MICROCOSM: GILTS > Quick Rundown - Data, Supply, Curve and Qtr-End - IDEAS

Morning…

- Weekend news centered on talk of further lockdown in Europe as Covid-cases remain higher than hoped and vaccination efforts stumble. Talk of travel restrictions from UK to Europe this summer (despite end of UK restrictions) adding to bullish tone in rates.

- GILTS This Week - Qtr-end, light supply, busy data calendar, 3 APFs and scattered repo richness...

- Technically we have 8 more days before qtr-end but we'd expect, given the mayhem this qtr's seen, that dealers will look to lighten up on positions earlier than usual this time. With a light auction calendar of just £2.25bn 1T49s tomorrow and a paltry £350mm linker 56s on Wednesday to finish up the qtr, there is little reason for dealers to carry big positions this week unless they're planning to unload them into one of the 6 APFs this week and next.

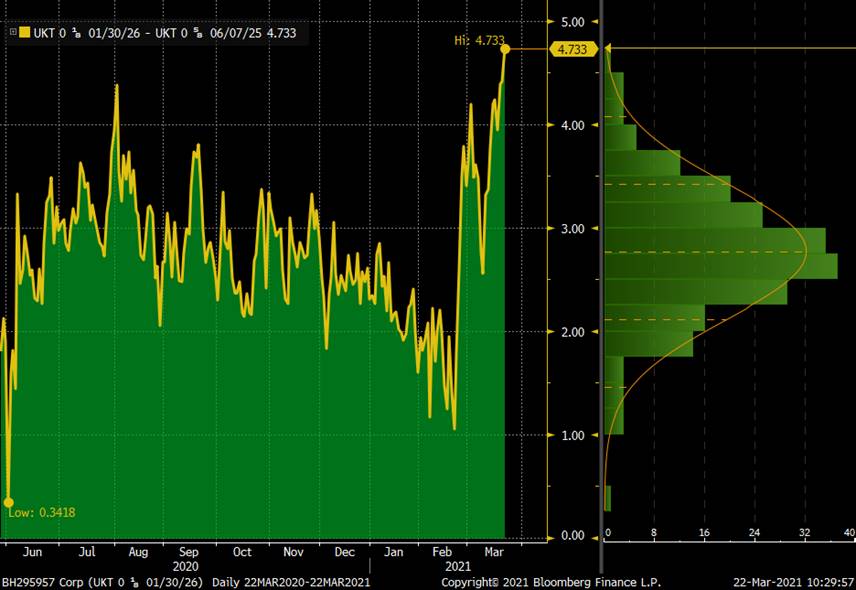

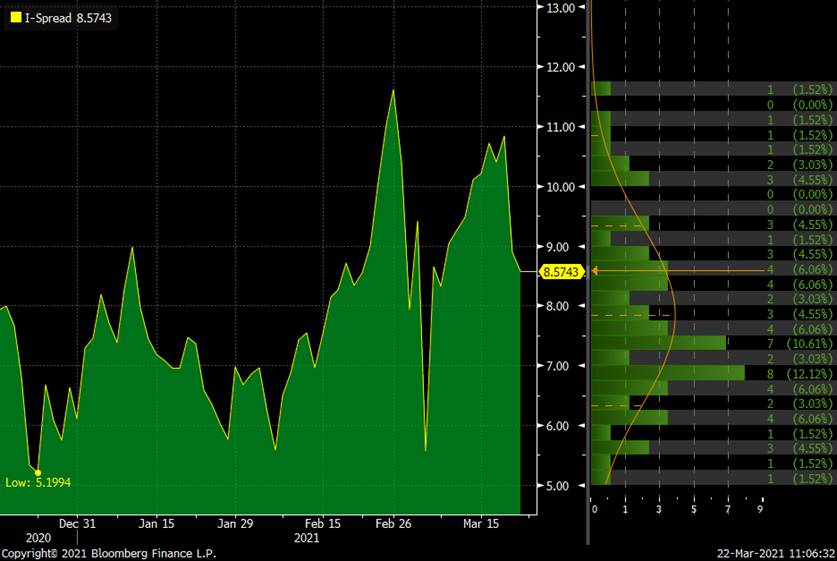

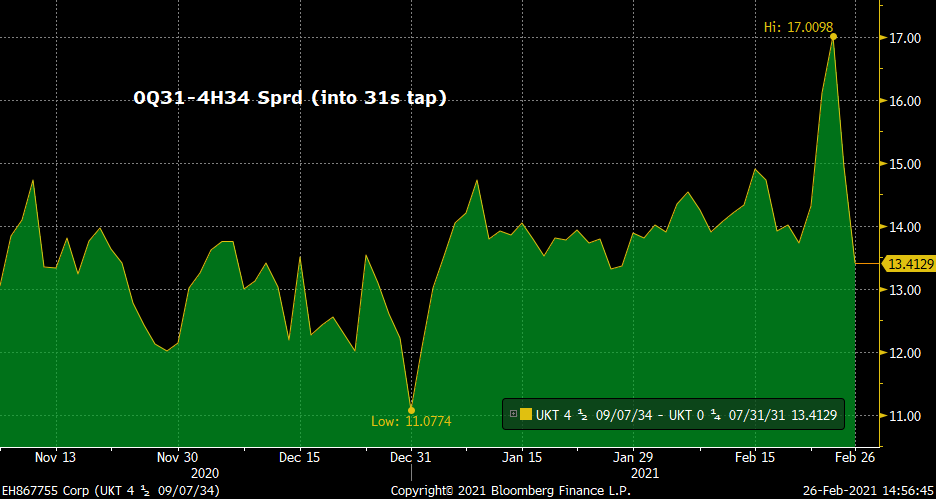

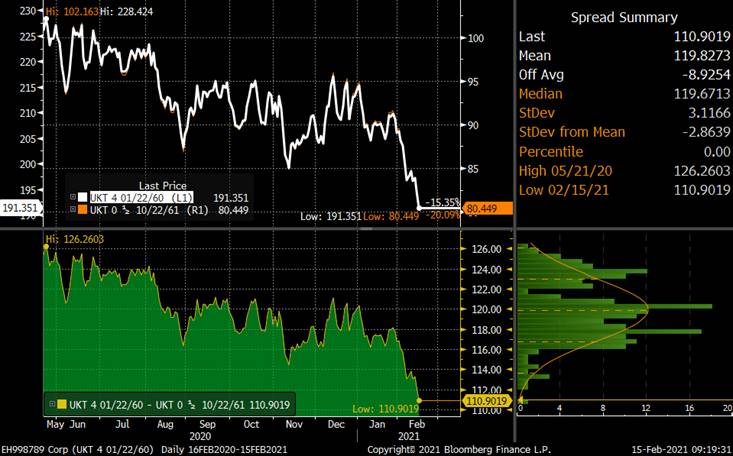

- Mid-late last week, we saw a surge in repo bids for selected issues, most of them in the 3-7yr bucket. This was accompanied by a richening of gilts general collateral which closed at/near zero having hovered around O/N Sonia levels of +5bps for most of the last 6mos. While these weren't necessarily headline-grabbing events, per se, bids of -13/-14 bps for the UKT 0F25s and other older, more seasoned issues, drove a richening of these issues vs MM OIS to their richest-ever levels. This has also put a pressure on GEMMs who are asked to offer more of issues that they're already short, exacerbated by a dearth of supply in this sector of just 1 auction of the new 0R26s and one tap of the 0E24s in March. This repo bid wasn't evident in the newer, low-coupon issues like the 0E26s or 0R26s, which helped to drive a steepening of spreads like 0F25s-0E26s and/or 0F25-0R26s to levels that overshot where the correlation to the curve moves said they should. By Friday afternoon, the 0F25-0E26 yield spread traded as wide as +12.5bps – a new wide and a rather tempting fade given this is only a 6mo gap. We were on the right track, as the spread is now +12.0bps, but had liquidity been better than .4bp from mid, we would have been much more involved.

The question now becomes, "How does repo trade into quarter-end?".

We're assuming this repo bid is driven by the dealer community trying to cover shorts, rather than clients demand for collateral, simply because it's happening in a bullish move for the underlying issues. From a positioning standpoint, the sharp richening of issues like the 0F25s vs swaps reflect not only the temptation of a repo bid but buyers of the underlying gilts given their attractive C&R and overall curve steepening bias. Clients might want to take profits into qtr-end if their curve view shifts, or is if these spreads to swaps stretch much more. That said, the first auction in April is the first tap of the new 0R26s on the 7th, followed by the 0E24s on Apr 20th – very unlikely to meet all the short-end demand for paper, especially since the 0E24s aren't even eligible for QE.

In this case, the simplest trade here is to be long the 0E26s within the sector. At current repo levels, APF ineligibility and worsening liquidity within the sector, there's little upside to sticking with these richer issues. On the other side, a persistent repo bid raises the odds that the 0E26s will catch-fire in repo too, richening back to the curve in line with their neighbours. If the market dumps their longs into qtr-end, the GEMMs will cover their shorts and the repo bid fades.

This AM's levels:

ON TN at Zero

0F25s -0.14 -0.15 decent volume 1.4bn in ON market

0E26s 0 -0.04 decent volume

0R26s -0.02- 0 barely trades

1Q27s -0.12 -0.14 decent volume

UKT 0F25-0E26 flattener vs MM SONIA

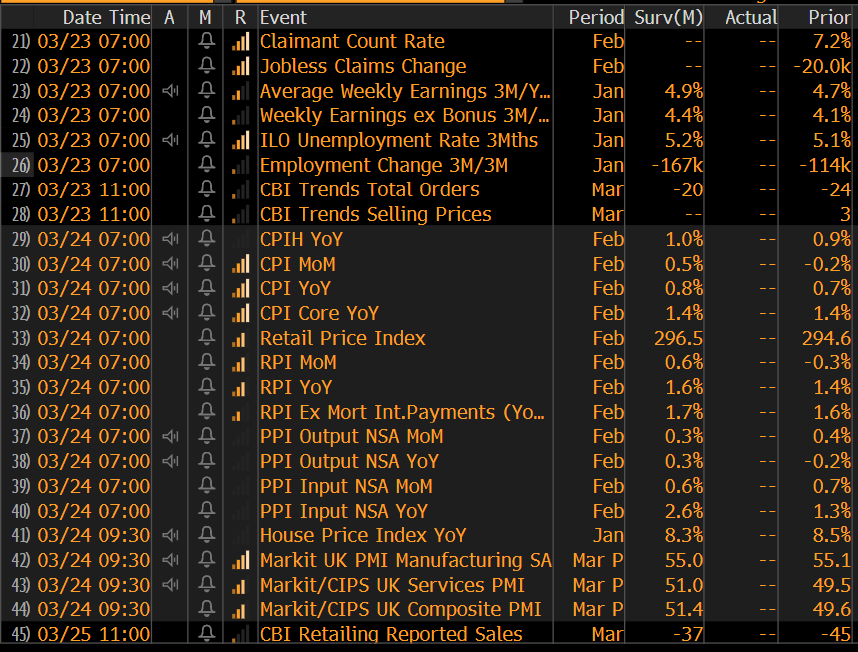

- DATA! On of the biggest weeks for UK data in about a month. Here's the BBG rundown:

The UK's current lockdown is its longest yet when it'll be completed. The last MPC meeting made mention of a lively debate between the hawks and the doves. While there is little argument that 2H21 will show stronger growth than 1H21, the path there could be a bit bumpy. In addition, the market's fixation on inflation and the spike in breakevens suggests heightened sensitivity to softer inflation numbers than expected.

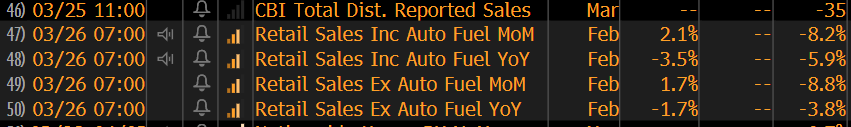

- The Long-End of the Gilts Curve… Considering how much paper the UK issues in the long-end of their curve, one would be justified in wondering how the curve could be flattening due to supply constraints, especially considering the bear steepening we've seen from 2yrs-15yrs. Like it or not, tomorrow's 1T49s tap is simply not enough to satiate demand for long gilts until the April 7th tap of the new UKT 0.875 46s, especially with THREE more 20y+ APFs to come between now and then. The US curve remains a barometer for the long-end of the UK and the UST 10-30s spread has also been flattening sharply, now +70.9bps having peaked at +86bps in early March. With a ton of UST 2yrs, 5yrs and 7yrs coming this week, this flattening bias isn't likely to change much barring some shockingly weak US data this week (Home sales, durables, PMIs, GDP, personal spending, U of Mich all on tap this week!).

Last week we recommended getting long the 0F50s vs the 1T49s as their cycle is over and we've seen a modest .3bp flattening which we expect to continue. The 1F54s tap last week was a tad sloppy but appeared to clear ok. We're seeing some flattening interest out of 49s into 54s which has been a slow grind but we're .9bps flatter since late last week and see more to come as the Z-sprd corrects.

1T49-1F54 Z-zprd

- Random RV:

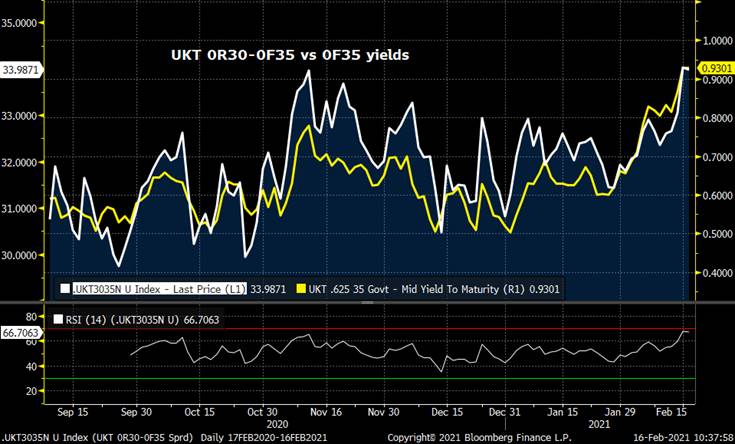

- UKT 0R30s have caught fire lately, our 0R30-4H34 sprd steepening 2bps in Z-sprd and 2.3bps vs MM Sonia. Considering how poorly the 10yr sector has traded lately, this is news. 0R30s still have £7.7bn APF room left (vs 1.47bn for 29s) so they'll remain on our radar.

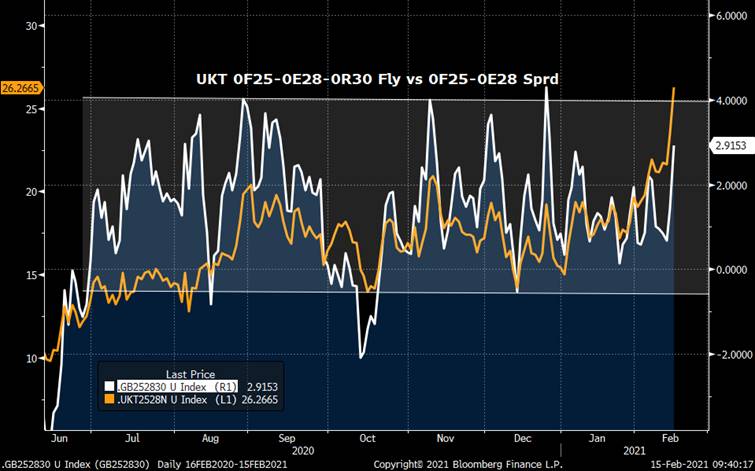

Want a bullish trade? 0S29-0R30-4T30 fly – buying 0R30s. This is VERY well correlated with 5y5y SONIA and is showing signs of topping out…

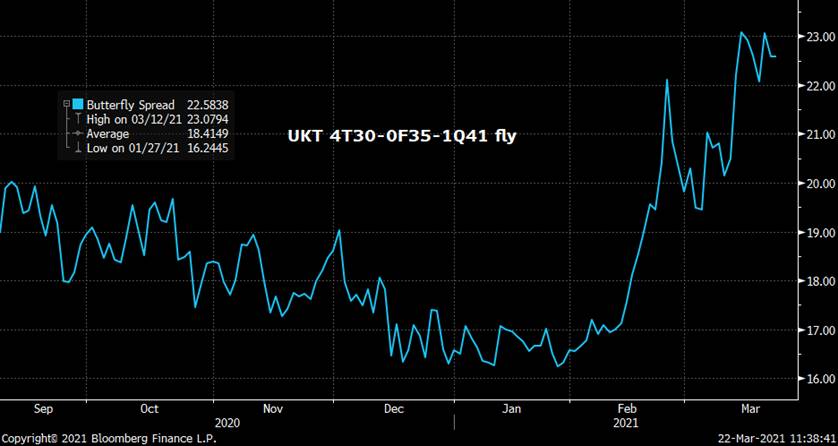

- UKT 4T30-0F35-1Q41 fly looks cheaper on a relative basis than more obvious flies like the 3-10-30 or 2-10-30, driven largely by struggles in the 35s taps. No UKT 0F35s until Apr 21st, however, and a lot of wood to chop before then, including 4 mediums APFs.

We'll be in touch to discuss.

Thanks,

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: GILTS > Quick Supply and MPC Meeting Rundown - TRADES UPDATE

Quick GILTS...

- Last BUSY supply week this month with £3.5bn 0E24s and £1.5bn 1F54s tomorrow and £2.5bn 0F35s Wed. We've also got a much anticipated MPC meeting on Thursday.

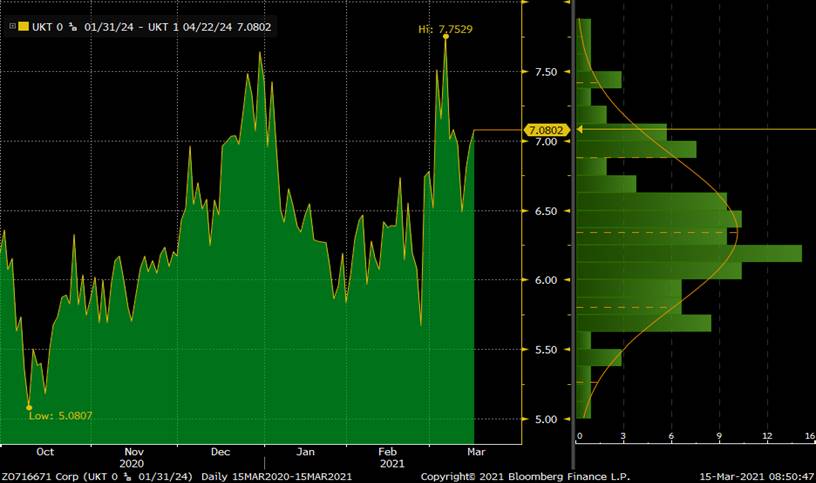

- 0E24s - Roll vs 124s got to -3.6bps before 124s richened back to -4.25bps. We're seeing interest to roll back up the curve into this tap. More 0E24s to come next qtr. The 124s will fall out of the shorts APF bucket after their April cpn payments (22nd).

UKT 1 24 into UKT 0E24s Z-sprd

- 1F54s - LAST TAP EVER (we'll see!) has the issue on the cheap side in micro-RV. The 3T52-1F54 Z-sprd is at the steep end of its range, despite the recent curve flattening bias and the 52-54-55 fly is cheap. The 41-45-54 fly remains rich, even with confirmation of 3 0S46 taps next qtr.

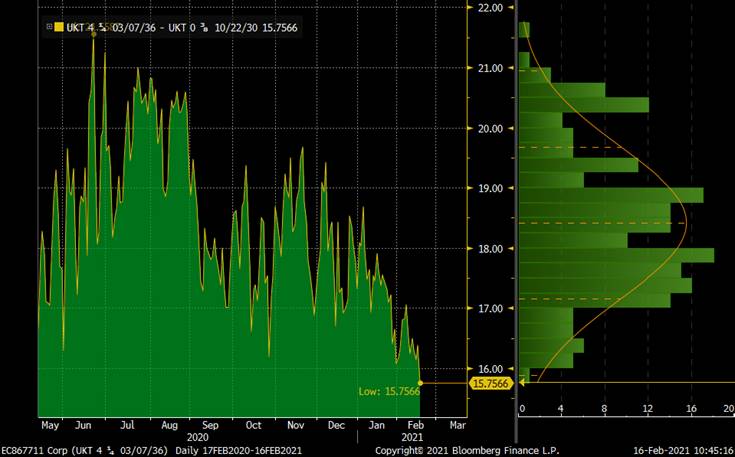

- 0F35s - These gilts have traded like toxic waste since last Thursday morning, cheapening massively on the curve as GEMMs price in a huge concession for this tap (and the 3 to come next qtr!). The 0R30-4H34 steepener we recommended mid last week is now +21bps, 2.4bps in the money and the 30-35-41 fly we liked at +18.5bps is now +19.8bps. This move is flushing a lot of RV longs which we HOPE will clear the decks for the issue/ sector to settle down. The 0F35-0F50 sprd is at its all time flattest, despite a 25yr+ heavy auction calendar in April.

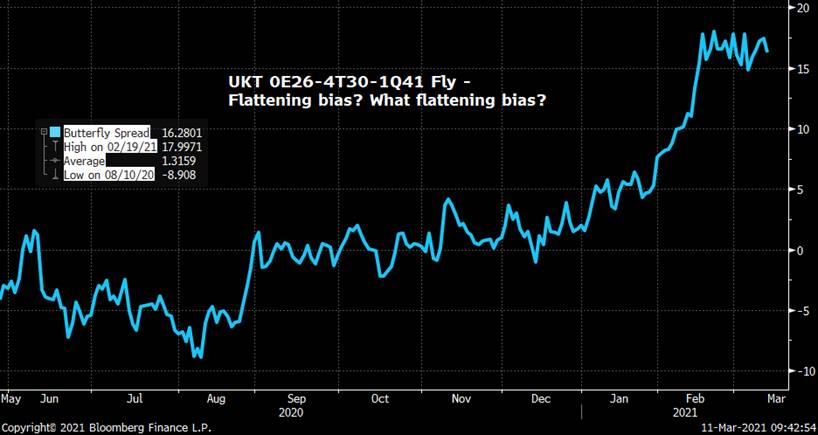

- 0R26s – Following the DMO's confirmation of 3 taps of the UKT 0.375 10/26s Friday we advocated taking profits on the recent outperformance of the 0R26s which occurred even with the issue ineligible for QE. We still think this makes sense as the issue's a bit 'frothy' given its stage in the auction cycle. The popular 0E26-0R26-1Q27 fly is opening at +5.7bps this am and we see it cheapening into the mid-upper 8s into April, exacerbated by the repo richness of the other issues in the sector.

- 0F50s – The DMO announced a new 2051s syndication for April which, as highlighted Friday morning, should free up the 0F50s to complete their 'cycle' by richening to the curve. We like the 1T49-0F50 roll as a simple expression of this but we've seen interest in other issues in the 44s-47s sector too given how rich they've been trading. Either way, we still think the 50s have 1-1.5bps of richening to come.

1T49-0F50 yield sprd

- MPC MEETING Thursday – This morning's FT Article entitled "Problems mount for Bank of England governor after weathering Covid storm' (click Here) raises some rather prickly issues that Governor Bailey is going to have to answer for, ranging from the MPC's handling of the negative rates shambles, his growing disdain for Brexit, the uncertain outlook and impact of QE and his own mini-fiasco while at the FCA. While these are certainly providing a distraction he, the rest of the MPC and the markets can surely do without, there's still the business of central banking to attend to.

This meeting is likely to be more about answering for the gilts-market meltdown in February, the MPC's outlook for inflation/growth and confirmation of their plans for QE, at least until the end of Q1 21/22. Most dealers expect the MPC to leave QE as-is given the chunky net gilts supply this fiscal year (highest since 2011) and the turbulence they've helped to cause for most of this quarter. There seems to be more division than usual within their ranks so corralling his governors into a unified message would provide some much-needed leadership and calm.

More to come…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: GILTS > APF/Supply Hiatus > 2 day Roadmap w/TRADE IDEAS

Quick UK Rundown...

> Usual 2-day APF/supply hiatus will be spent looking abroad. What will the ECB do (if anything) and what will demand be like at today's 30yr tap after a lukewarm 10yr auction and a well-attended 20y-30y Fed buyback yesterday?

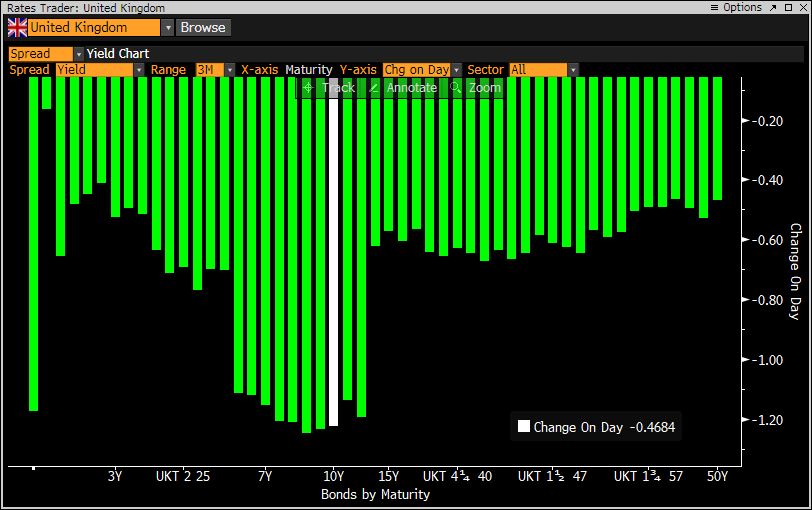

> We've got another round of 'GILTS CURVE ROULETTE' today. Yesterday we had a bull steepening led by 3y-5y for most of the day and Tuesday was a bit of position-squaring after a solid 41s tap.

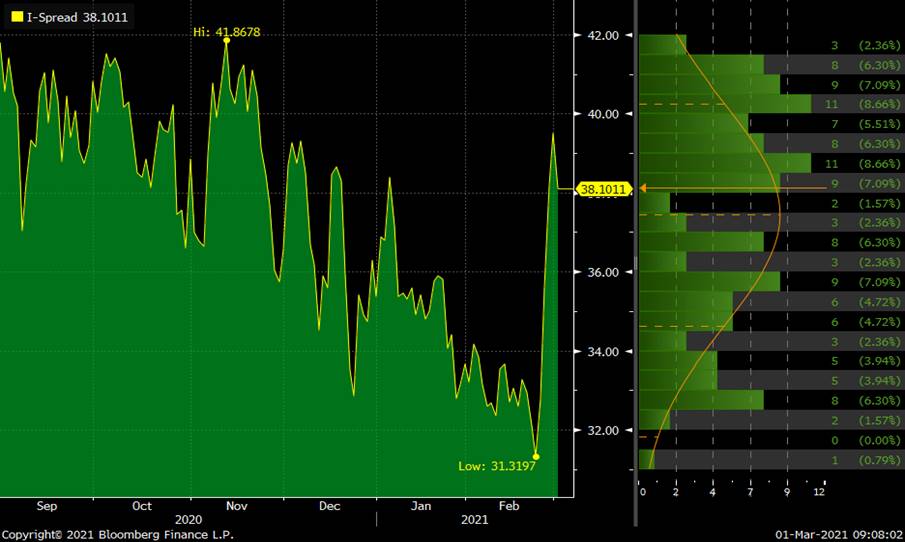

> TODAY we're opening with a bullish bias (on light volumes) with the 10yr sector leading the way. The chart below shows it's been a LONG while since we've seen the 0E26-4T30-4H34 fly muster any momentum richer so this is worth keeping an eye on.

> Next week is the last 'real' supply week this FY with taps of the 0E24s and 1F54s on Tues and 0F35s on Wed. (1T49s tap Mar 23 closes out the month for conventionals).

> As noted yesterday, we like the 0R30-4H34 steepener here.

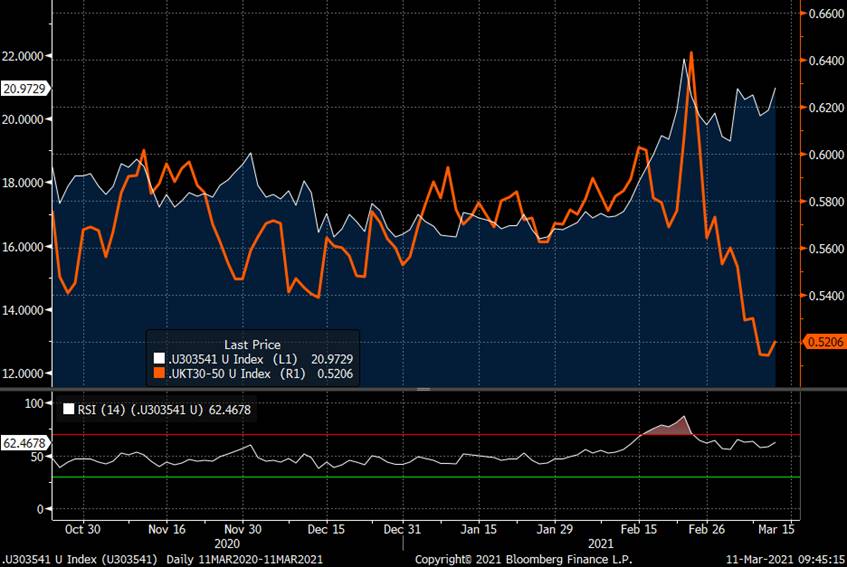

We also think the 1F54s are on the cheap side on a micro-basis and don't expect them to be tapped next qtr. Check out the 1Q41-1T49-1F54 fly - at its richest levels following the recent flattening move and 1T49s tap soon.

> Lastly, 0F35s have cheapened up on the curve enough to warrant some attention. They WILL be tapped next qtr (2-3X) after next week and the last 2 taps were mediocre at best. That said, UKT 35-50s is at its flattest at 17bps, almost 8bps flatter since Feb 24th, 3/4 of the 30-50s sprd move. A 'safer' steepener could be vs 1T49s, 0S46s or 3H45s where charts look the same, just a smaller gap.

UKT 35-49s

> For those who want to stick with the flattener bias, the 4T30-0F35-1Q41 fly is back to +21bps (vs +22 wides) despite having an embedded flattening bias (short leg +35, back +14).

30-35-41 fly cheap relative to 30-50s sprd

More to come!

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MACROCOSM: Quick ECB Preview > QE vs Inflation

Quick ECB Mtg Preview:

> Riddle me this: How does the ECB keep EGB yields in check while their staff projections for inflation are revised higher, reflecting the sharp rise in inflation breakevens?

The answer is: They don't.

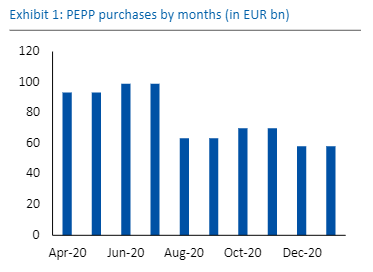

> The majority of the pundits we follow expect the ECB to maintain their 'benign neglect' PEPP policy that's been in place this year, promising to step in when needed but doing little in reality.

Nice chart borrowed from our friends at RBC:

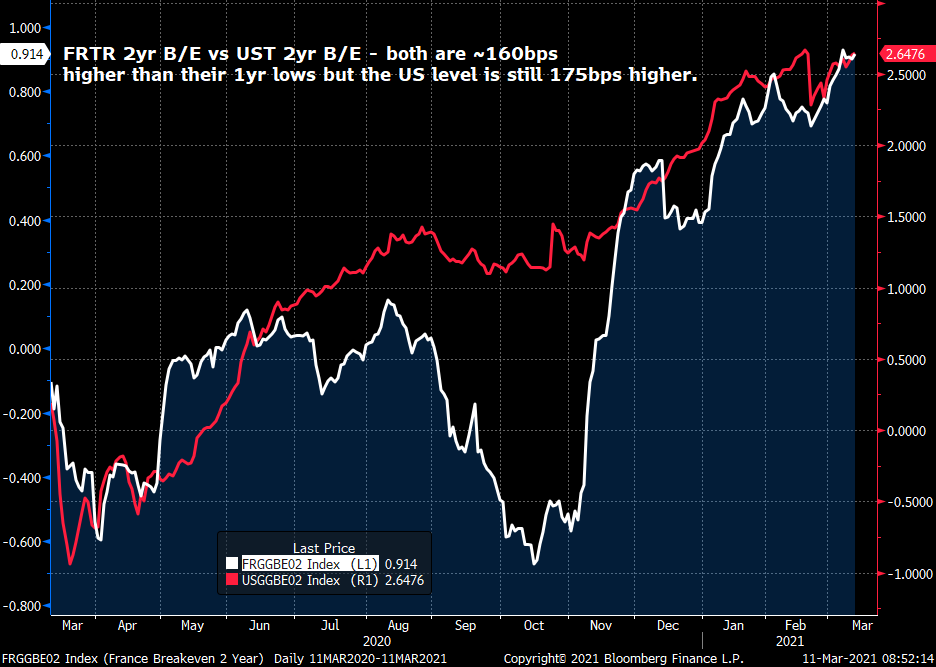

> As we can see from the charts below, 2yr OATs B/Es have risen ~150bps since early Nov '20 to 91bps (from the lows) which still implies sub 1% inflation rates. Compared to the US's 2.64% reading, Europe's pretty tame. Even the 5y5y EUR inflation swap reading at 1.44%, while at its highest since mid 2019, is still well below levels that prevailed for most of '17-early '19. So, even if the staff forecasts say another 50bp will be tacked onto inflation in the next forecast horizon, that's not such a big deal on a global basis.

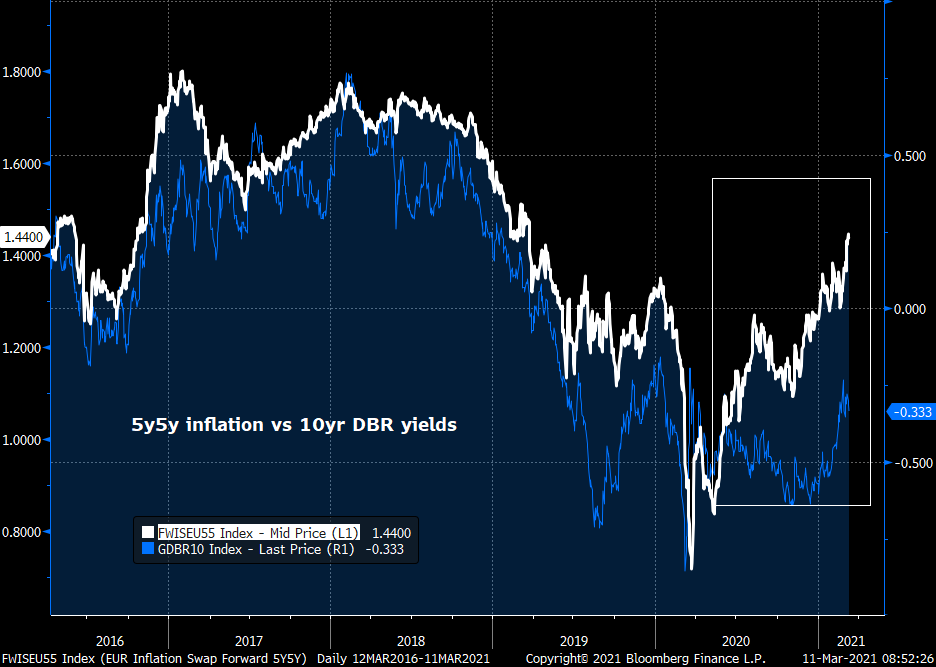

> What WILL be tough to justify, however, is the growing gap between core EGB yields and these inflation #s. The chart below of 5y5y inflation vs 10yr DBR yields shows DBR yields finally turning higher in 2021 (after ignoring B/E moves in 2020) but the gap is still a good deal wider than it was for most of the last 5yrs.

> If this inflation move is deemed justified by improving fundamentals and is demand-led, then the ECB should maintain their current stance and let nature take its course.

The question is whether we'll get some showers or another Jan-Feb hurricane.

More to come…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: GILTS > 3 Auctions to Test Our Resolve

Morning… Happy March… Best of luck…

TRADE IDEAS in the sections…

In Friday's note (attached), we looked at some of the macro/micro influences on the rates markets and measured the market's appetite for more bull flattening. We concluded that the 'perfect storm' of stocks into bonds, much worse than usual liquidity conditions and overdone technicals drove long-end demand for US/UK/EUR rates (govts AND swaps) that prompted a high volume dash for the exits. Just what the market didn't need after a very challenging month. Our conclusion was that it was time to wade back into steepeners and fade this move.

We've got three important auctions in gilts this week sandwiched around the new 0R26s and 0H61s tomorrow and the 0Q31s on Thursday.

Some quick thoughts:

- £3bn 0.375 10/26s at 10am

- Inaugural auction of the eventual new 5yr benchmark.

- 0E26-0R26 roll opening at +10.2bps mid, .2 steeper than the opening sprd last week.

- As the 5yr benchmark, the roll will be quoted vs the 0E26s but there will likely be good interest to buy them vs the 1H26s (ineligible for QE, still a bit rich to the curve and we've got a flattener ~+5.5bps on Z-sprd to roll fwd) and the 1Q27s 9mos steepener at just -3.2bps (1Q27-0E28s is -7.4bps for a 6mos sprd).

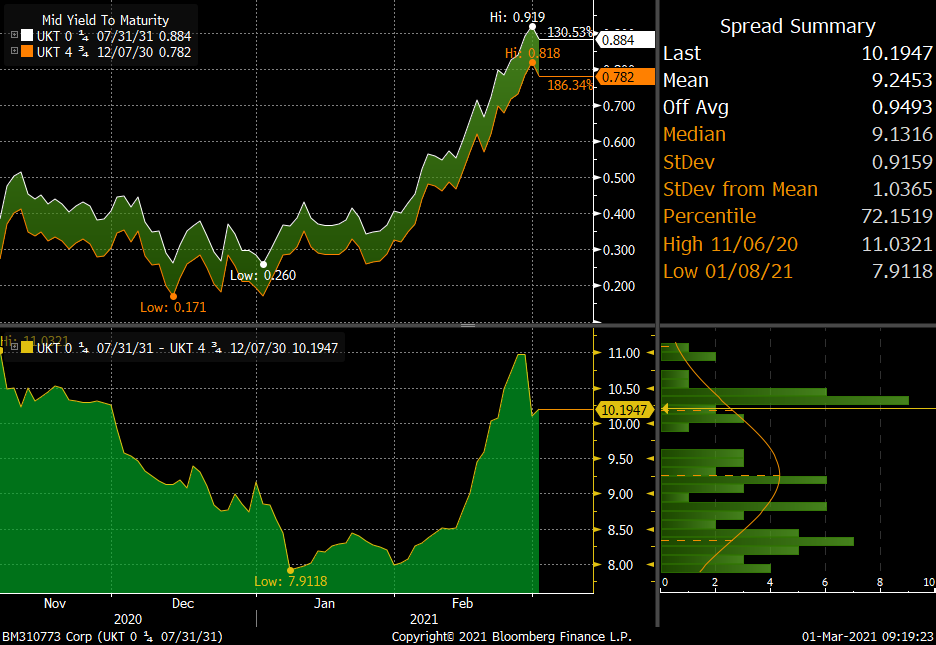

- The UKT 2-5-10s fly cheapened mightily last week, taking it to levels that we think will attract some demand, especially in steepeners.

- While the market might be inclined to look for more auction concession into this new issue, we expect support will be solid, especially with short-end supply in the budget likely to be smaller than 20/21 as a percentage of issuance AND the recent back-up in rates.

UKT 2-5-10s fly

- £1.25bn UKT 0.50 10/61s Tap Tomorrow at 11:30am.

- 31.6k G M1 equivalents

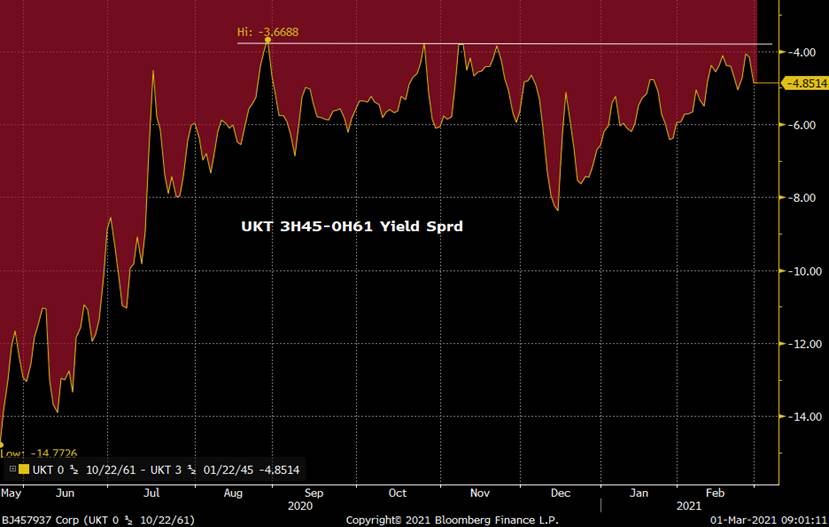

- The UKT 3H45-0H61 sprd has been a popular one with some of our leveraged clients as the 25-27yr sector has been well anchored while ultras have been a challenge as the curve steepened.

- Even after last week's late gap flatter on the curve, the 45-61s yield sprd only flattened .3bp, just off their cheapest levels since August.

- In the attached note, we advocate getting back into steepeners and as you can see from this am's curve moves, 10-30s has already begun to retrace Friday's massive move. So, we're less keen to own these 0H61s vs 45s. Where we think it makes A LOT of sense, however, is to buy the 0H61s vs swaps as either a SONIA OIS box vs 3H45s/0F50s or just buy them vs swaps outright. We can see that as a result of the massive flattening of 10-30s swaps (outpacing the gilts curve move by 4-5bps), these 61s shot cheaper vs SONIA, backing up 8bps on the day which we are in the process of unwinding right now.

0H61 vs SONIA

3H45-0H61 Z-Sprd box

- Thur 10am £2.75bn tap of 0Q31s

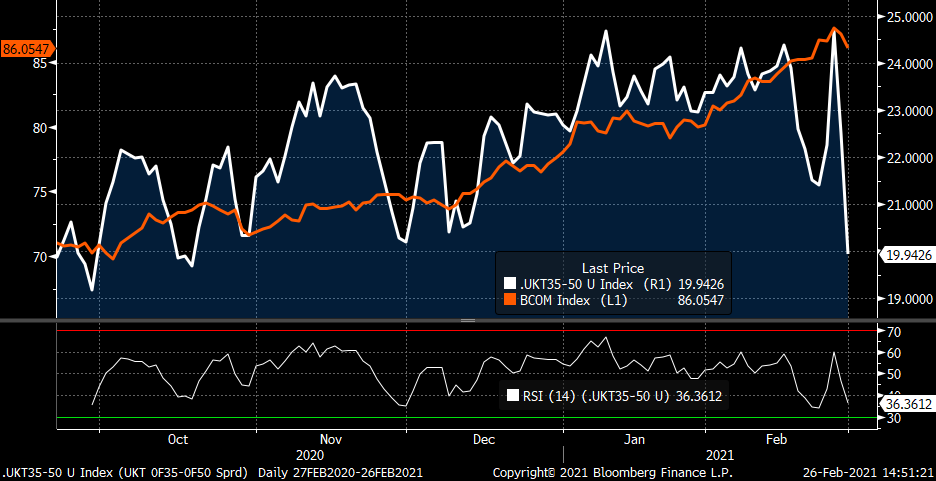

- This issue's been all over the map of late, cheapening up to our +11bps target last week, a combination of the overall steepening bias, the richening of the 4T30s into Mar-Jun rolls and the expected tap of the 31s this week.

- We can see from the chart below that Friday's flattening bias took the yield sprd back to the 10.2bps area and with a handful more taps of the 31s coming AND our resumption of steepening call, we're inclined to look for the sprd to inch back to the 10.5bps area.

- Much of where the spread will be Thursday will depend on the budget so tough to make a call on them right now, however, if the pundits are right and mediums supply into 2021/22 is at or smaller than 20/21's share of the slate then these 31s will be well bid, especially given their APF room and their room vs the Z-sprd curve.

- So, buy the bounce on the curve…

More to come!

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MACROCOSM: Will Frantic February Mean Manic March? Some Thoughts...

YIKES! If February's markets mayhem is what happens with the post-pandemic outlook improves, I am not sure it's worth it!

In no particular order, we saw:

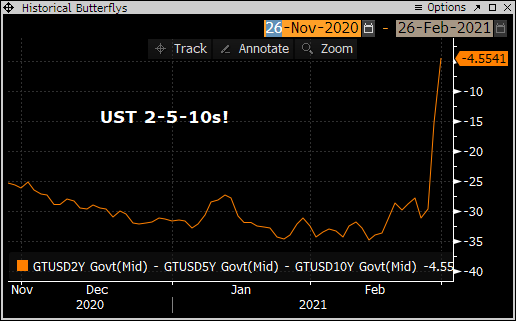

- Oil rallied 20%, copper rallied 19% and the S&P rallied another 6% (before dipping on moves into bonds)

- Gilts under perform UST and DBRs by 30bps (10yrs) as 10yr gilts sold off 50bps!

- GBP 10-30s swaps have flattened 11.5bps since 3pm yesterday, far outpacing the gilts move and reversing Z-sprds sharply.

- USTs 5-30s steepened 23.5bps before flattening 18bps yesterday afternoon!

- Central bankers "forward guidance" became "forward futility" as the BoE and ECB's baffling messages exacerbate illiquidity.

- Bitcoin rallies 76% before giving back 35% of the move.

- USD 2y1y OIS sells off 43bps despite the FED's insistence that rates are staying put.

- Fears of negative rates in the UK are long gone with 1y1y SONIA +17bps and cuts priced out of the curve.

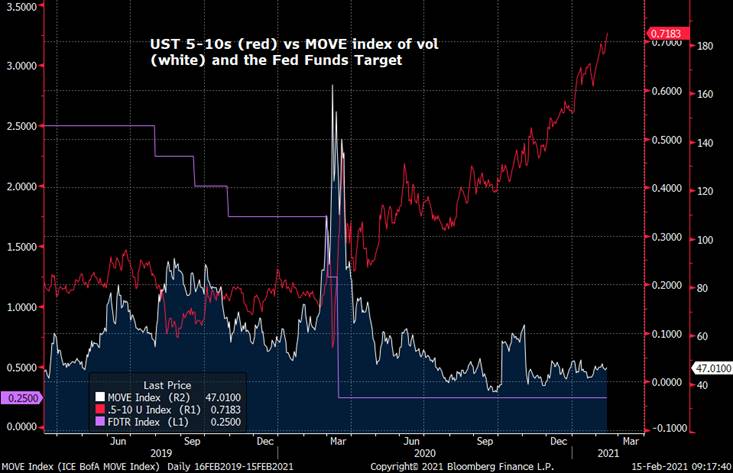

- The MOVE index of implied vol rallied 60% in 8 days to 74, a huge move in that short a span.

- The UST 2-5-10 fly cheapened over 20bps in 2 hours yesterday following an ugly 7yr auction!

Let's preview what's on tap for March:

- Biden's stimulus bill should pass in the House and hit the Senate soon with approval likely by mid-month. Unlikely to be $1.9trln but will certainly set records for fiscal spending. This week's market rejection of the 5yr and 7yr suggest appetite for more USTs is shaky at best – where's the money coming from then?

- The UK budget on the 3rd, according to the pundits, should provide additional spending and extension of current schemes until at least mid-summer. The bigger the check, the faster Q2/Q3.

- ECB meeting on the 11th, FOMC meeting on the 17th, MPC meeting on the 18th. Fan the flames or calm our nerves?

- Vaccinations will continue building pace, especially across Europe where delivery has been relatively slow.

- Economic data in March should continue to show signs of sluggishness, especially in Europe where much of the region is under severe restrictions. Market trades like it's old news but what will central bankers say if the data's ugly?

- Issuance in Europe and the UK should slow from the torrid pace of Jan/Feb. The UK DMO announces the Apr-Jun calendar and EGB syndications will abate, supported by solid cash flows into April.

The last two days of this month were a whirlwind with remarkable curve, spread and yield swings that were exacerbated by lighter than average dealer balance sheets after recognizing that they were not being compensated for the liquidity they were providing. While the massive bid to the long-end of the UST and UKT curves of the last 24hrs was clearly driven by month-end asset allocations that caught the market unprepared (even though there were expectations of these flows), one has to now ask whether this long-end bid will abate now that their month-end index needs have been met.

The market spent much of February trying to rationalize the remarkable yield/curve moves we were seeing, especially in gilts. Needless to say, it's been a very long time since we've seen a 50bps cheapening of 10yr gilts in one month, especially in an environment of such extraordinary economic fragility and uncertainty. With commodities surging higher and covid-cases declining as vaccination rates climbed, the curve/yield moves became more reasonable, even if they seemed relentless at times.

Here's a question for you: Is the next 10bps in the UST 5-30s curve flatter or steeper? Or what about the UKT 10-30s yield spread which steepened 7.5bps over February, only to end the month FLATTER than where we began…?

As for Gilts, we'll find out where we stand pretty soon. The DMO will be auctioning £1.25bn of the LONGEST DURATION issue on the whole curve on Tuesday – 32k G M1 worth of her majesty's finest. We'll also get £3bn of a shiny new UKT 0375 10/26s issue that will be sandwiched between issues that have cheapened 35bps in February and have given up over 13bps vs 30yrs in the last 24hrs. Then on Thursday, after Wednesday's budget, we get another £2.75bn of the UKT 0.25% 31s.

Personally, I think this end of month curve move is a great opportunity to get back into steepeners.

UKT 0F35-0F50s steepener

UKT 0Q31 – UKT 4H34 yield sprd. The 4T30-0Q31 sprd peaked at +11bps (our target into the tap).

1Q41-3H45 sprd

Etc etc…

Have a great weekend – let's talk Monday.

Best,

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: GILTS > Caution Into UKT 0F35s Tap Tomorrow

This is a follow-up to yesterday's Gilts note where we highlighted the 0R30-0F35-0F50 fly dynamics into tomorrow's tap. Upon closer inspection, we think a bit of caution could be warranted into this one…

GILTS... 0F35s Tomorrow AM

- We get a £2.5bn tap of the 0F35s tomorrow which will take them to ~£21.5bn. Tomorrow's tap will be followed by another on Mar 17th.

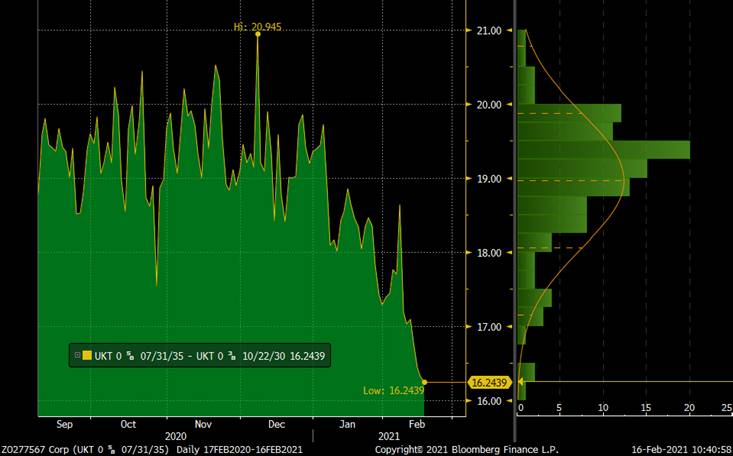

- This is a tale of two charts, yields and Z-spreads.

- The 0R30-0F35-0F50 yield fly (first chart) shows the fly cheapening back up towards the +10bps level (9.8bp mid now), cheapest since mid-Dec. The chart shows, however, the complete disengagement of the fly from the 0F35s yield level, having been reasonably well correlated for the first 3 mos of the 0F35s life. From this perspective, one could argue the 35s look on the rich side here.

- From a plain vanilla yield curve perspective, the 0R30-0F35 sprd has steepened nicely, back to the early Nov wides, despite the under performance of the 10yr sector on the curve. The alignment of the sprd level with 0F35 yields also suggests the 35s are fairly priced and, while not necessarily cheap into their tap, they aren't 'out of whack'.

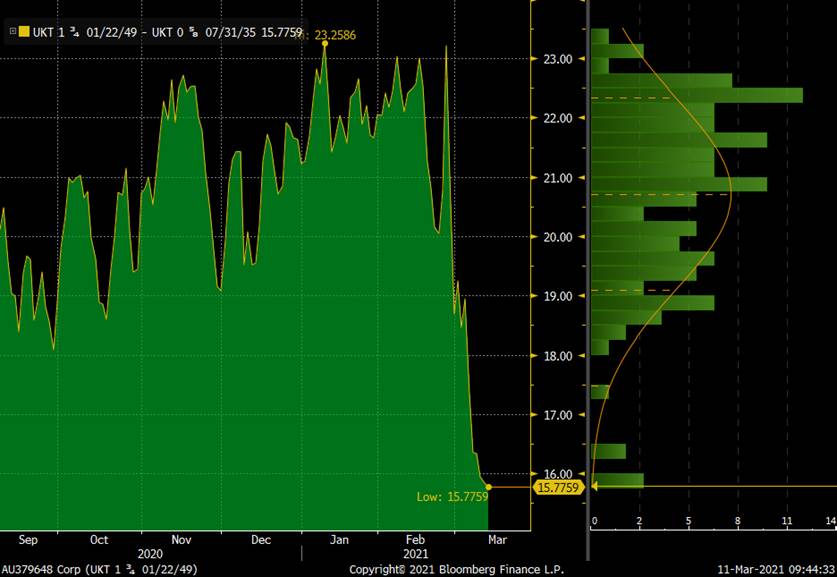

> The Z-sprd charts are where things get a bit more complicated. While the steepening of the 0R30-0F35 yield sprd looks enticing for buyers of the 0F35s - the Z-sprd tells a completely different story as we're making new lows this am at 16.2bps, 2.5bps flatter since the MPC meeting and almost 5bps flatter since mid-Dec.

We can see below that this Z-sprd is only .5bps cheaper than the 0R30-4Q36 sprd.

- The 0R30-0F35-0F50 Z-sprd fly is 2.1bps mid this am, 1bp cheaper in the last 2 days but a lot richer than it's +6.5bps wides in mid-Dec.

- Scatter plot of Z-sprds in the 10y-18y sector show the 0F35s are still a bit cheap to the curve but not glaringly so, especially since the 34s and 36s have also cheapened up into this tap.

> So! While the 0F35s could see demand on an outright yield or even cross market basis (they're +111.5 bp cheap to DBR 0 35s this am!) and even richen a touch more as they normalize to the curve, we can see this tap getting recycled post-auction unless they cheapen some more on the curve…

More soon…

Best,

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MACROCOSM: Quick GILTS > Crazy Start to 2021! Update w/IDEAS

Quick GILTS... Cable! Vaccinations! Yields!

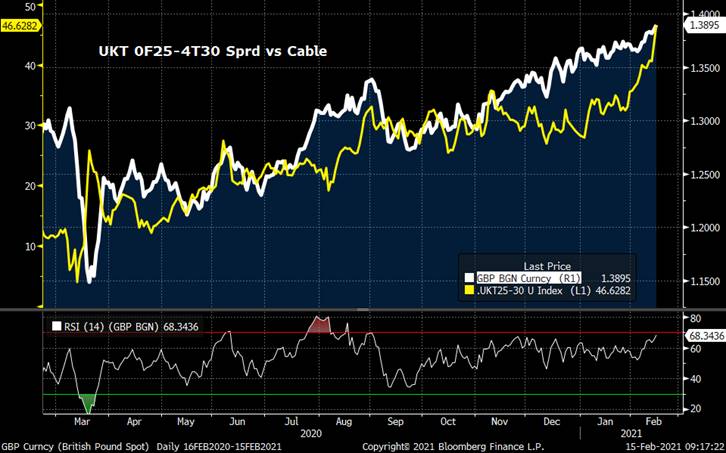

- UK vaccinations surge past 15mm and are now targeting 65yr olds and above. Talk of lifting the lockdown by March 8th is gathering steam as new cases and mortality levels decline. Kids are expected back to school soon (AMEN!). This is helping to drive another surge higher in the pound, dragging the FTSE and gilts yields higher too. Despite the market's post-MPC meeting temper-tantrum, the tone of the GBP rates markets is little changed since.

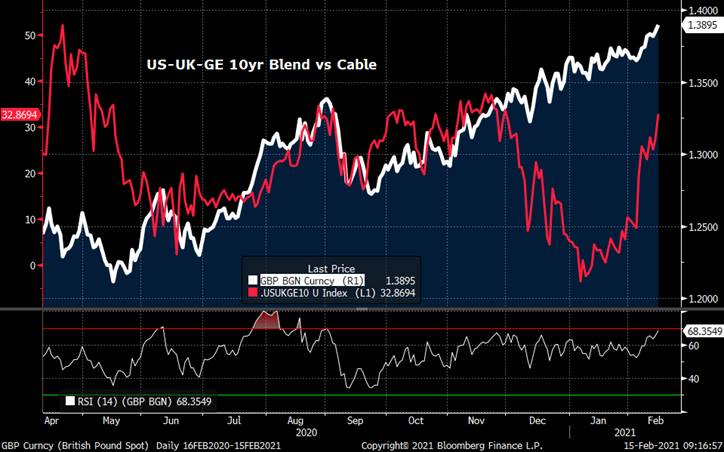

- Charts below show after a Dec-Jan wobble, the correlation of the 5y-10y curve and the US-UK-GE 10yr blend to cable have resumed. All three of these measures are looking rich from a momentum perspective, especially the US-UK-GE blend which has cheapened almost 35bps since early January, back near the Aug-Nov highs.

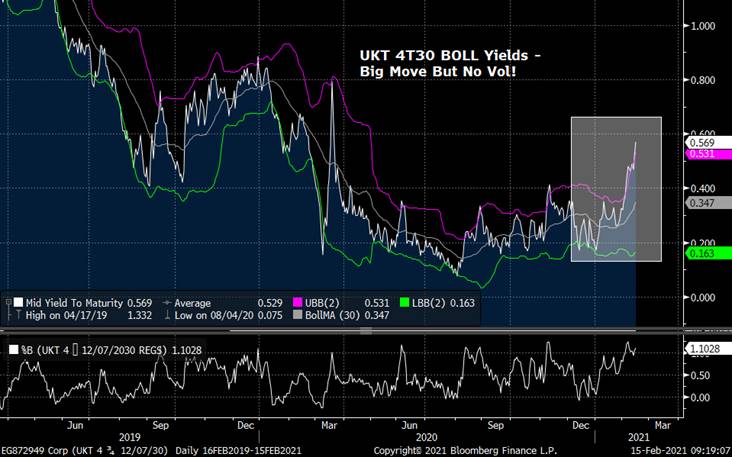

- The 'main-event', however, has simply been the sharp cheapening of the 10yr point (the 4T30s) which, as of this am, is now 40bps cheaper since early January. This remarkable move has come during a lockdown and amidst worries of a double-dip recession. Even more remarkable is rates vol has barely budged with both swaptions and bond vol flat-lining. While the US and EGB curves continue their march steeper, the long-end of the UK curve has been quite stable with some GEMMS reporting LDI demand for ultra-long gilts a they surged past 1%, the 1T57s now 1.117%, their cheapest level since March.

- This week's conventionals issuance is relatively busy compared to last week with a tap of the 1T57s tomorrow and the 0F35s on Wednesday, in line with their APF sector operations. The next two weeks are relatively long-end heavy as 3 of the 6 auctions are 30yrs and longer (1T57s, 0F50s and 0H61s), followed by a two-week lull before we close out March with 1F54s on the 16th and 1T49s on the 23rd.

- From an end-user perspective, we're expecting the 0H61s (and, to a lesser extent, the 1T57s) to find solid support due to the widening chasm between their relative prices and the reinvestment advantages of taking out 111 points has for LDI investors. This helps explain why the higher cpn issues within the sector continue to trade cheap on a relative basis and until this gap has closed substantially, it should persist.

- Positions:

- UKT 4T30-4H34-1T37 (and 1Q41) fly – sell the belly. The combination of a very oversold 10yr AND the scheduled tap of the 0F35s on Wednesday has helped to cheapen the belly on both flies. We can see from the charts below, however, that there's still plenty of room to run on these should we crack these technical hurdles.

- UKT 0R30-0F35-0F50 fly - We've been long the belly of this fly as a 'core' position for much of the second half of 2020. We can see from the chart below that the correlation of this fly to 10y5y SONIA was 'OK' from Sep until December as both the levels were relatively stable. Since January, however, the sharp cheapening of the SONIA forward hasn't been mimicked by the fly since the movements of the wings have been small. That said, we're back to the fly's cheapest level since December and we'd expect any break cheaper up to around the +10bps level would attract RV demand.

- UKT 0F25-0E28-0R30 Fly – This is a relatively well-behaved fly in a volatile sector of the curve. The slight lean towards the short leg in a 1-2-1 weighting gives this fly a modest directionality, cheapening in a sell-off. That said, the 25-28s sprd has steepened about 11bps since Jan 4 and the fly is still in a tight 0-4bps range. Medium-term, we like the 0E28s and expect this range to hold for now, so any move into the +3.5-4.0bps range is a buy in our view.

- CHARTS:

Ratio of UKT 460 to UKT 0H61 Prices – 61s very cheap…

More to come…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

QUICK RATES RUNDOWN > Mario, Reflation and Gilts

QUICK RATES ROUNDUP

> Light volumes in Asia with a bearish bias as stocks trade well and the market braces for another huge US refunding announcement this pm. Estimates for the 3s, 10s and 30s auctions next week center around $58bn 3yrs, $41bn new 10yrs and $27bn new 30yrs. As noted in the article in our chat, the market's bracing for another surge in issuance post the next stimulus package which, when combined with reflation expectations, could renew bear steepening pressures on the UST curve and beyond.

UST 5-30s curve makes another new high…

SUPER MARIO?!

> Regardless what your view is on the state of the ECB and Draghi's tenure as chairman, he brings instant name recognition globally and is considered the safest of hands in what's broadly considered a political circus.

> Hence, we're expecting BTPS to trade well this am on the back of reports he is being touted as the next PM of Italy. Whether this bid extends beyond BTPS is the bigger question, especially with a PGB deal and a big chunk of OATs and Bonos tomorrow am. T DBR 2/31 - BTPS 4/31 sprd back near its tightest levels at 106bps.

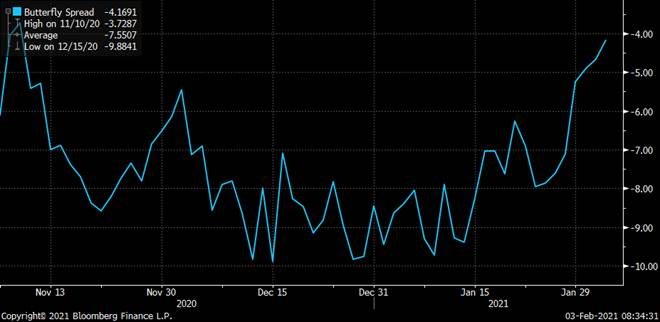

> GILTS are opening lower in line with the rest of the EUR and US, G H1 back to the late Nov lows at 133.50 area. (Chart below) The £2.75bn 10am tap of the 0Q31s comes with the issue at its cheapest on the curve (our 0E26-0Q31-1Q41 fly is back to -4.1bps, about .4 cheaper this am) but there's been little cheapening vs SONIA or on roll vs 4T30s. Lastly, our 0E26-0Q31 flattener is about .7bps under water from where we recommended it, reflecting the overall pullback.

G H1

0E26-0Q31-1Q41 Fly

> Macro vs Micro: The influences here are MACRO, not micro. In other words, the outlook for the UK remains the same in our view - relative economic stagnation for the next few months given lockdown and Brexit pressures with a medium term bullish outlook due to the pace of vaccine delivery and pent-up activity. Funding cash flows are neutral at worst into the end of the qtr and the MPC is broadly expected to be dovish tomorrow. The front-end of the curve has been very well supported due to the accumulation of cash, the shift of funding to the long-end and APF demand that has dwarfed supply. At current levels vs swaps and signs that the surge in home buying is tapering off, front-end demand is likely to wane from it's brisk pace.

More to come…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: GILTS > G H1 Poised to Break Higher

GILTS > G H1 Chart

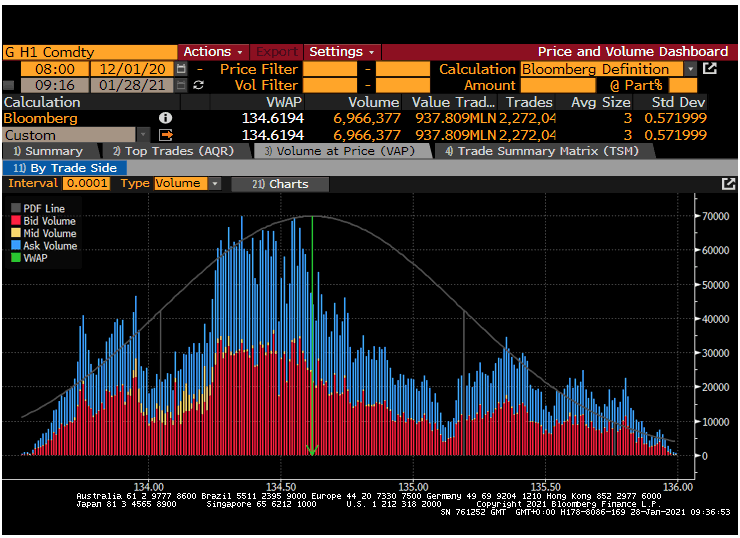

> Last night's VAP chart highlighted the volume zone between 134.25 and 134.65 as a key support/ resistance area.

> Since the start of '21, open interest has been rising steadily after the Dec balance sheet cut. With G H1 now 134.90, much of that exposure is well below here - good news for the bulls but not great for the bears.

> With the FED still quite dovish and the ECB keeping another rate cut on the table (back door EUR mgmt?), the market's assuming the MPC will fall into line and also bang the dovish drum next week by officially putting neg rates on the table.

> Daily chart below shows we're poised to take out a key resistance level that's supported by the 5/20day MA crossing to the upside.

> Despite the front-end support a cut to neg rates provides, we're seeing this move as generating more bull flattening as we've done this am. Next Tuesday's 31s and 71s taps should be well supported...

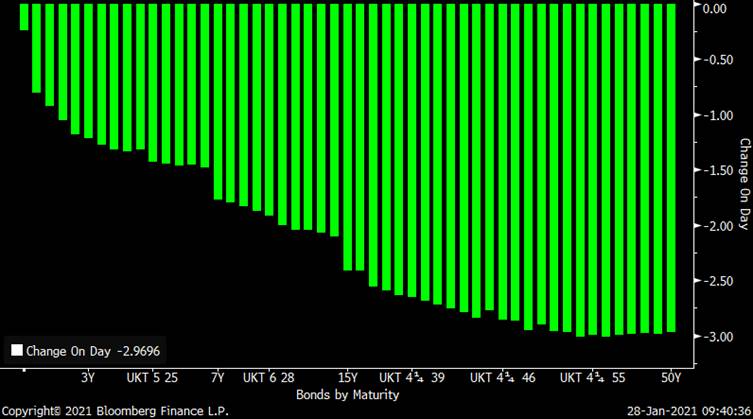

UKT bull flattening this am…

Keep an eye on this area - a break opens the door for a move to 135.50...

More soon…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796