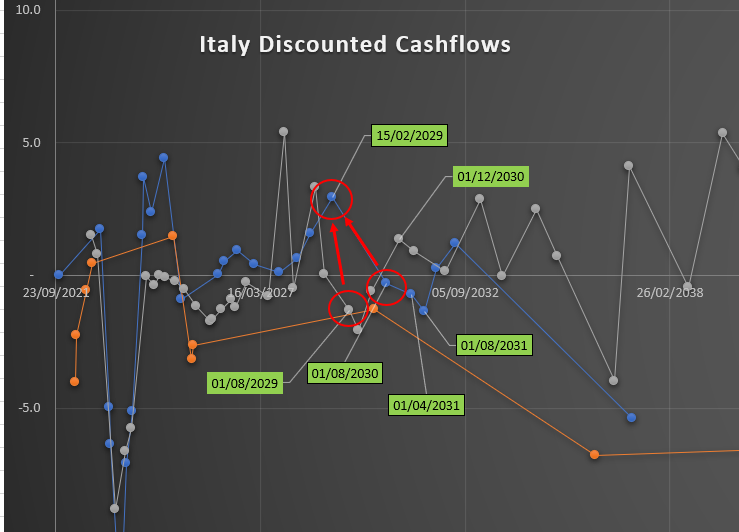

Italy to buy back bonds on 4th November / Analysis

Italy just announced their widely anticipated buyback, hot on the heels of a 40+ tick rally in BTS today. Note that today the 2y-10y curve had pretty much a parallel shift with many questioning why we weren't flattening – now we know why!!

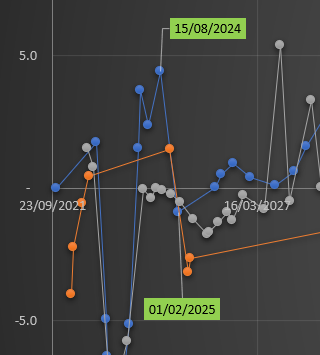

Changes on Day 2nd November 2021 – Italy in red

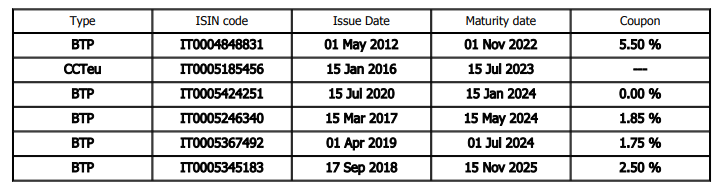

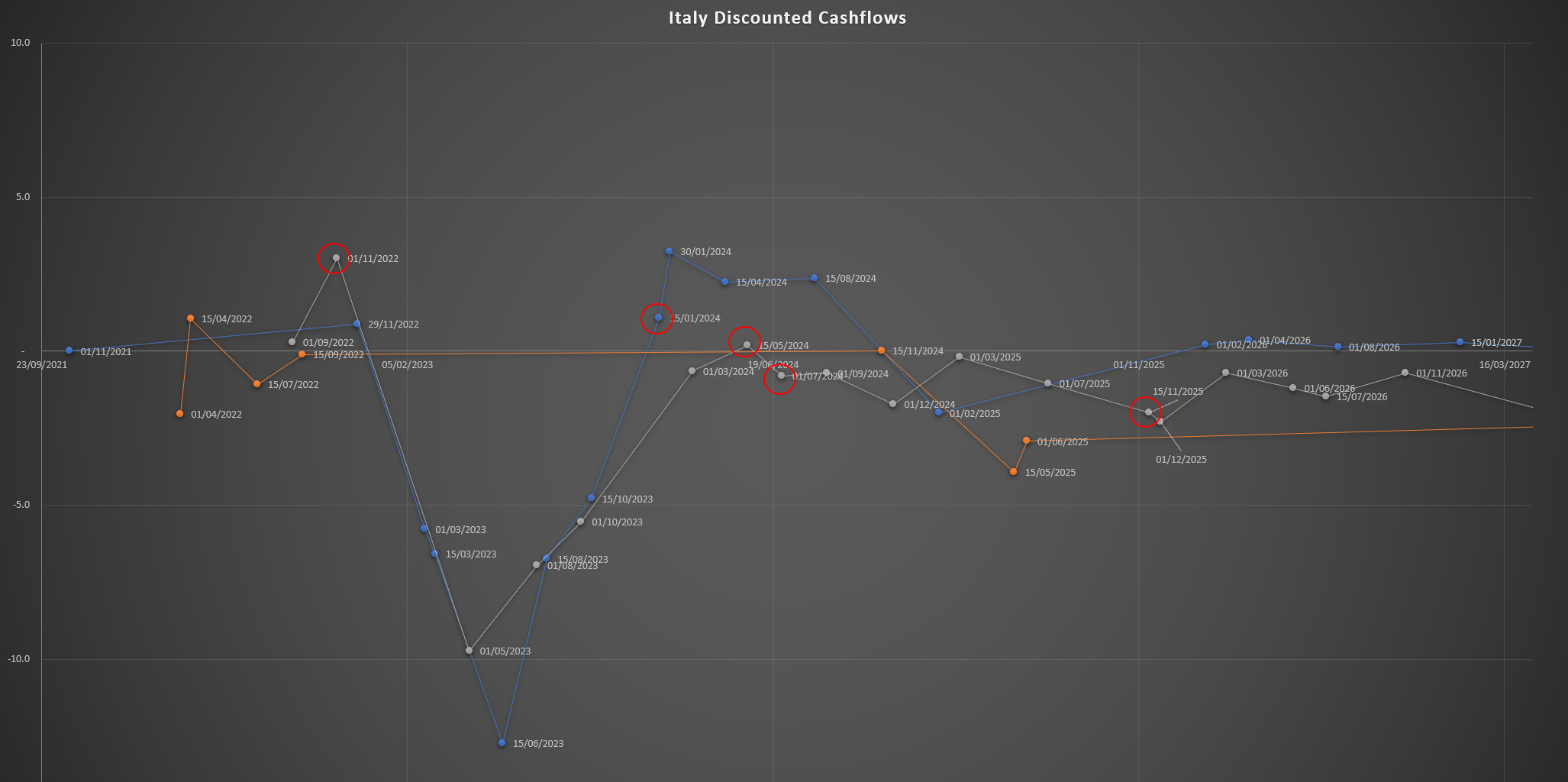

Size will be up to 5bn of the following bonds:

Note that the already incredibly rich 2023 sector is only represented by the 7/23 CCT.

Instead they are buying a whole bunch of "cheap" bonds – did someone at the Tesoro start trading RV? Note as well that the 15/1/24 is the CTD to BTSZ1, and the 7/24 should be CTD to BTSM2.

In addition this may well take some pressure off the 2023 sector which dealers have been reluctant to short given the presumption that the sector will be bought back.

Worth keeping an eye on the results – some of these 2023 have gone to live in a very special place as a result of buybacks.

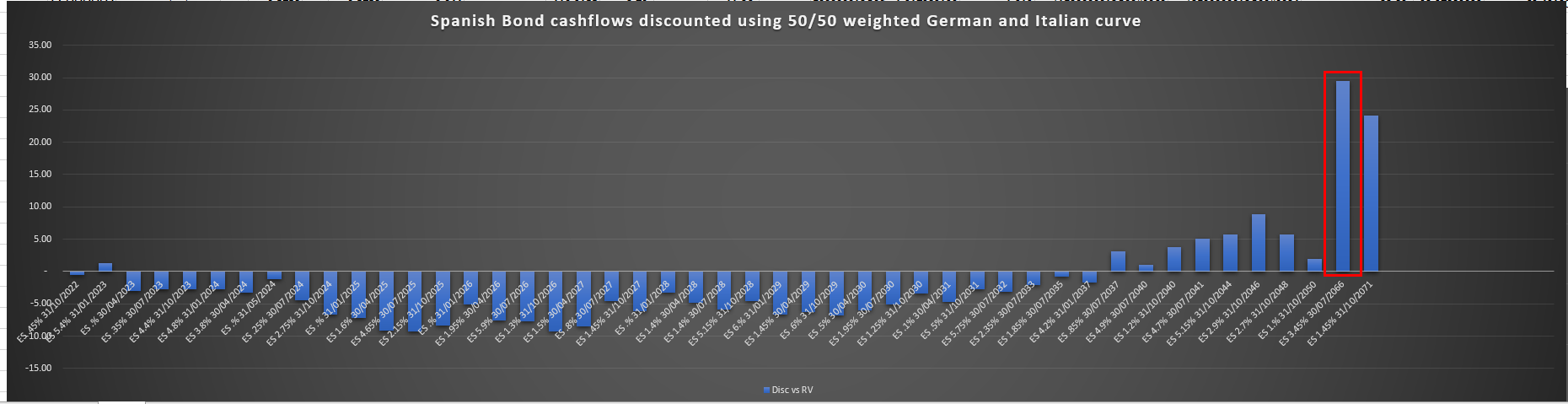

Italy Rich/Cheap below (DCF Methodology) with Buyback bonds (excluding CCT) circled in red

Link to the press release here:

![]()

Will Scott

O: +44 (0) 203 - 143 - 4800

M: +44 (0) 789 – 441 -7709

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Will Scott. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Eurozone "Greeniums"

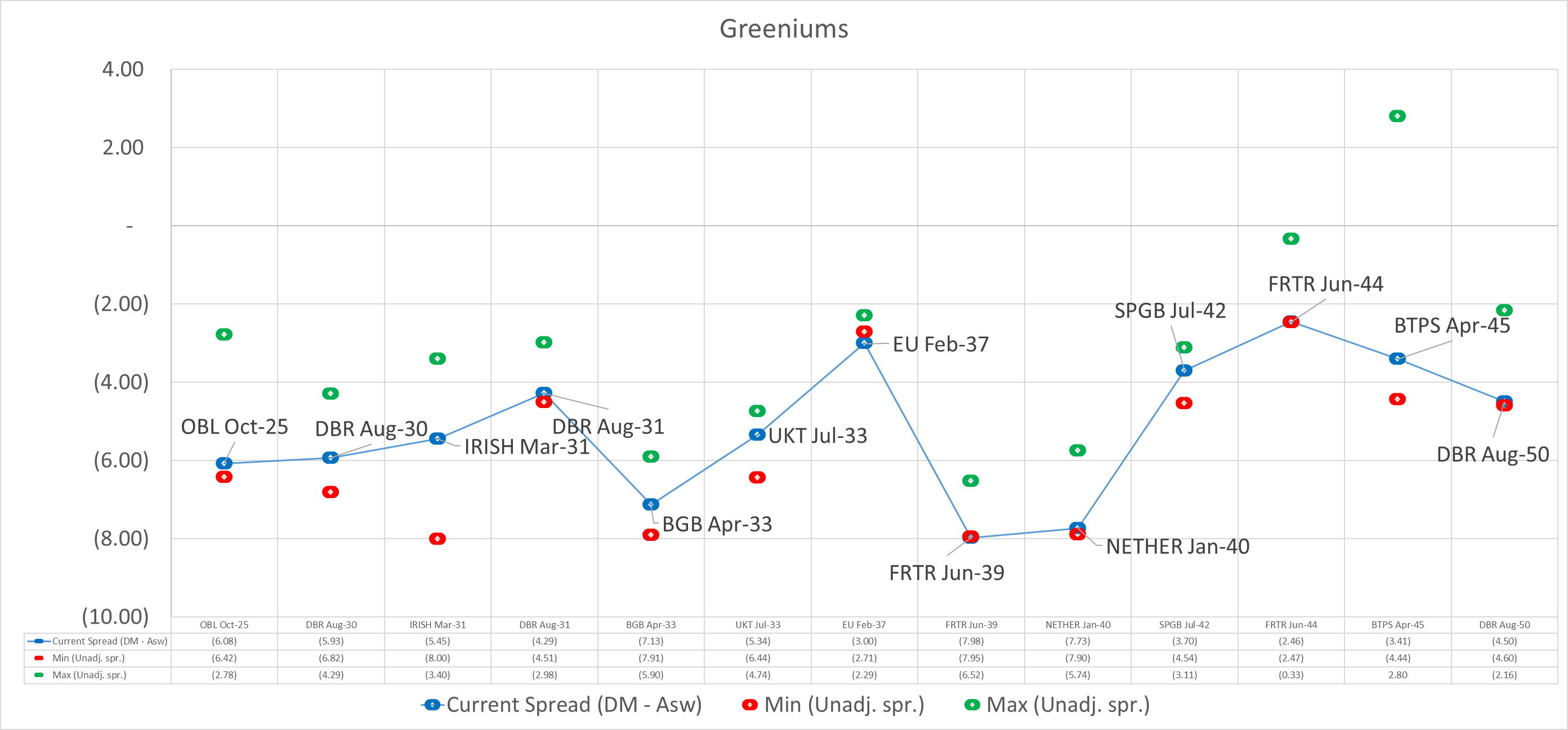

Taking a look at the Green premium vs fitted curves, and it highlights the following:

- The average premium is 5.15 basis points

- EU 37 (new bond), SPGB 7/42 and FRTR 6/44 all trade "cheap" in this context. Worth noting that both the EU and the FRTR 6/44 are at or through their 60 day tights today

- UK 7/33 fairly neutral as we head into the 53s next week

- It's unsurprisingly a quite consistent picture, but worth keeping an eye on as it is clear that -2 (for example) is something of a boundary condition. Whether this endures as the green curves build out is another matter, but it's an interesting relationship in the context of less PEPP:

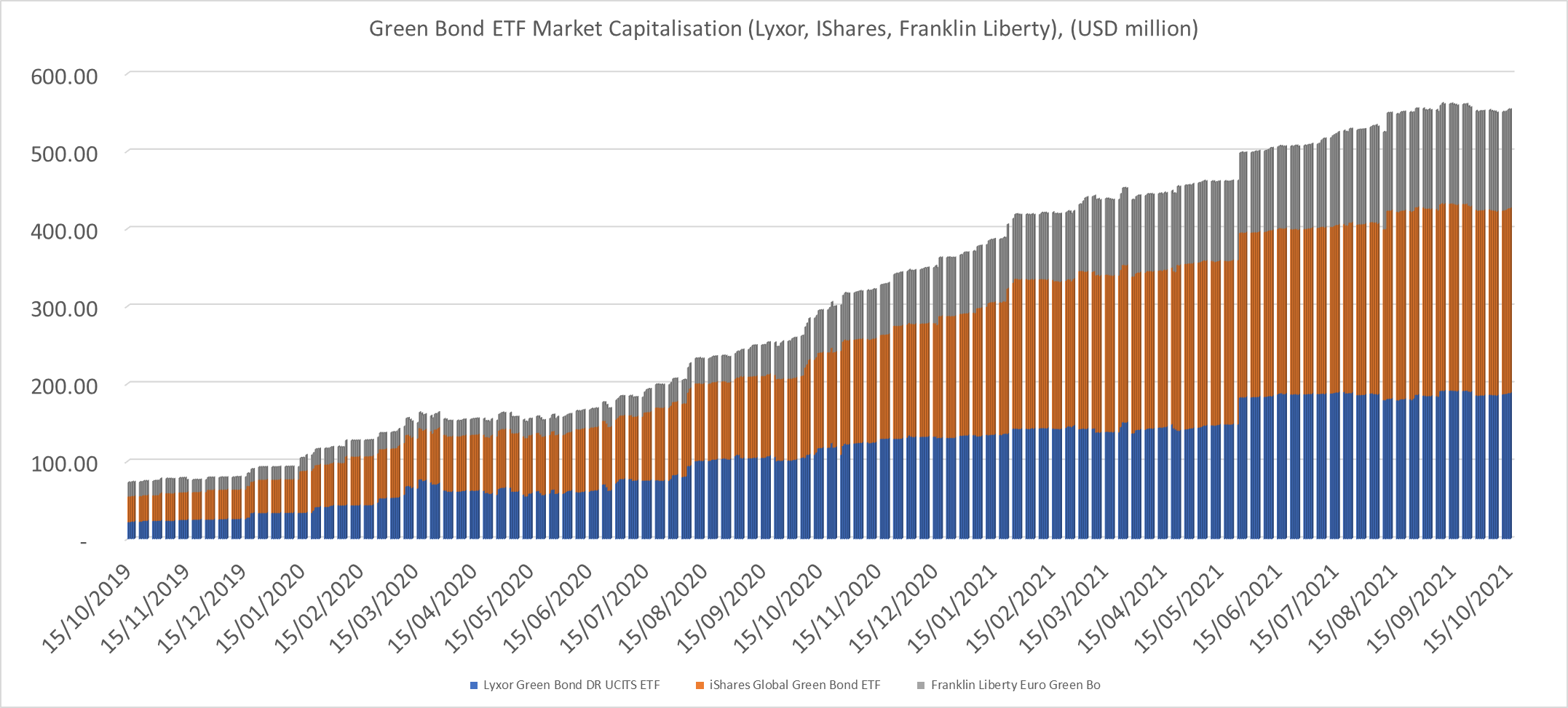

- All the major ETF providers seem to be launching Green bonds ETFs

- Below is the randomly selected Market Cap of 3 Green bond ETFs (Lyxor, Blackrock, Franklin Templeton). Whilst currently small, they certainly exhibit upward growth.

- Green EGB are naturally a core holding for these funds, and the outstanding size of the Green bond universe is still "relatively" limited.

- Strikes me that as APP purchases slow and ESG space continues to gain traction we should see continued support for Green spreads and dare I say it they could even trade with a slight short delta bias?

Will Scott

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4171

Mobile: +44 (0) 7894417709

Email: WILL>SCOTT@astorridge.com

Website: www.astorridge.com

This marketing was prepared by Will Scott, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

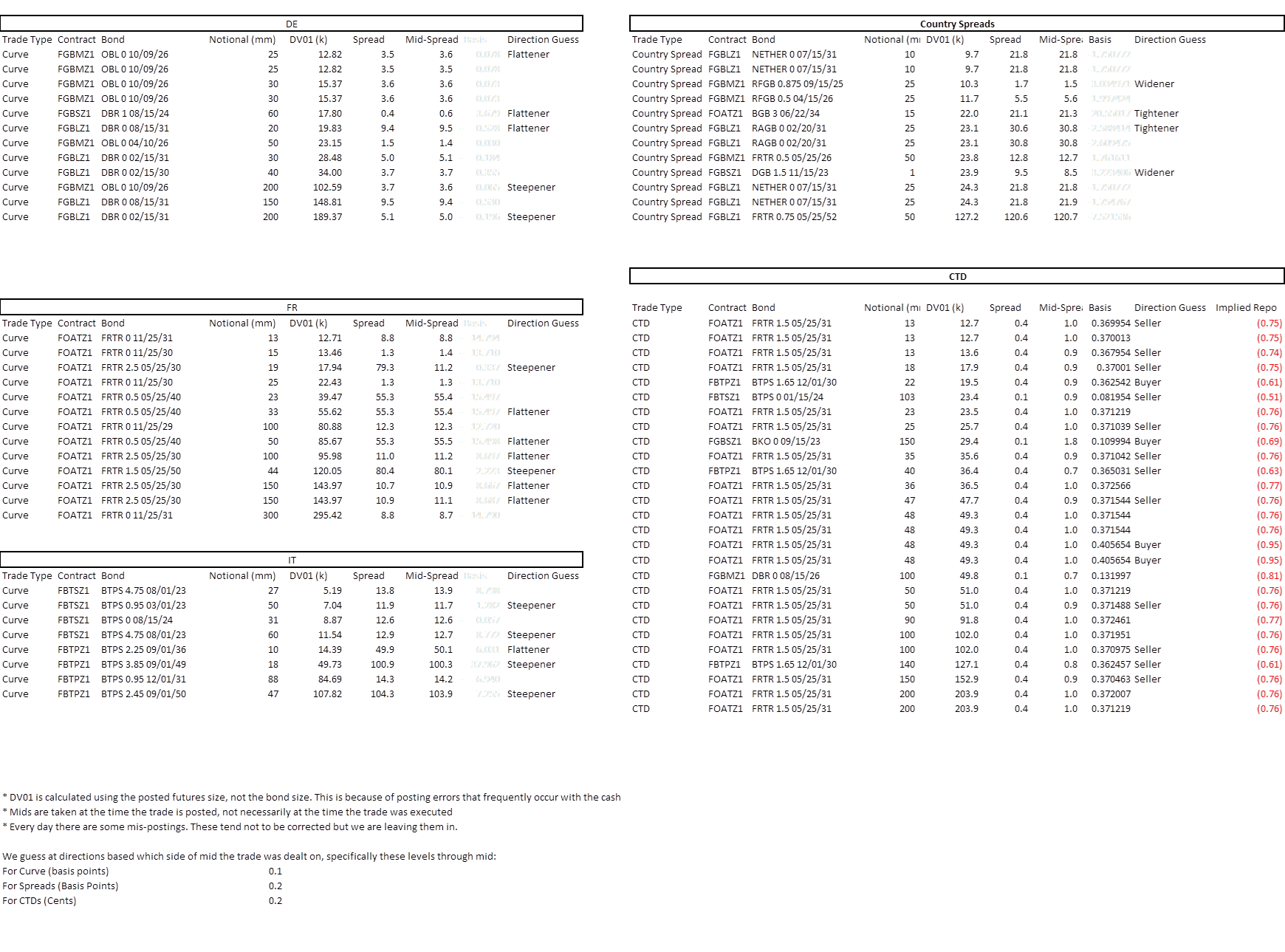

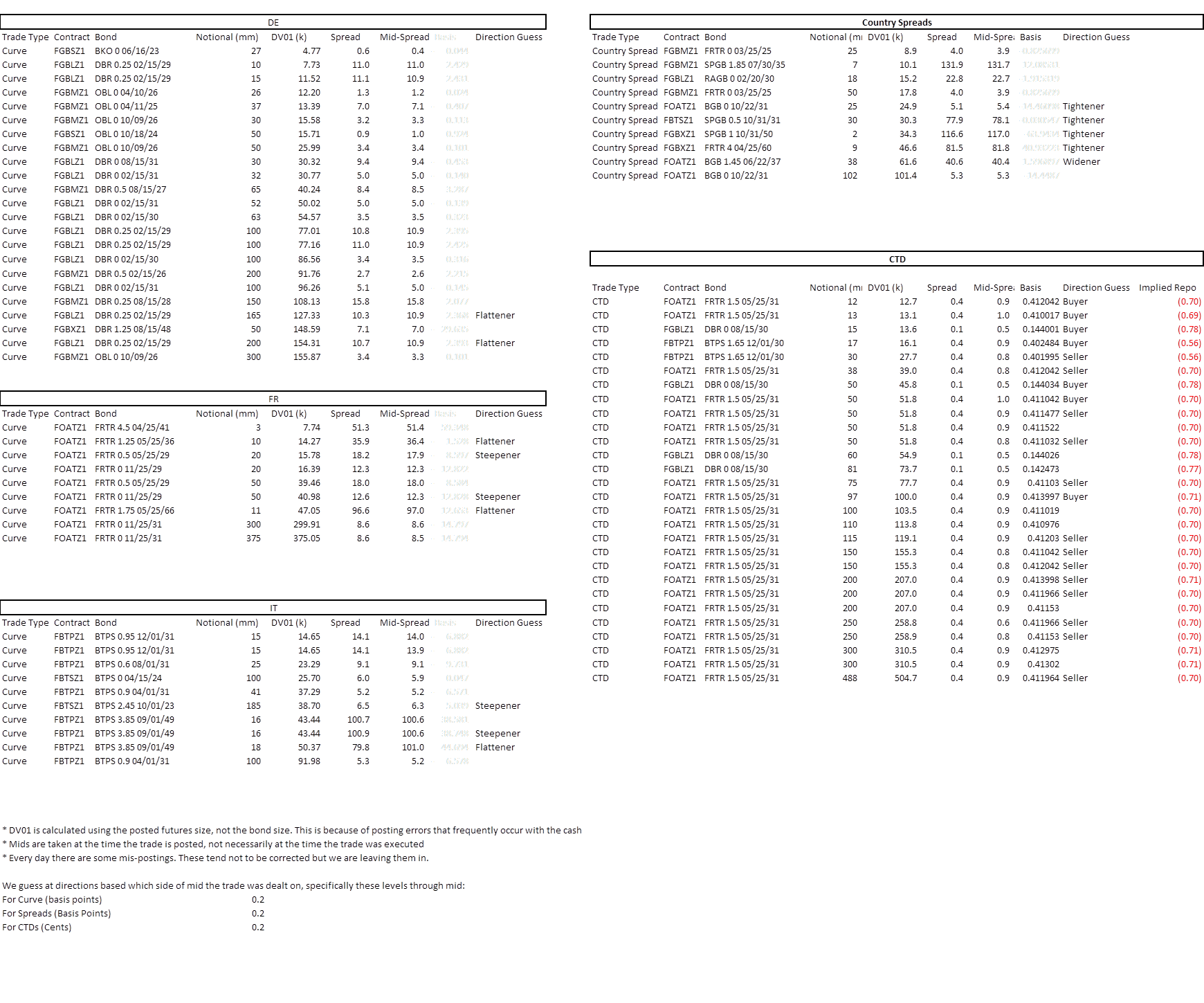

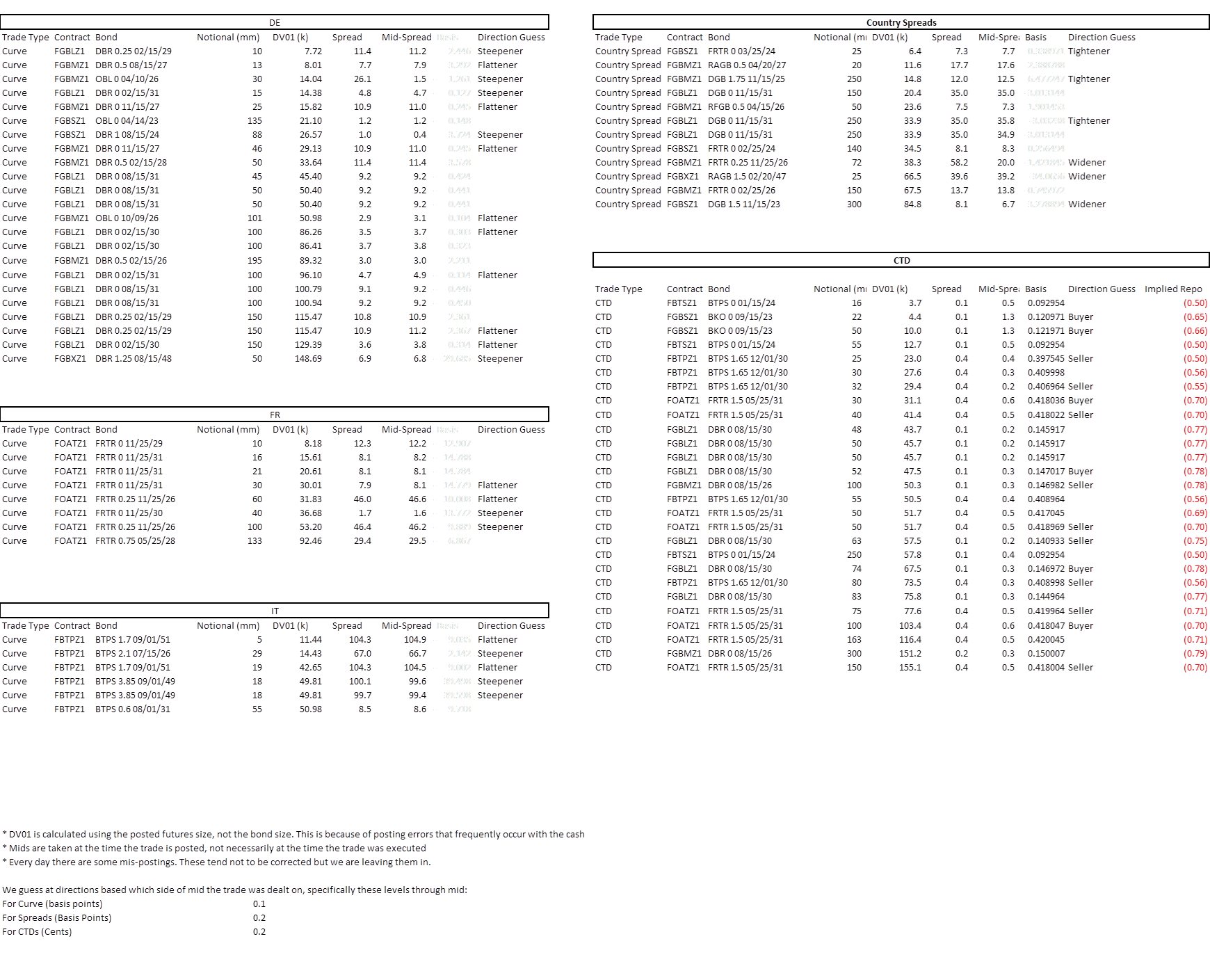

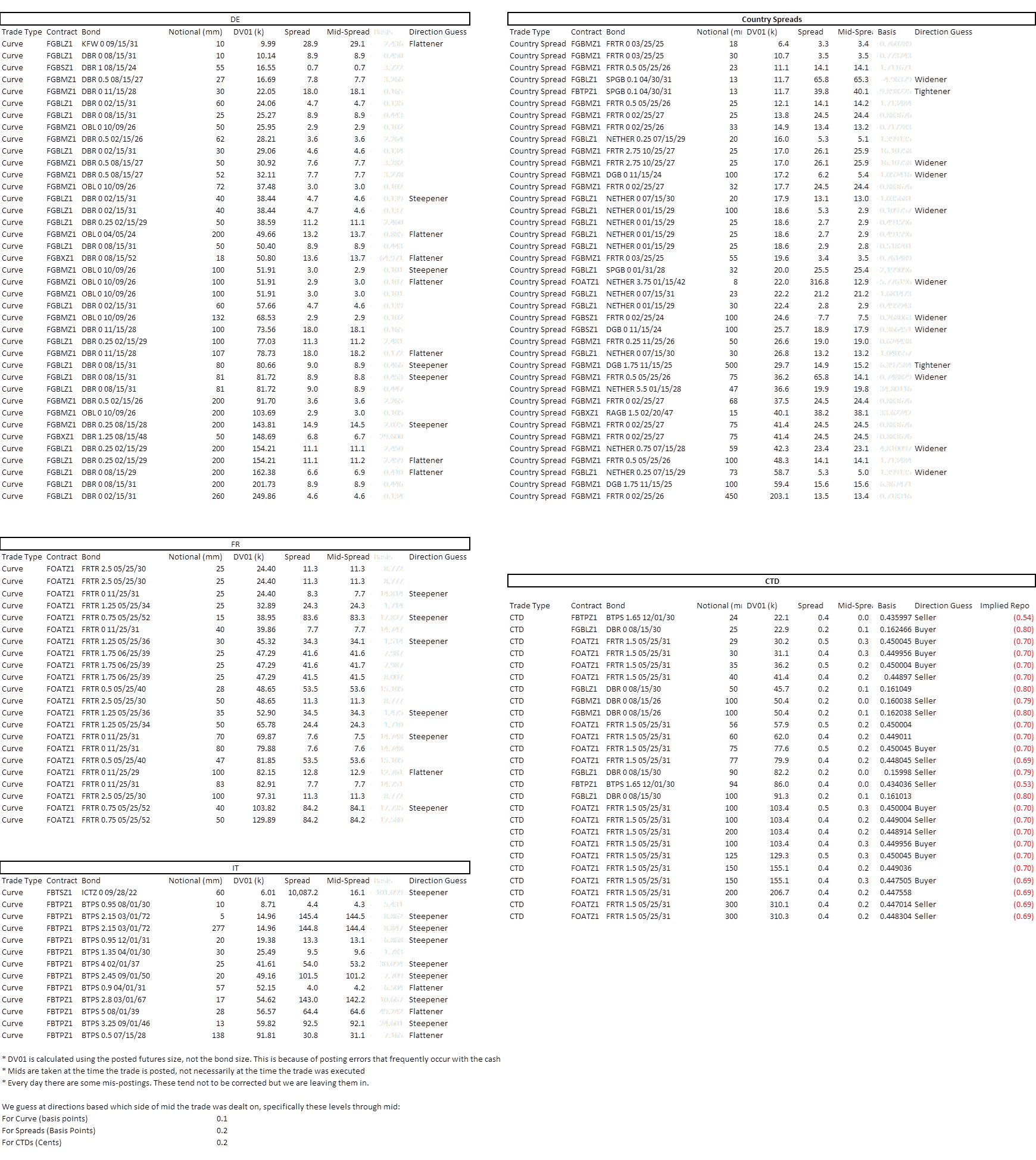

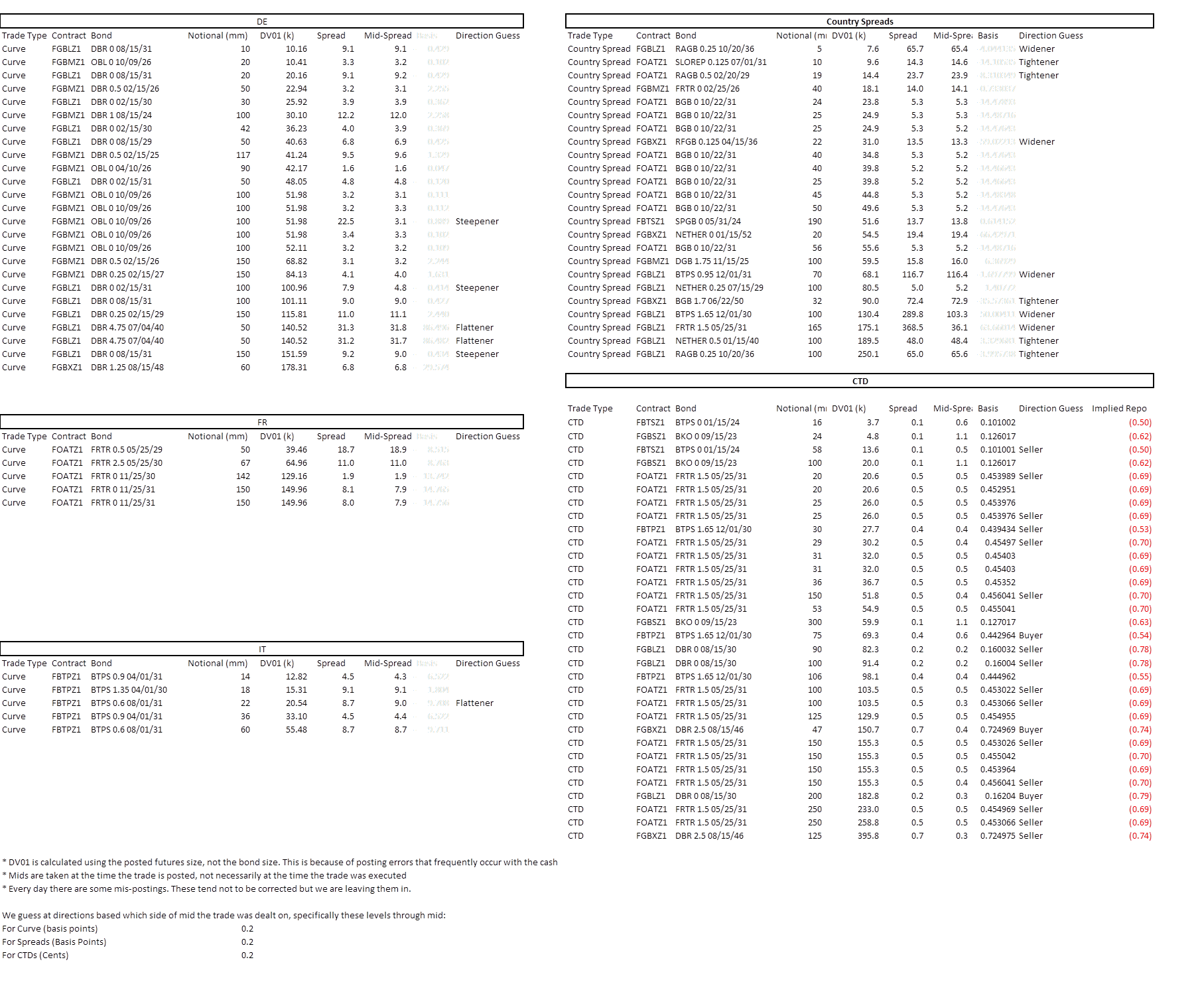

EGB EoD Eurex Basis Trades

![]()

Will Scott

O: +44 (0) 203 - 143 - 4800

M: +44 (0) 789 – 441 -7709

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Will Scott. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

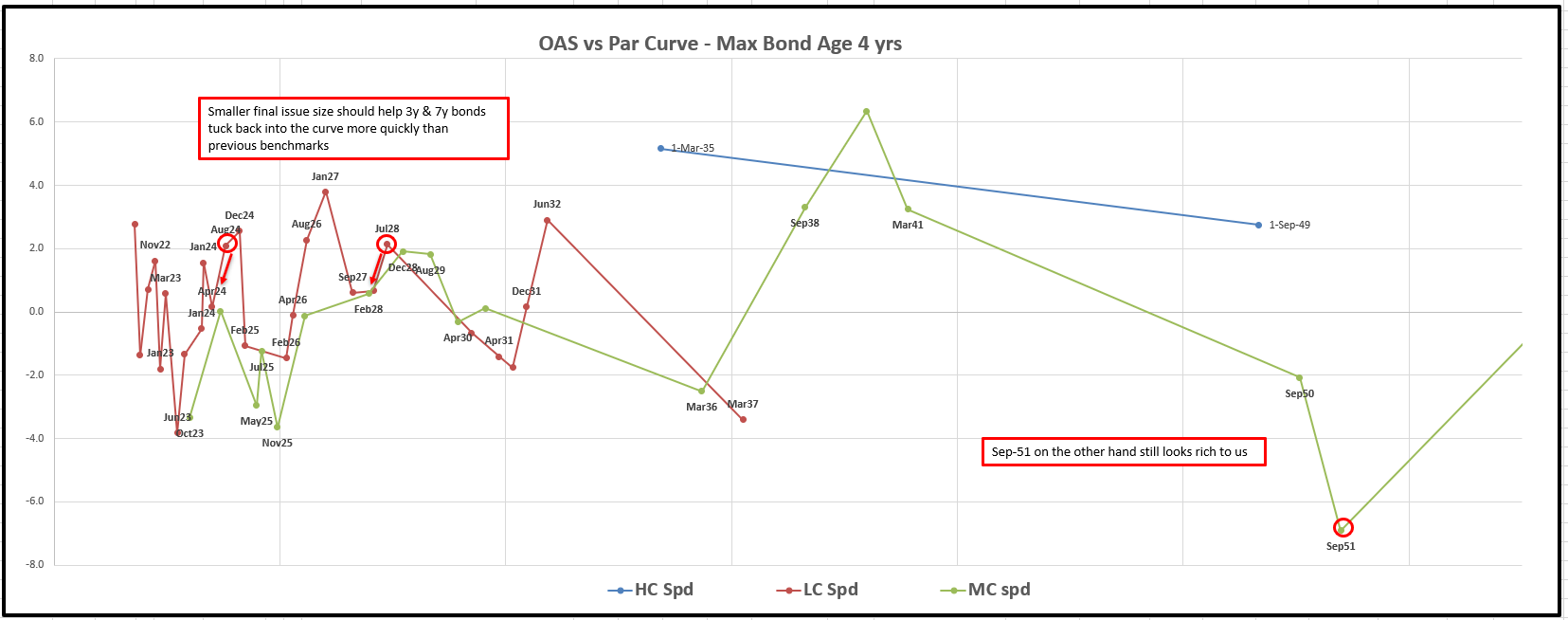

BTP Supply & RV - Will & James at Astor Ridge

- Italy to tap 3y,7y & 30y tomorrow

- 3bn 8/24

- 2bn 7/28

- 1.5bn 9/51

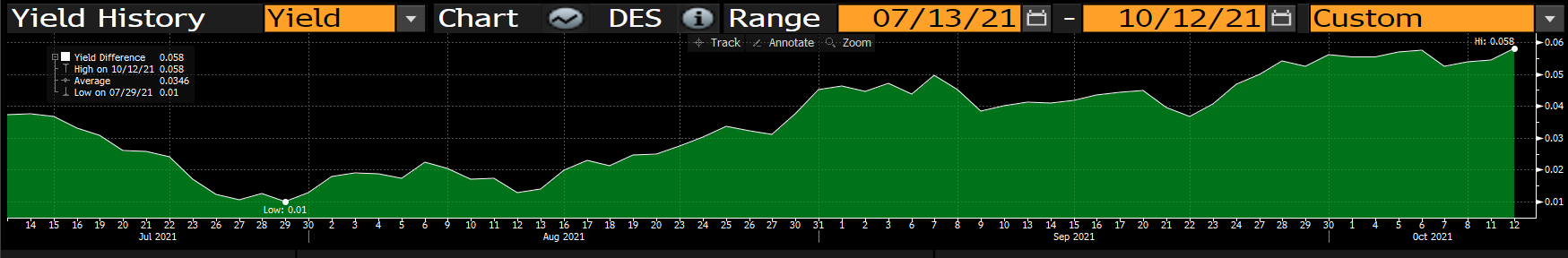

- Italy in general is doing pretty well as a credit. Politics is drifting more centrist; huge EU grants are driving post-pandemic productivity and funding costs are very low. On top of this it remains the only EU issuer that yields meaningfully more than zero… even if you need to go out past 5y to get it.

- Additionally, the Tesoro is using its current strong cash position to issue lower auction sizes, tap off the runs in the long end and if we are to believe "market sources" won't be doing a syndicated (nominal) long bond in the immediate future

- All that said, we don't really know how higher inflation is going to feed into valuations over the next couple of quarters, and whether we like it or not BTPs are the credit bellweather in EGB space. Right now, they are trading in a touch rich vs x-mkt assets. I think any meaningful tightening towards 100 bpts will be faded.

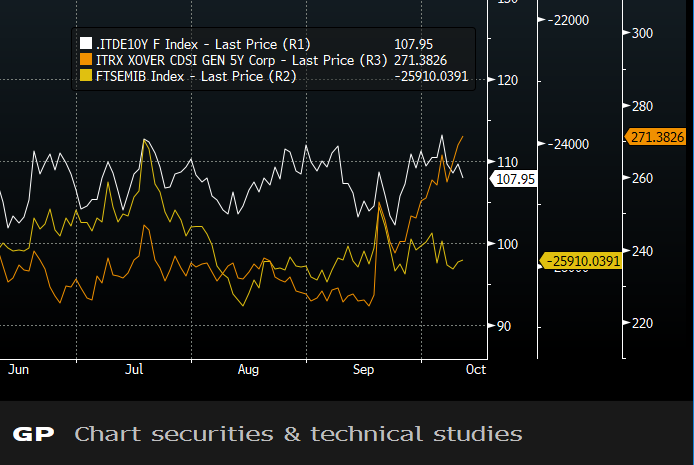

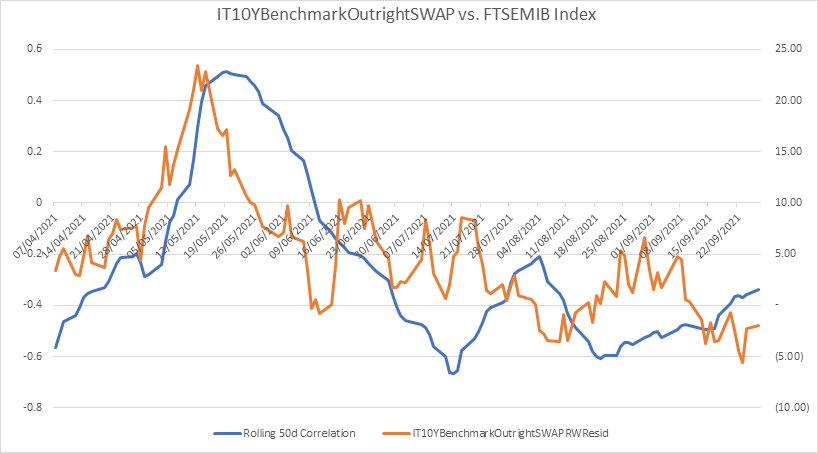

It/DE, XOVER & FTSEMIB – Italy outperforming

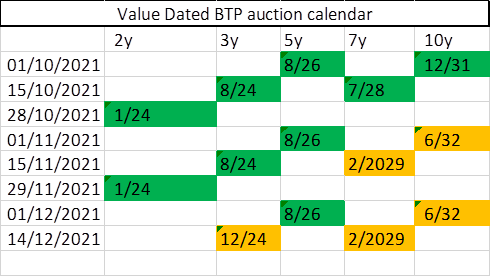

- Q4 issuance gives us a whole host of new bonds before year end. According to the below schedule (our guesses) we likely see a new 10y this month (6/32), new 7y in November(2/29) and a new 3y (12/24) just before Christmas

- This leaves both the 3y & 7y as pretty small sized bonds relative to their predecessors, which means they should, unlike a lot of other benchmarks in EGB right now, perform back into the curve more quickly.

Spreads to par curve below: We want to own the 7/28, but they have done pretty well, so we are looking for a pullback given that the new 2/29 could come cheap and the old 9/28 is already/still VERY cheap

- Similarly, whist there is clearly demand out there for 30y Italy (judging by the price action) we don't see the value in the curves vs Germany, and in Germany don't see the value in the 30y point full stop compared to cheaper and shorter forwards.

Trade: Buy BTPS 8/24 vs BTPS 2/25

Enter: 6 basis points

1st Target: 9 basis points

- Btps 8/24 should only have one more tap

- Feb-25 is trading rich and should roll up to curve towards the on the run-3y point

- New Bond to be likely launched in December will be a BTPS 12/24, which should pressure the 2/25

- Flat 3m carry

Forward curves show a distinct kink in the curve between 8/24 and 2/25

As illustrated by the move in the 10/23 vs 8/24 vs 2/25 fly

So whilst the spread looks steep as a function of the selloff in rates, we feel that it has further to go

Will Scott

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4171

Mobile: +44 (0) 7894417709

Email: WILL>SCOTT@astorridge.com

Website: www.astorridge.com

This marketing was prepared by Will Scott, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

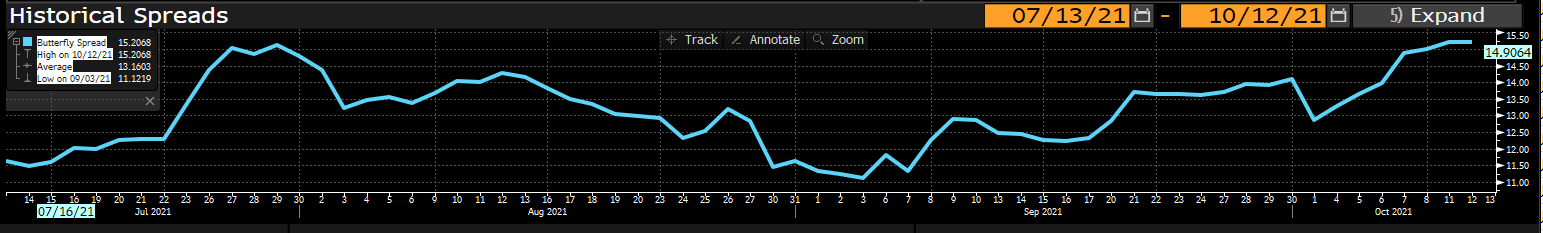

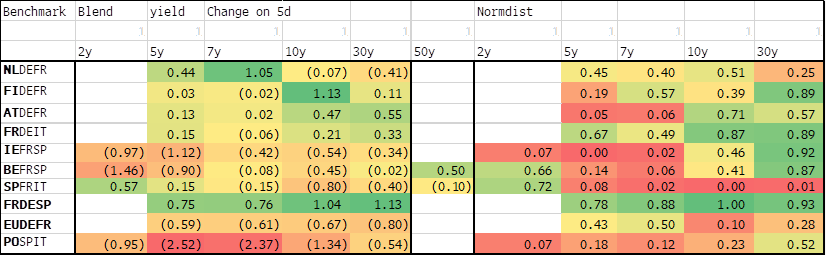

EoD EGB Comment - Will & James @ Astor Ridge 07/10/21

- Markets unable to maintain their bullish start to the day given the rebound in stocks and the late afternoon bid for crude

- Spreads telling a different story though with BTP tightening from the outset on the back of last night's ECB headlines, and remaining well bid into the close

- You could argue that IK/RX should have tightened anyway given the equity bounce, as the below chart shows, but if ECB really will be able to diverge from the capital key at will then it's pretty bullish for 5y Italy/Germany spreads – more than 10y spreads I would argue

- Trade and fades out from James on a separate email – let us know if you didn't get it

IK/RX, XOVER & FTSEMIB all moving in lockstep

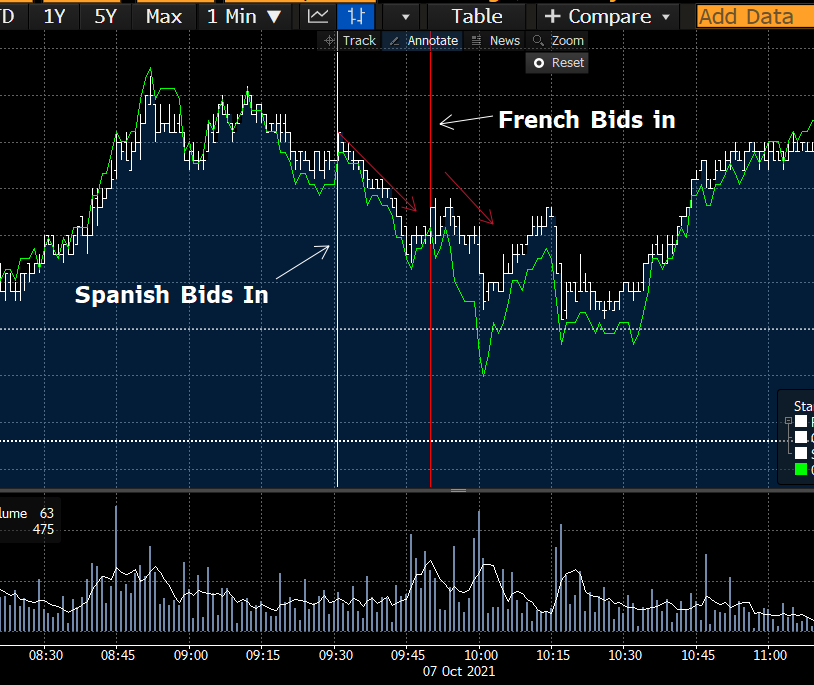

- This bullishness on spreads was pretty evident into the French and Spanish auctions, where we saw decent selling of futures contracts into both the 9:30 and 9:50 cutoffs. My assumption is that a lot of both auctions were taken down as spread tighteners on the back of ECB PEPP headlines

Trades:

- 10y point still looking cheap on FRTR 27/31/34 fly

Buy SPGB 66s? (GULP)

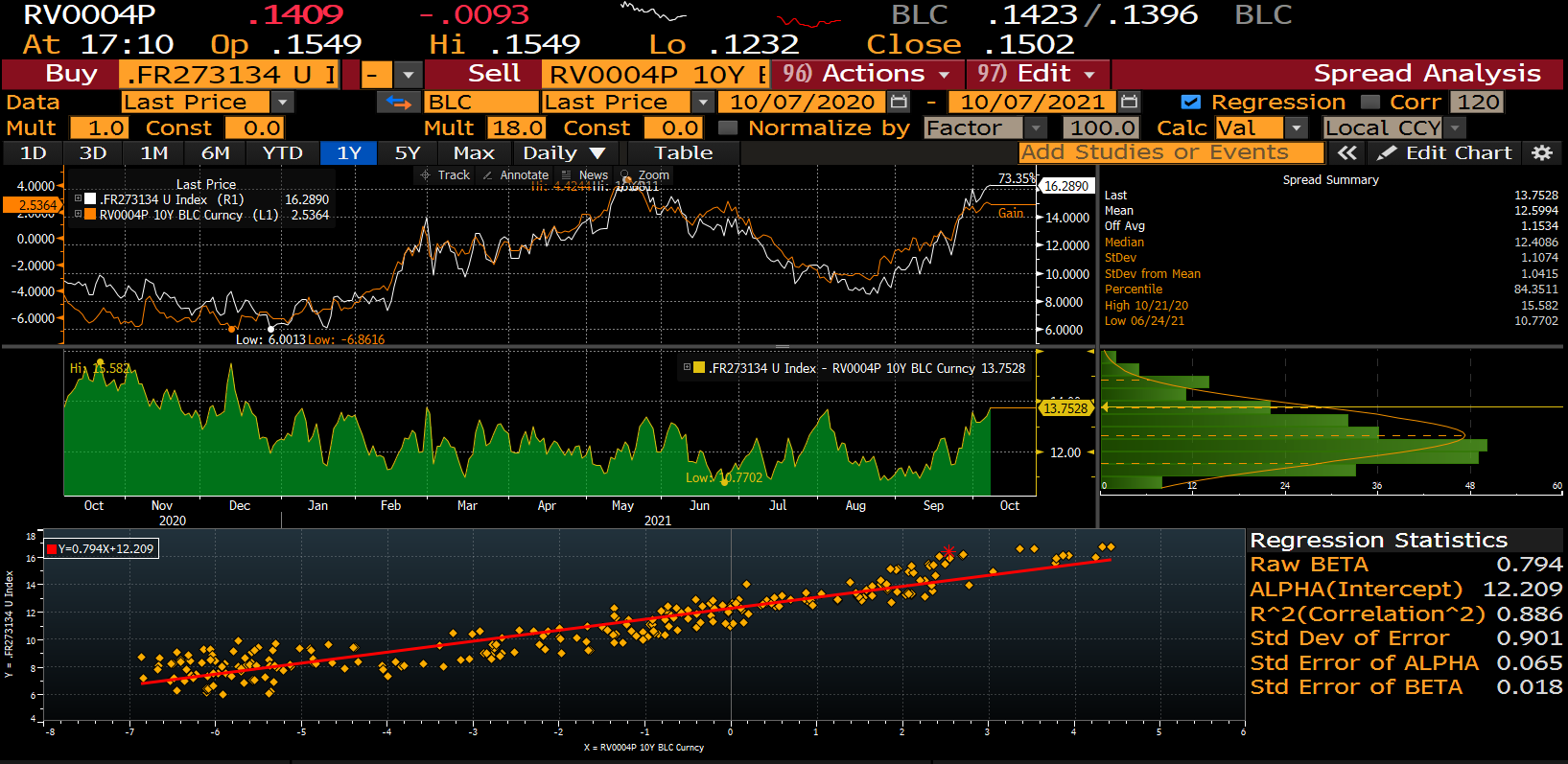

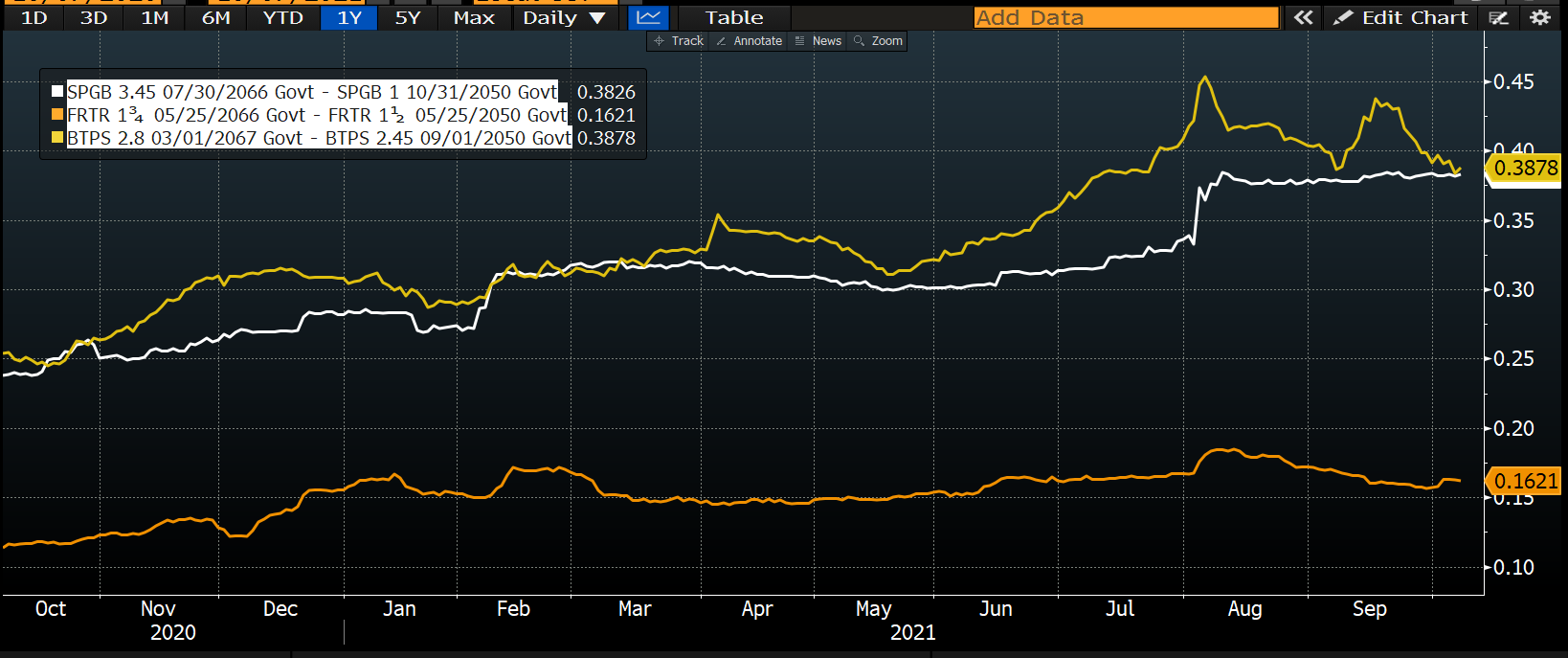

- More on this tomorrow, but am starting to think the SPGB 66s are too cheap. The curve has lagged the flattening in both France and Italy, and whilst consensus is that there is almost zero structural demand for Spanish ultras, the fact is that they do stick out

- Both France and Italy have given back a lot of the stop-related steepening from early August

- As Spain has rallied into France we haven't seen any sympathetic move in the 30/50 spread… in fact it has underperformed even BTPS

- This is also echoed in the FR/SP/IT Blend. The below graph is Spanish bond z-spread discounted using a 50/50 blend of Italy and Germany – 66s shows up as cheap . Would love to discuss

Basis trades below. Highlights include

- Selling if BTP 44,48,49 & 50 all vs IK (total ~500k/01)

- Buying of SPGB 10/50 vs RX (150k/01)

- Buying of FRTR 2/27 vs OE

- Buying of FRTR 50s & 52s vs OAT (pre auction)

Have a good evening

Will Scott

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4171

Mobile: +44 (0) 7894417709

Email: WILL>SCOTT@astorridge.com

Website: www.astorridge.com

This marketing was prepared by Will Scott, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

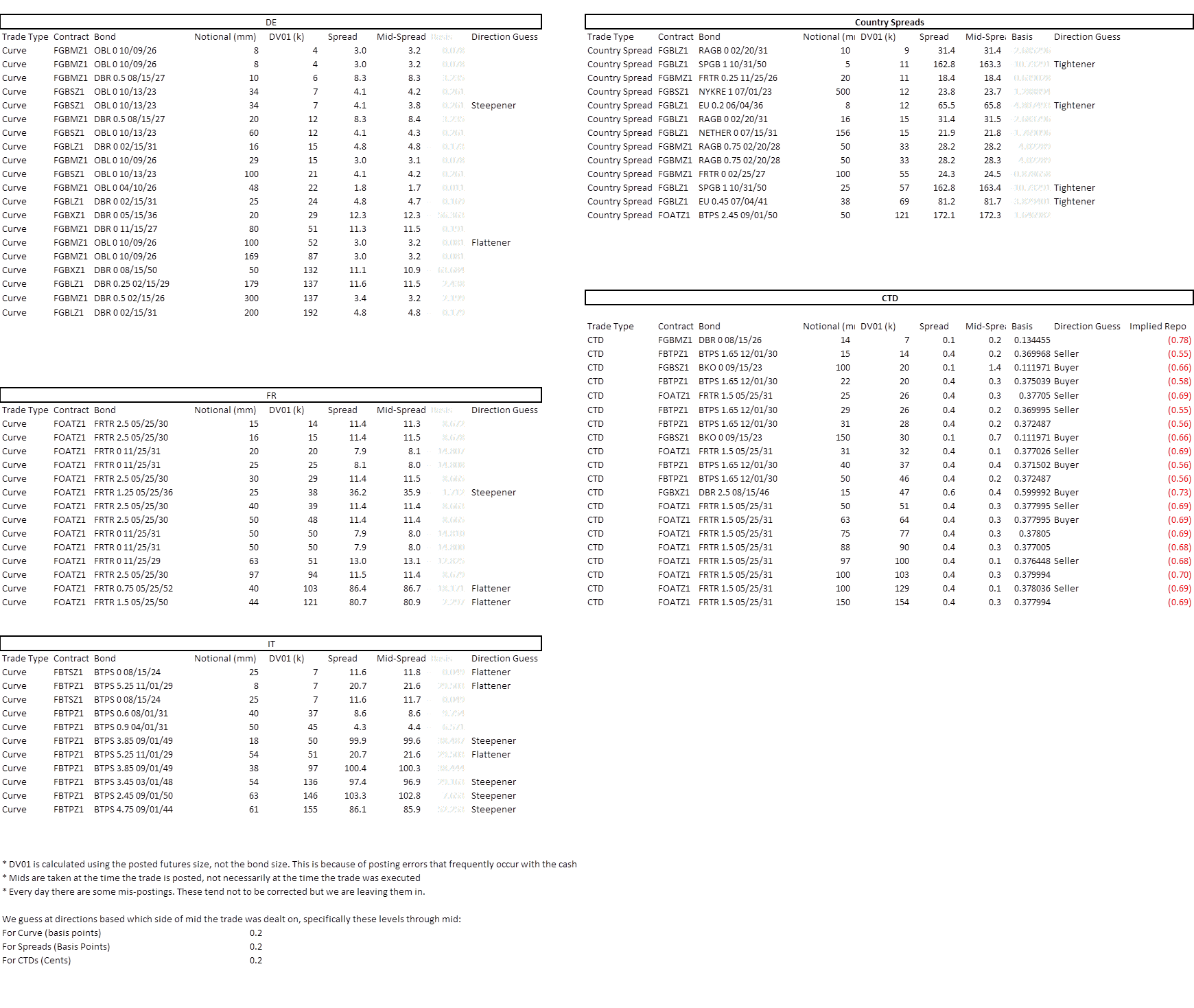

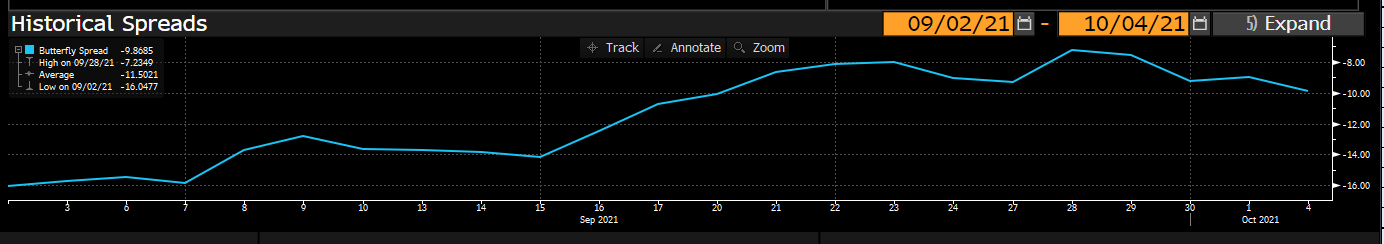

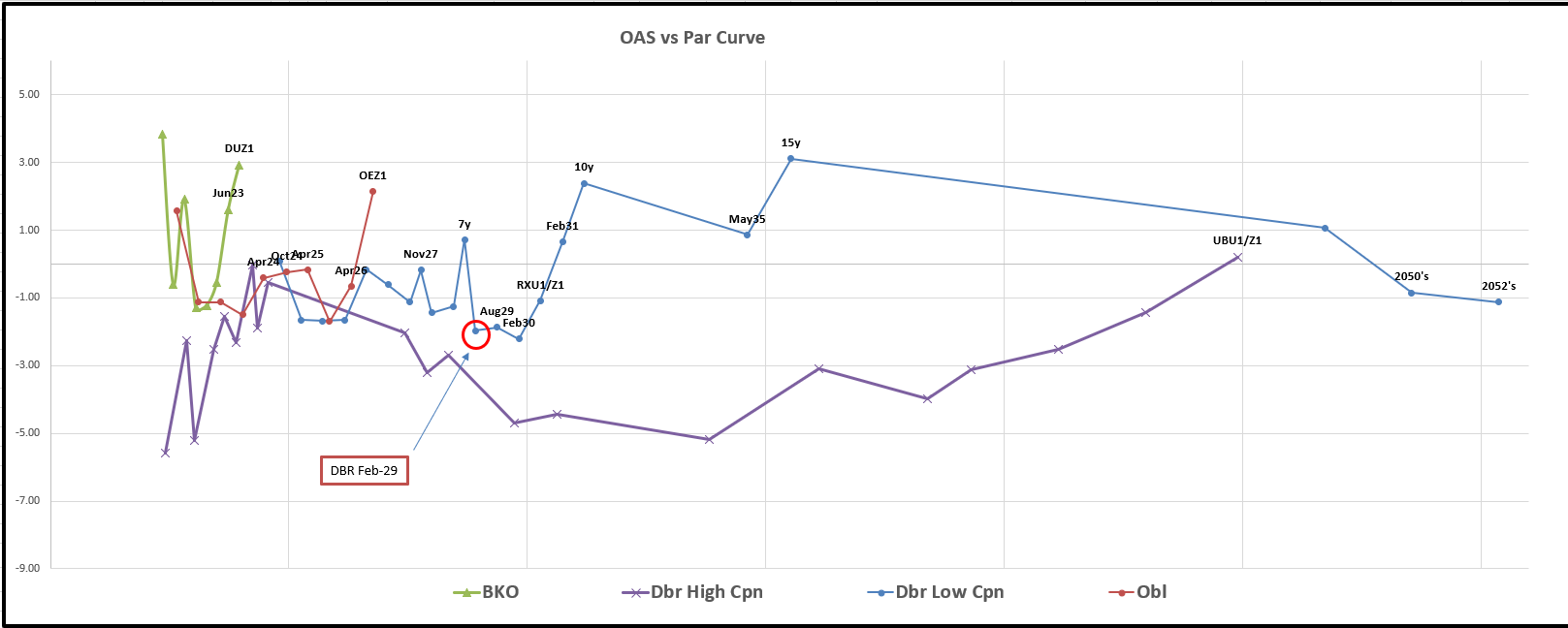

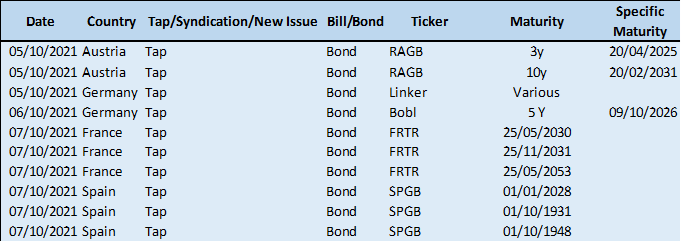

EoD EGB - 04/10/21

- Market having a hard time again with stocks off into the close and Bunds struggling to put in a meaningful reversal

- Italy still flirting with the wides, but only seems to be driven there by the equity market

- France under-performing x-market as we head into the supply on Thursday. Even Spain trading a little weak today. I won't hold my breath though

- Finland starting to turn in 30y. We like owning 30y Finland on a blend of France and Germany here.

Buy RFGB 52 vs DBR 52 & FRTR 52s

– Was better levels this morning, but feels like it has turned. Obviously mkt a little weaker on spread widening in general and also French supply on Thursday. Either way I would watch this one for a pullback

- SPGB 1/28 cheapening up on the curve. Looking for a fade for this. Maybe +SPGB 1/28 vs short DBR 2/29 with small IK/RX widening overlay?

- DBR 2/29 turning over A LOT the past few weeks, but really in the past 7 days. Looks from the basis reports like >2bn have traded since 8th September

- If this is real money taking off longs outright then the bond can cheapen a fair way still

Basis trades below:

Have a good evening

Will Scott

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4171

Mobile: +44 (0) 7894417709

Email: WILL>SCOTT@astorridge.com

Website: www.astorridge.com

This marketing was prepared by Will Scott, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

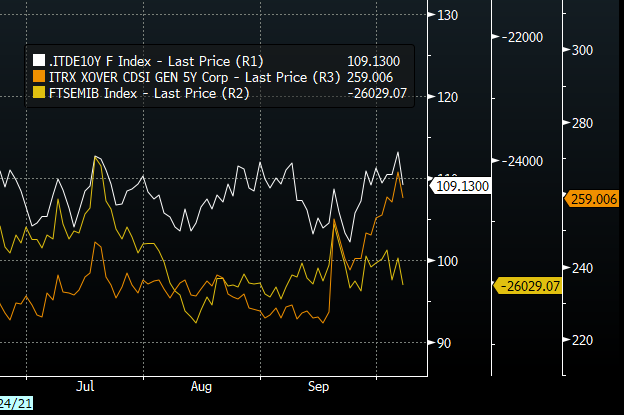

EGB EoD - Will & James at Astor Ridge - 1/10/21

- Not convinced the market really knows what it is doing this week. The threat of higher rates (amongst other things) has left equities on the backfoot, but given that it's a higher yield move on the back of inflation the old equities down, bonds up play doesn't doesn't really makes any sense. If the market was an Excel spreadsheet it would be telling you there was a circular formula somewhere

- Decision time for risk assets? IK/RX, S&P and Xover all testing recent wides. Granted in the case of IK/RX the flow seems very 2-way, but as we all know the levels are historically rich

IK/RX, Itrx XOVER and S&P (inverted)- testing recent wides

- Cross market spreads pretty mixed on the week all told, but France is leaking wider despite little direct concern being expressed over current election polls. They're ages away I know, but anyone who has done their homework on the 2017 elections knows that it all kicked off in Q4 2016

- Supply next week relatively limited:

- Austria 4/25 is a cheap bond, but it's getting increasingly hard to monetise post repo. 10y Austria looking on the cheap side, and it's worth entertaining as a vehicle to be short France against if that's your slant.

Germany/Austria/France .6/1/.4

- Spain and France the jury is out. Let's see what equities bring over the weekend.

Basis flows below:

- More flattening in 8y vs 9y Bunds

- Denmark pretty active – solid tightening vs Bunds today

- Steepeners going through in 10/30 btp

Have a good weekend

![]()

Will Scott

O: +44 (0) 203 - 143 - 4800

M: +44 (0) 789 – 441 -7709

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Will Scott. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

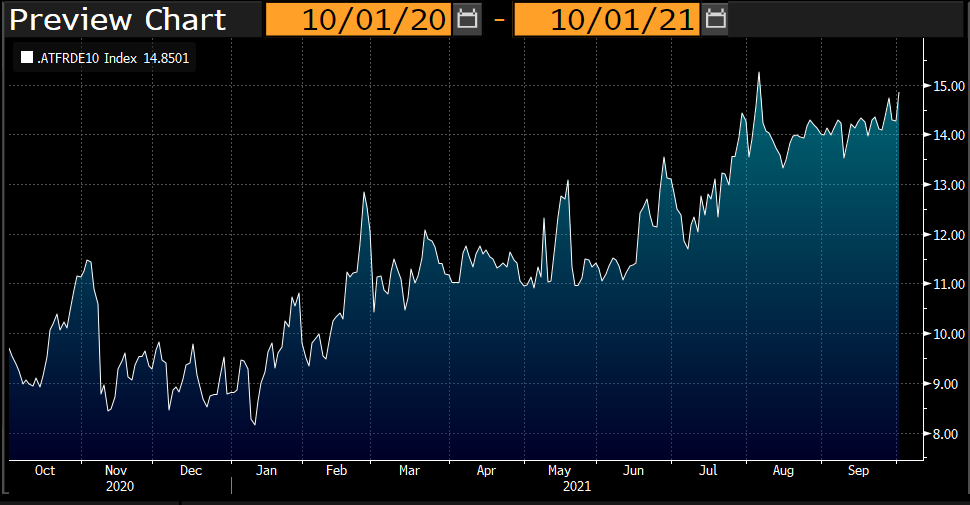

EGB Eod - Astor Ridge 28/9/2021

- EGB markets recovered a little into the close, but we go out below key levels & spreads certainly remain wider.

- IK/RX at recent wides on the back of equity market weakness, arguably out-widening other risk assets today, but really just giving back the out-performance we have seen over the past 10 days.

- All about overnight stocks now, but we are taking another dip into the close, so watch this space

IK/RX has been in a narrow range for most of the year

X-Mkt Regression vs FTSEMiB shows IK/RX as being pretty close to fair value, so any further weakness in stocks will probably pass through to sovereign spreads quickly

- Market still seems pretty keen on Spain, but feels like a lot of this is being driven by dip-buying of longs in Spain

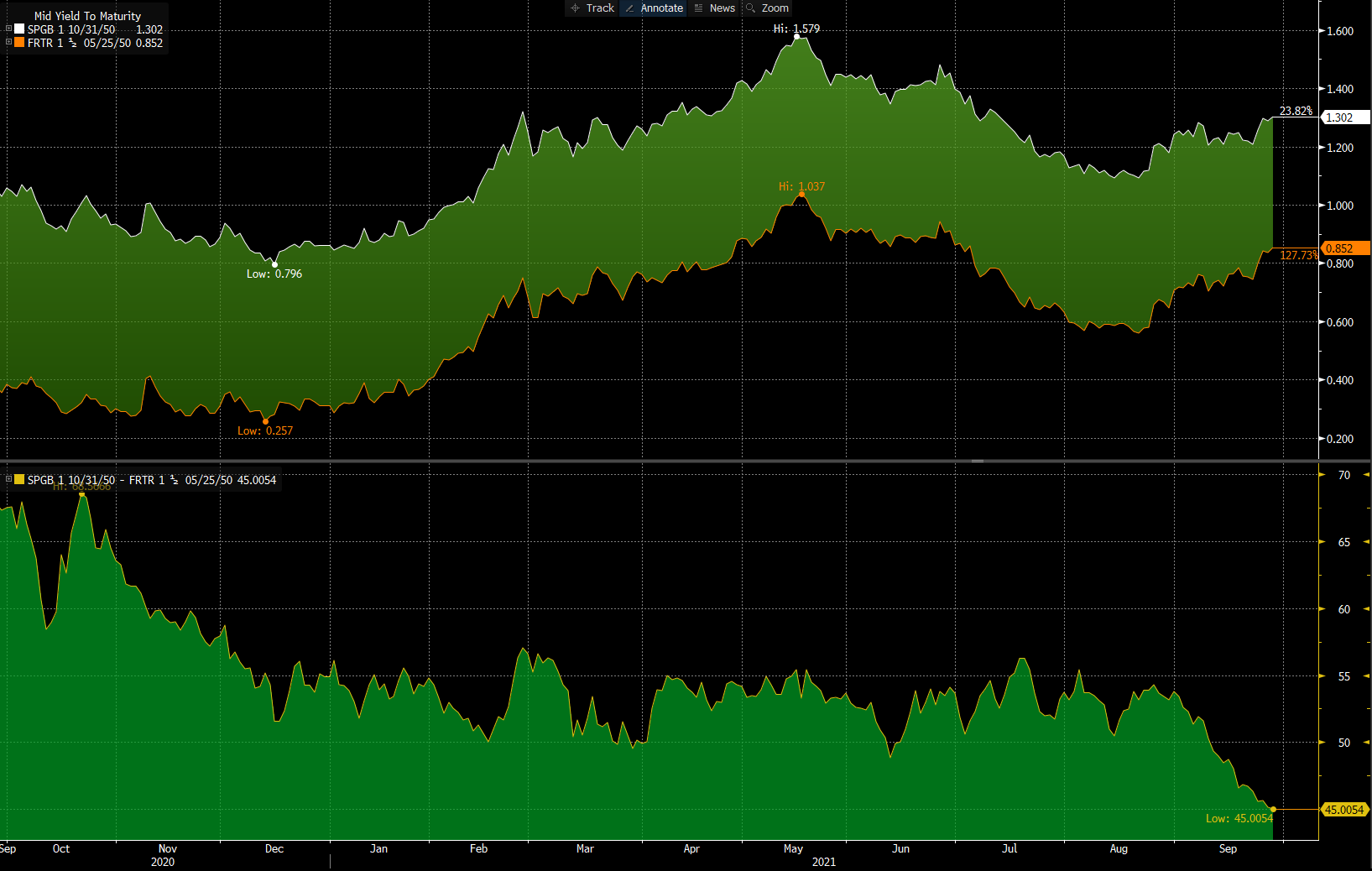

SPGB 10/50 vs FRTR 5/50 continues to narrow

- Germany to auction 8/31 tomorrow. It's not normally a delta event at only EUR 2.5bn, but at these yield levels it should be a good test of demand, especially after the weak Gilt auction today:

GDP weighted 10y yields in Europe nudging against recent highs, exacerbated by the recent widening in IK/RX

- Lot of basis going through today as well

![]()

Will Scott

O: +44 (0) 203 - 143 - 4800

M: +44 (0) 789 – 441 -7709

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Will Scott. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Eurex EoD Basis highlights 27/9/2021:

Lot of flows going through today

- DBR 7/40 vs UBZ1 in 280k/01 look like selling the 7/40s

- FRTR 11/31 vs OATZ1 in 300k/01 steepening (selling 11/31)

- RAGB 10/2036 vs RX in 250k/01 tightener

- NETHER 1/40 in 190k/01 also looks like tightener

- BGB 6/50 vs UBZ1 tightening in 90k/01

Will Scott

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4171

Mobile: +44 (0) 7894417709

Email: WILL>SCOTT@astorridge.com

Website: www.astorridge.com

This marketing was prepared by Will Scott, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796