FRTR 39s are rich on the 10s30s curve

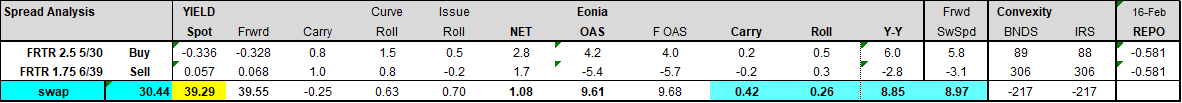

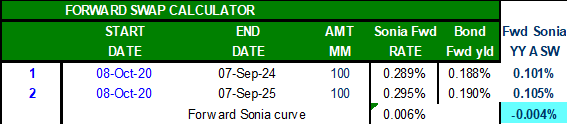

Trade 1): Buy FRTR 2.5 5/30 vs 1.75 6/39 on MM Eonia at 9 bps:

3mo carry/roll = 0.7 bps

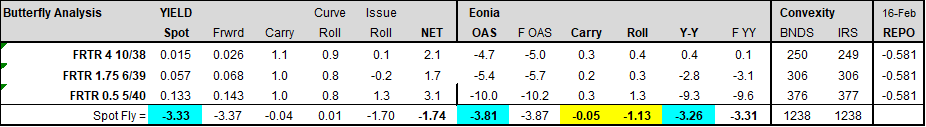

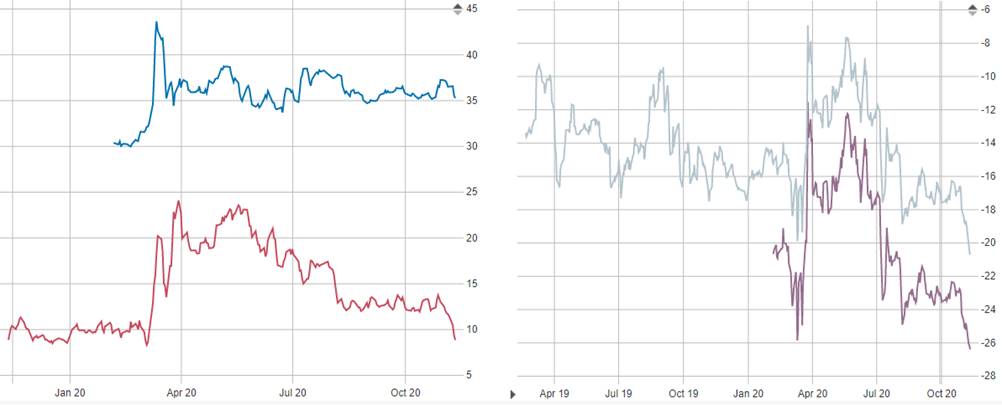

RATIONALE: FRTR 30s39s cash curve (red/lt axis) and MM Eonia curve (blue/rt axis) are moving in opposite directions – due to risk-on driven steepening of Eonia 10s20s:

However, the swap curve could re-flatten as initial euphoria fades, given the recent Covid spike and lag times in vaccine distribution.

The 39s (green bond) are also locally rich on the FRTR curve:

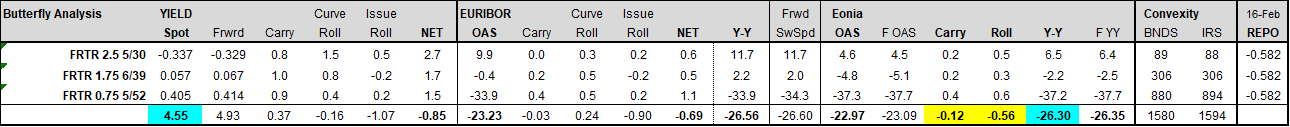

TRADE 2) Sell belly of FRTR 5/30-6/39-5/52 MM Eonia bfly @ -25 bps:

Short the belly ~ + 0.7bps carry/roll over 3mos

RATIONALE - FRTR 39s remain rich on the 10s30s curve:

30s39s52s bfly:

The richness is magnified when compared to the Eonia curve, where 10s20s30s = +30bps:

FRTR 39s52s (blue) vs 30s39s (red) MM Eonia spread Purple – FRTR 30s39s52s MM Eonia bfly

Grey – FRTR 30s39s50s MM Eonia bfly (for more history)

At some point in the QE cycle, the 35 bps pickup in FRTR 20s30s curve vs the Eonia curve should encourage RM to extend.

Moreover, the FRTR 0.75 5/52 roll steeply to the 1.5 5/50 (+5.6 bps on MM Eonia for a 2yr gap), AND will be eligible for QE (PSPP/PEPP) in 6 months when they fall below 31yrs.

Regards,

Jim

Jim Lockard

Founder / Managing Partner

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4172

Mobile: +44 (0) 7795-027-865

Email: jim.lockard@astorridge.com

Website: www.astorridge.com

This commentary was prepared by Jim Lockard, a Managing Partner at Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and it should be treated as a marketing communication even if it contains a research recommendation. A history of his commentary can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge does not engage in market making or proprietary trading, and has no position in any security discussed in this e-mail. The views in this e-mail are those of the author(s) and are subject to change.. Any recommendations contained herein reflect solely those of the author and were prepared independently of Astor Ridge or its affiliates. This publication does not constitute personal investment advice and may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate recommendations discussed herein. Actual investment returns may fluctuate as a result of changes in economic and market conditions (including market liquidity). Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by us is owned by us.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

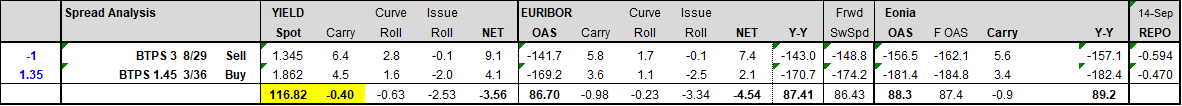

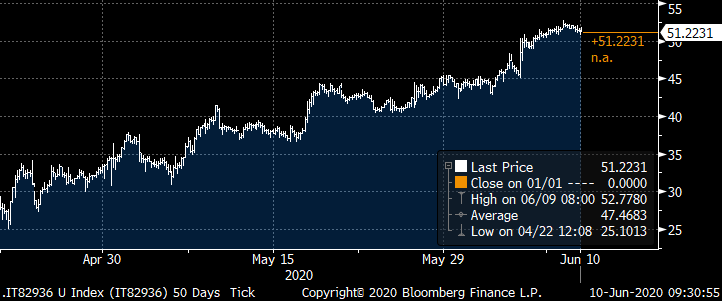

BTP 15yr point is Cheap

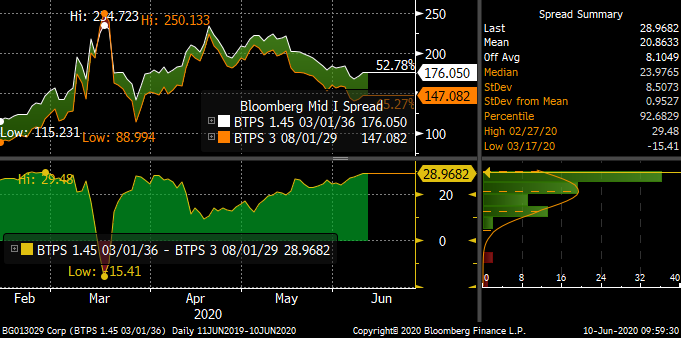

With 2bn BTPS 1.45 3/36 being tapped tomorrow, it's cheap on several metrics:

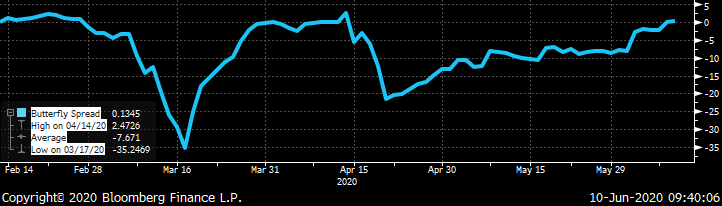

BTP 10s15s30s fly (CTD 8/29-3/36-9/50):

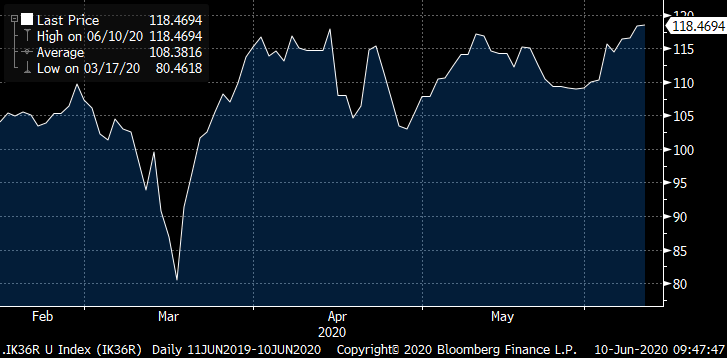

The IK-36s curve is at its highest proportion of the 10s30s curve.

The 8/29-3/36 curve (6.5yr gap) is now 50% of the 8/29-9/50 curve (21yr gap):

HEDGING OUT DIRECTIONALITY: Looking at IK-36s curve regression weighted (1:1.35), we are at the top of the mean reverting range:

1.35 x yld( BTPS 1.45 3/36) – 1.0 x yld (BTPS 3 8/29)

IK-36s 1:1 yield spread – at post pandemic highs - is very steep vs level of IK yields (orange – inverted) and BTP-DBR 10y spread (blue – inverted):

BTPS 8/29-3/36 YY Euribor ASW Spread – at pre-virus and post-virus highs:

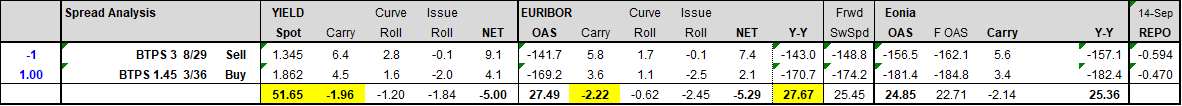

TRADE – Buy BTPS 1.45 3/36 vs IK (CTD 3 8/29) either on YY ASW, Beta weighted (1.35:1), or on 1:1 yield spread to fade the recent risk-on correction.

Macro Rationale: BTP yields, BTP-Bund spreads, and BTP 10s30s curve have all retraced to pre-virus levels, as the S&P equity index has traded within 6.5% of its all time high.

However, while equity indices can take comfort in the eventual re-opening of the global economy, coupled with unprecedented fiscal and monetary stimulus (estimated double of the stimulus for the GFC), Italy was already on an unsustainable fiscal path due to anemic growth prior to the pandemic.

TLTRO, PEPP, and the EU Recovery Fund have provided massive (albeit ultimately temporary) liquidity and support, coupled with impressive resolve by the ECB (with heavy references to proportionality to push back against GCC ruling). Moreover, the PEPP has deviated from the Capital Key (127% of Italy purchases) in succeeding to close BTP spreads by 100 bps. At 180 bps, BTP-DBR 10yr spread is estimated 30bps inside of fair value, given Italian government pandemic support could see its debt/GDP ratio rise from 135% to 160% in 2020 (Citi). From current levels, it would not be surprising if the ECB took more of a containment approach vs actively tightening peripheral spreads. Bottom line is that peripheral supply is likely to outweigh PEPP purchases in 2020 with the exception of GGBs.

Risks to BTP flatteners:

- Negative carry – Carry is close to -2 bps per quarter for both the yield spread and YY ASW:

However, negative carry is mitigated to -0.4 bps per quarter if the trade is beta weighted (1:1.35):

- The recent steepening has provided little to no tactical trading opportunities in the IK-36 flattener. Tactical trading opportunities (i.e. lightening up on dips, and resetting on bounces) would normally offset the negative carry of holding the flattener.

IK-BTPS 1.45 3/36 curve = intraday chart – very shallow pullbacks offer few tactical trading opportunities from the short side:

However, if sentiment weakens after the recent episode of risk-on euphoria, fading the sharp BTP steepening into tomorrow's 15yr supply could pay dividends.

I would look for 5bp tactical trading opportunities in the short term, approaching the EU Council meeting on 18-19 June, could show fissures over the EU Recovery Plan (e.g. Finland and Nordic resistance).

Best,

Jim

Jim Lockard

Founder / Managing Partner

![]() image001.jpg@01D21F14.8E7A1C60">

image001.jpg@01D21F14.8E7A1C60">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 EAST 49th ST, New York NY 10017

Office: +44 (0) 203 -143 - 4172

Mobile: +44 (0) 7795-027-865

Email: jim.lockard@astorridge.com

Website: www.astorridge.com

This commentary was prepared by Jim Lockard, a Managing Partner at Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and it should be treated as a marketing communication even if it contains a research recommendation. A history of his commentary can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge does not engage in market making or proprietary trading, and has no position in any security discussed in this e-mail. The views in this e-mail are those of the author(s) and are subject to change.. Any recommendations contained herein reflect solely those of the author and were prepared independently of Astor Ridge or its affiliates. This publication does not constitute personal investment advice and may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate recommendations discussed herein. Actual investment returns may fluctuate as a result of changes in economic and market conditions (including market liquidity). Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by us is owned by us.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

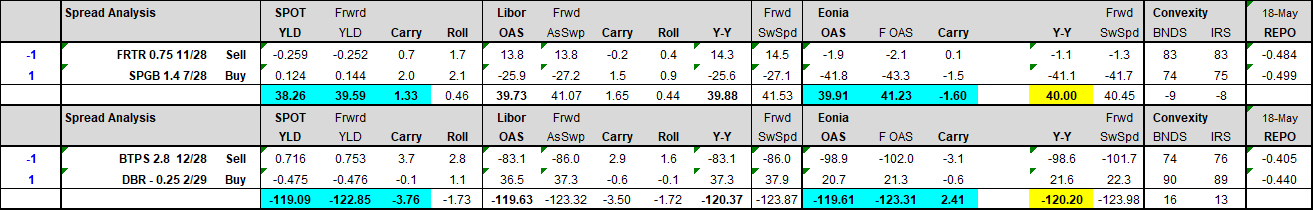

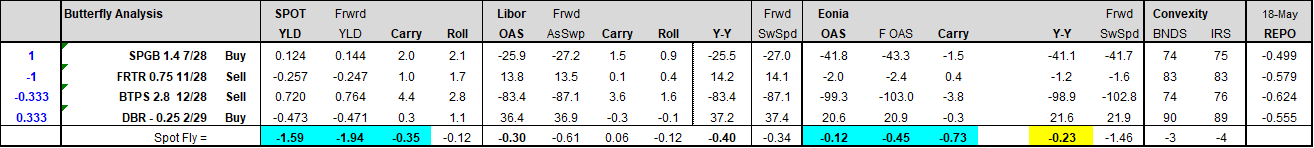

Buy 10yr SPGB-FRTR spread hedged with IK-RX

TRADE:

Buy SGPB 1.4 7/28 vs FRTR 0.75 11/28 (CTD) in $20k/01

Sell BTPS 2.8 12/28 (CTD) vs DBR 0.25 2/29 (CTD) in $6.7k/01 (33% credit delta hedge)

è> Long the FRTR-SPGB ’28 spread hedged with 33% BTPS-DBR CTD spread @ -2 bps:

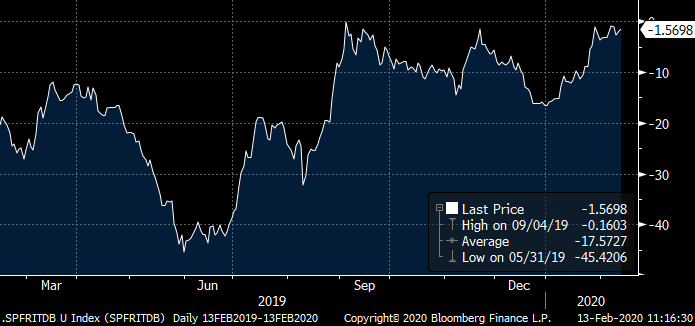

Chart below is SGPB 1.4 7/28 – FRTR 0.75 11/28 (CTD) spread minus 33% of BTPS 2.8 12/28 – DBR 0.25 2/29 spread – this spread has cheapened 15 bps since Jan and 43 bps since June.

100 * ((YIELD[SPGB1.4 7/28 Corp] - YIELD[FRTR0.75 11/28 Corp]) – 0.333*(YIELD[BTPS2.8 12/28 Corp] - YIELD[DBR0.25 2/29 Corp])):

1st Target: -10 (+8 bps)

2nd Target: -15 (+13 bps)

Stop: +2 (-4 bps)

RATIONALE:

===========

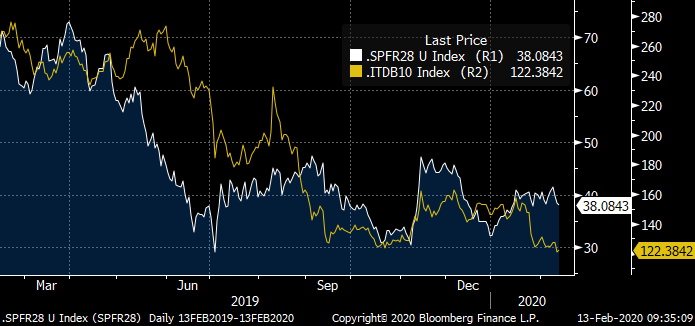

SPGB-FRTR spread has heavily lagged the tightening in the BTP-DBR spread:

White – SPGB 1.4 7/28 – FRTR 0.75 11/28 (CTD) spread

Yellow – BTPS 2.8 12/28 (CTD) vs DBR 0.25 2/29 (CTD) spread

From the chart above, the SPGB-FRTR spread looks 8-9 bps cheap.

The SPGB-FRTR spread hedged with 33% BTP-DBR has cheapened 15 bps since January, due to the following:

- Italian election results shifted power away from Eurosceptic factions (Norda/5 Star), tightening BTP-DBR hedge

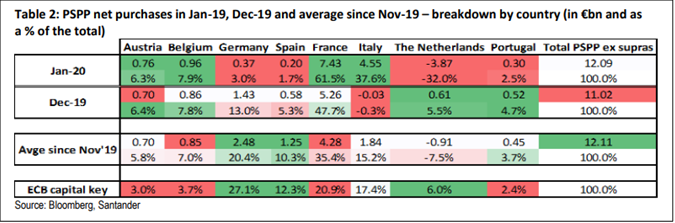

- PSPP bought a disproportionate amount (7.4bn) of FRTRs in January, deviating from the Capital Key to bolster heavy French supply

PSPP bought 61.5% FRTRs in Jan = 3x the Capital Key (20.9%):

- PSPP also bought 37.6% BTPS in Jan > 2x the Capital Key (17.4%)

- Conversely, SPGBs were underbought (only 0.2bn or 1.7% of purchases, vs 12.3% of Capital Key)

Why the SPGB-FRTR spread hedged with BTP-DBR should work:

- ECB will need to smooth out future purchases, e.g. buy more SPGB and DBR, and less FRTR and BTPs to realign with the capital key

- Spain’s YTD issuance is ~ 23.3% completed compared to France’s ~ 13.5%

- France has twice the amount of remaining net issuance (net of C&R flows/PSPP buying) than Spain (70.2bln vs 35.1bn).

- BTP-DBR spread has narrowed to new lows on global reach for yield and corona virus fears; however Fitch, while affirming Italy’s BBB view with negative outlook, gave a dire long term assessment:

“Based on our macroeconomic and fiscal forecast gross general government debt (GGGD) will increase to 137.0% of GDP in 2021 from 134.8% in 2018, driven by subdued nominal GDP growth, and a 1.1pp weakening in the primary balance from 2018 to 2021. This compares with the current 'BBB' median public debt of 36% of GDP and would leave Italy as one of the most highly indebted sovereigns rated by Fitch. Italy's 'BBB' rating and Negative Outlook reflect the extremely high level of general government debt, very low trend GDP growth, economic policy uncertainty and associated downside risks to our public debt projections. The relatively high net external debt and improving, but still weak, banking sector asset quality, also weigh on the rating.”

NB: This spread has tended to trade risk off (e.g. performs better on peripheral widening) in the short term.

Regards

Jim Lockard

Founder / Managing Partner

![]() image001.jpg@01D21F14.8E7A1C60">

image001.jpg@01D21F14.8E7A1C60">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 EAST 49th Street, New York NY 10017

Office: +44 (0) 203 -143 - 4172

Mobile: +44 (0) 7795-027-865

Email: jim.lockard@astorridge.com

Website: www.astorridge.com

This commentary was prepared by Jim Lockard, a Managing Partner at Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and it should be treated as a marketing communication even if it contains a research recommendation. A history of his commentary can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge does not engage in market making or proprietary trading, and has no position in any security discussed in this e-mail. The views in this e-mail are those of the author(s) and are subject to change.. Any recommendations contained herein reflect solely those of the author and were prepared independently of Astor Ridge or its affiliates. This publication does not constitute personal investment advice and may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate recommendations discussed herein. Actual investment returns may fluctuate as a result of changes in economic and market conditions (including market liquidity). Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by us is owned by us.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

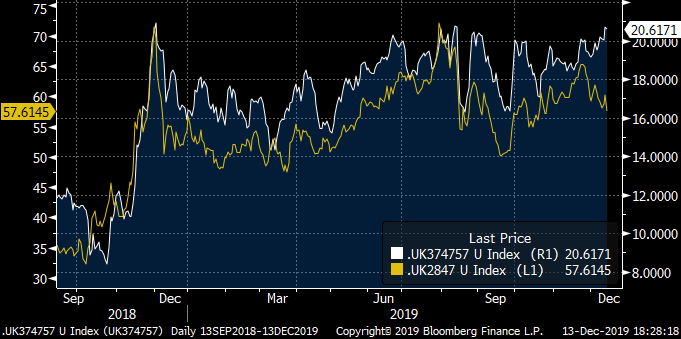

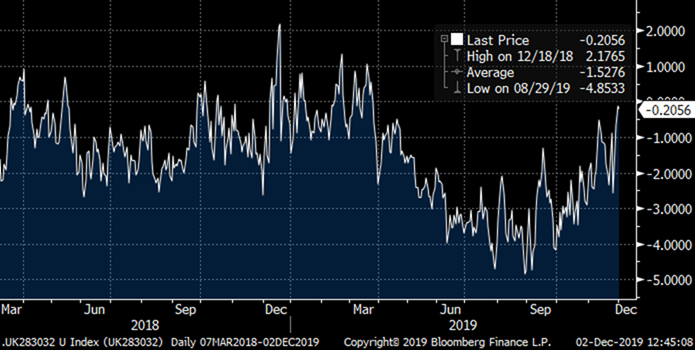

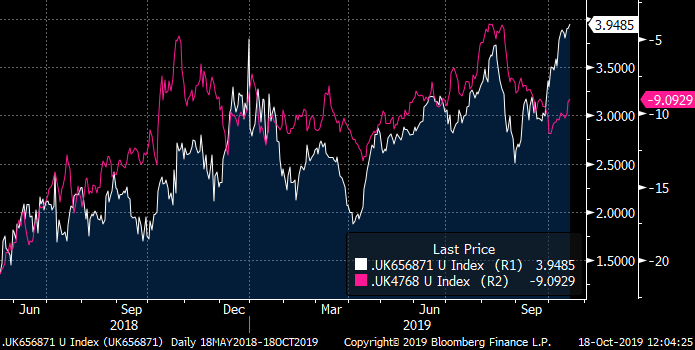

UKT 30yr belly too cheap now - UPDATED

Conservative victory has bear flattened the UK long end:

Despite the abatement of steepening risk that would have resulted from a Labour coalition government, the 30yr point remains very cheap on the 20s30s40s bfly.

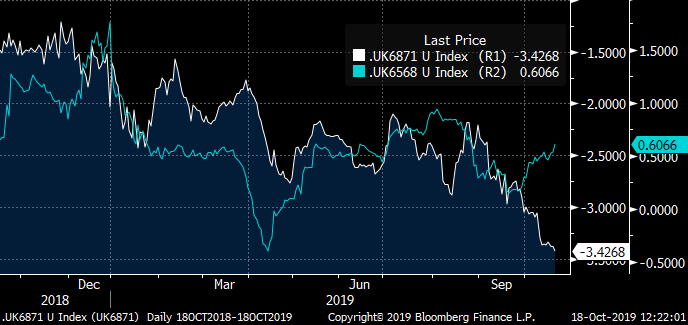

UKT 20s30s40s has recently decoupled from 10s30s:

Yellow – 10s30s (UKT 28s47s)

White – UKT 37s47s57s fly

We are now testing multiple resistance at 21 bps (first reached during the massive 10s30s steepening in Nov 2018, during mass defections by Theresa May’s cabinet).

Supply: We have just digested UKTi 30yr linker (48s) supply on Wednesday. The upcoming supply calendar favours the belly of the fly:

21st Jan – New 20yr auction (41s)

4th Feb – 20yr linker auction (36s)

11/17th Feb – Nominal syndication (likely 54s or 71s)

The next 30yr auction (49s) will not take place until 17th March.

Trade:

Buy belly of UKT 37s47s57s fly at +20.4 bps

Target: 16-18 bps

Stop: 22 bps

Regards,

Jim

Jim Lockard

Founder / Managing Partner

![]() image001.jpg@01D21F14.8E7A1C60">

image001.jpg@01D21F14.8E7A1C60">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 -143 - 4172

Mobile: +44 (0) 7795-027-865

Email: jim.lockard@astorridge.com

Website: www.astorridge.com

This commentary was prepared by Jim Lockard, a Managing Partner at Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and it should be treated as a marketing communication even if it contains a research recommendation. A history of his commentary can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge does not engage in market making or proprietary trading, and has no position in any security discussed in this e-mail. The views in this e-mail are those of the author(s) and are subject to change.. Any recommendations contained herein reflect solely those of the author and were prepared independently of Astor Ridge or its affiliates. This publication does not constitute personal investment advice and may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate recommendations discussed herein. Actual investment returns may fluctuate as a result of changes in economic and market conditions (including market liquidity). Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by us is owned by us.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

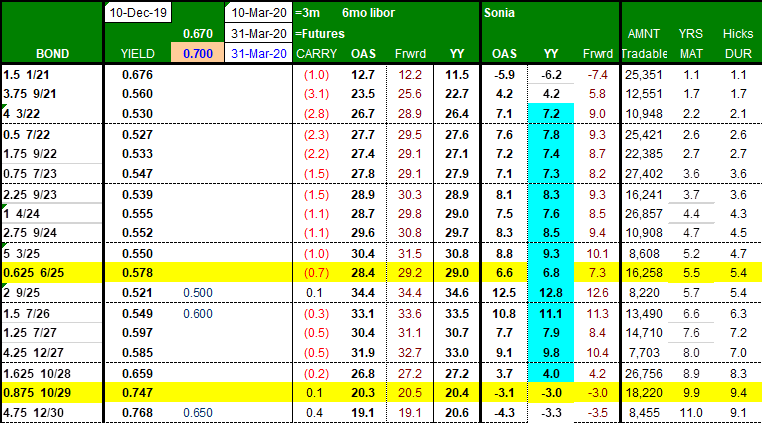

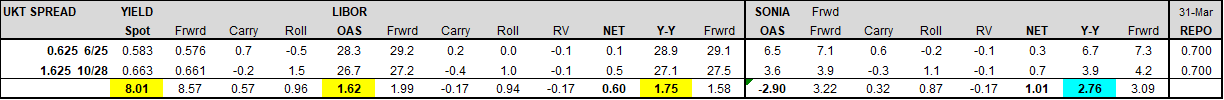

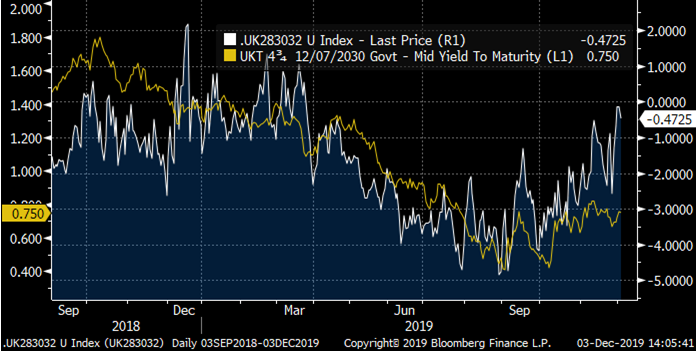

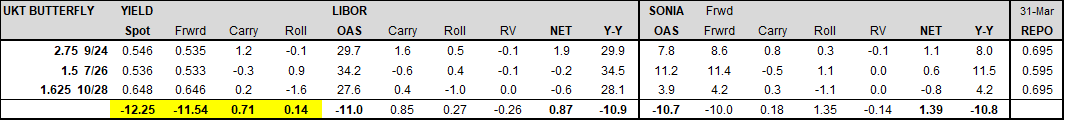

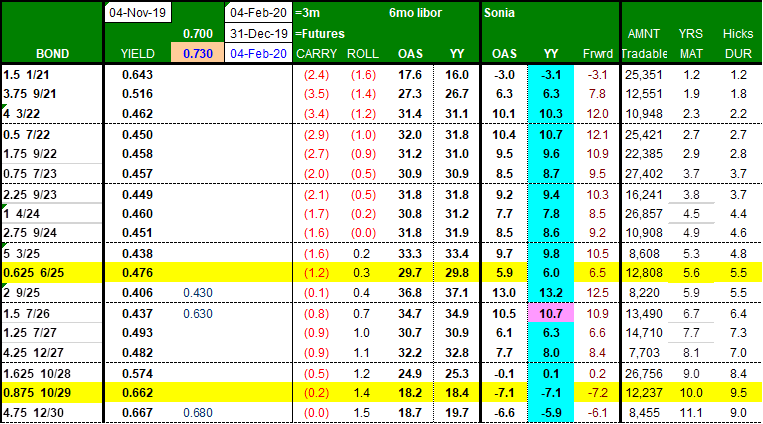

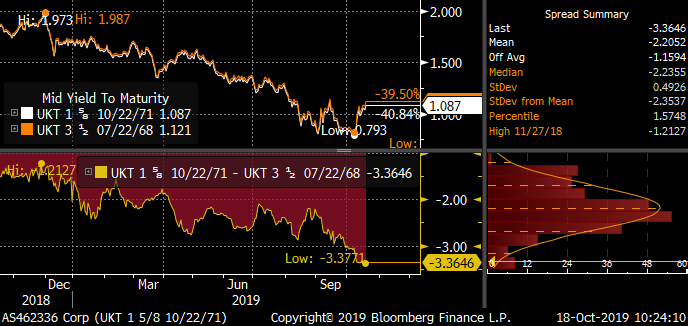

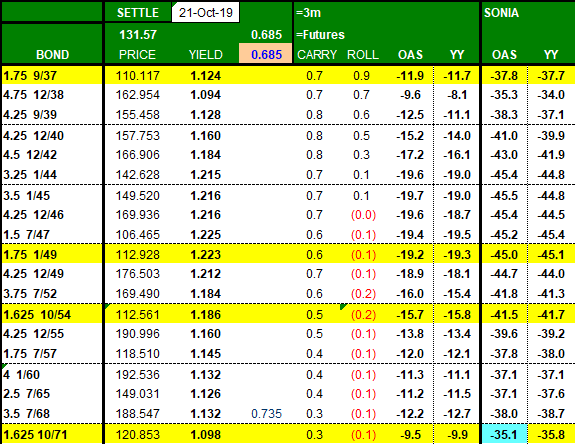

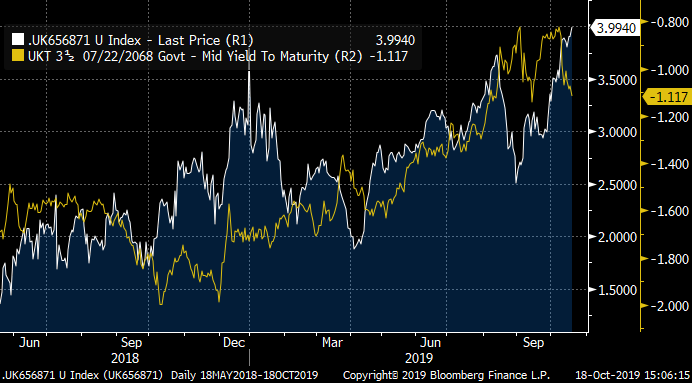

UKT ASW curve

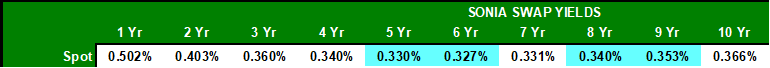

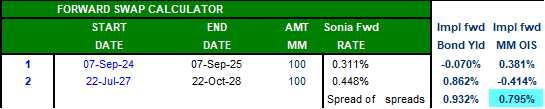

The Gilt Sonia ASW curve out to 10yrs has become very flat:

The 0.625 6/25, while still likely to have 3-4 more taps, rolls positively while cheap on the Sonia ASW curve.

TRADE:

Buy UKT 0.625 6/25 vs UKT 1.625 10/28 on Sonia MMS @ 2.5 bps or better:

Left – UKT 10/28 MM Sonia (blue), UKT 6/25 MM Sonia (Red)

Right – UKT 6/25-10/28 MM Sonia Spread

Target: 10 bps

Add: 0

Stop: -2 bps

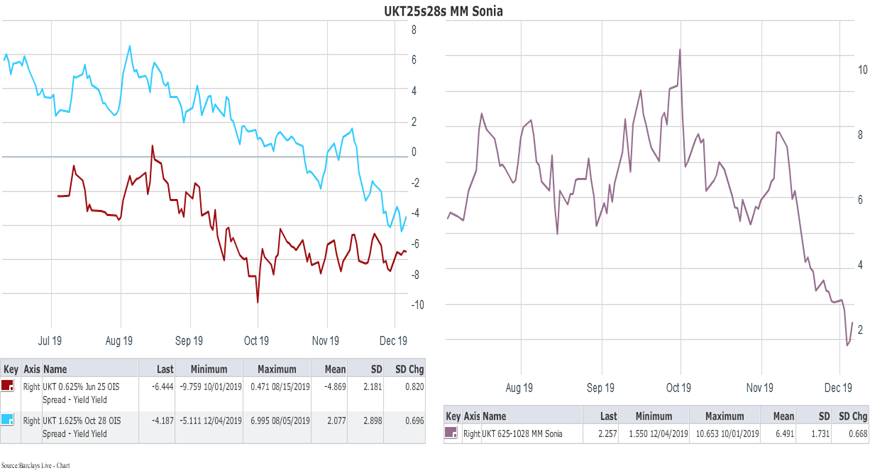

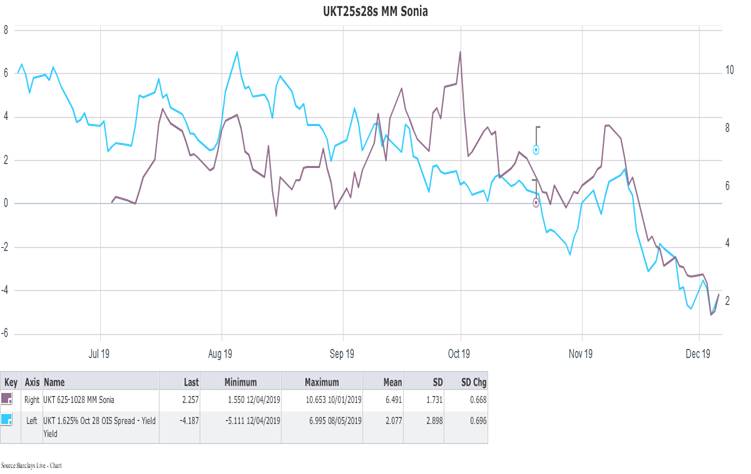

RATIONALE: Recently the 5s10s Gilt and Sonia curves have been moving in the opposite directions, with Gilt flattening / swaps steepening:

White – UKT 6/25-10/28 yield spread

Yellow – Sonia 5s9s curve

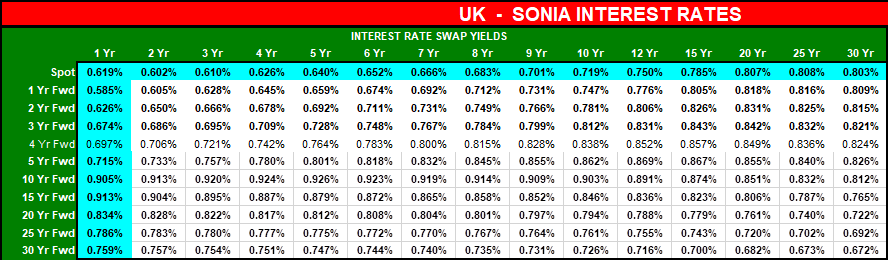

Swap steepening has appeared long overdue – taking a look at the Sonia forward yield matrix below, there isn’t one point on the rates surface that is pricing even one rate hike:

Horizontal axis – swap yields

Vertical axis – forward start dates

What is more perplexing is the Gilt curve out to 7 years is even flatter than the Sonia curve.

DRIVERS:

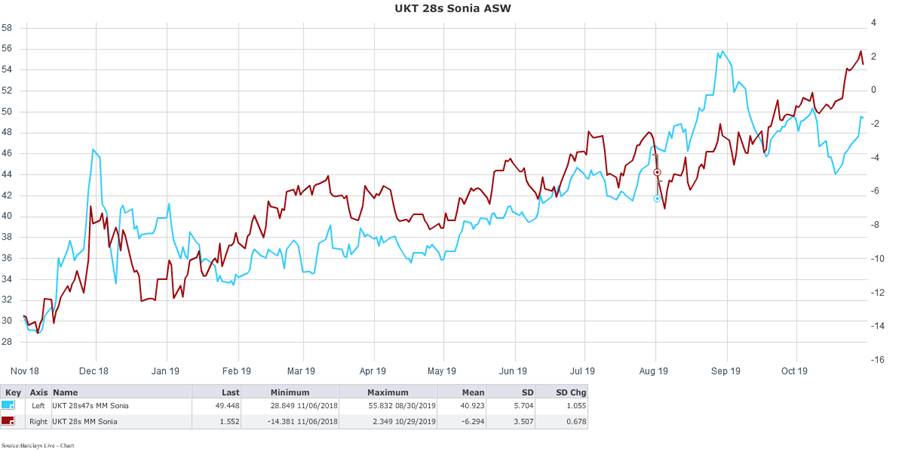

Spread levels – Given the 0.625 6/25 is already trading on top of the Repo-Sonia spread and rolls relatively flat, the 1.625 10/28 Sonia ASW trades with a much higher beta and drives the ASW box, i.e. the trade has a bearish bias on ASW spreads:

Blue – UKT 28s MM Sonia ASW (left axis)

Purple – UKT 25s28s MM Sonia spread

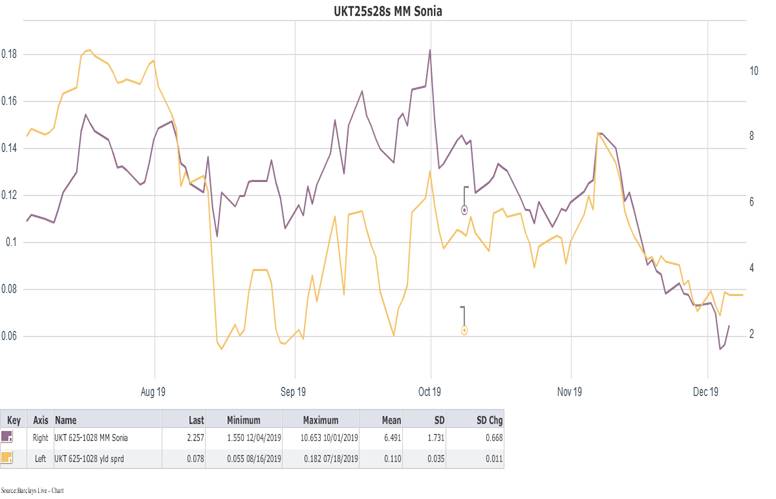

Curve – The Cash curve has recently exhibited a higher beta than the sonia curve; as a result the ASW box is more likely to work in a curve steepening environment:

Yellow – UKT 25s28s yield curve (left axis)

Purple – UKT 25s28s MM Sonia spread

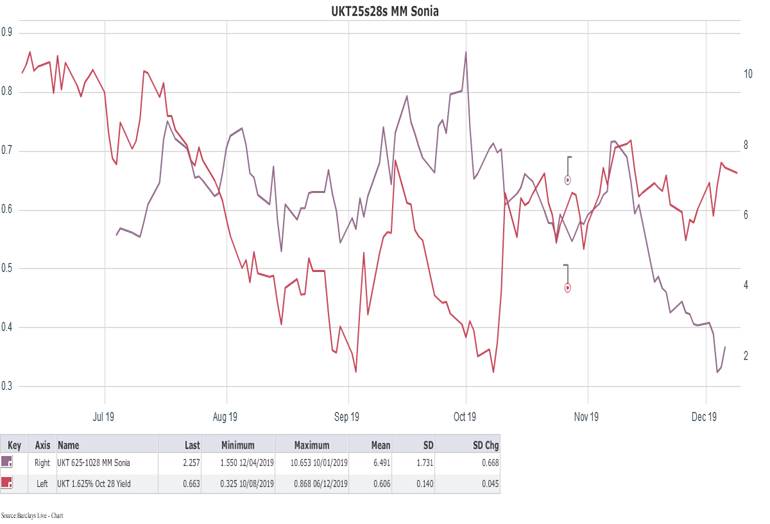

Level of yields – The ASW box has shown little recent correlation to the level of yields, with the box continuing to flatten despite the recent 35 bps sell-off:

Red line – UKT 1.625 10/28 yield (left axis)

Purple line – UKT 25s28s MM Sonia spread

Catalysts:

Elections – Both main parties are promising fiscal stimulus, whether it be in higher spending, lower taxes, or both. Higher borrowing is inevitable, which ceteris paribus should cheapen Gilts vs Sonia, steepening the ASW box. Moreover, the market will likely demand more term premium given higher borrowing requirements and inflationary implications of fiscal stimulus, which should steepen both the Gilt curve and the ASW box.

Jim Lockard

Founder / Managing Partner

![]() image001.jpg@01D21F14.8E7A1C60">

image001.jpg@01D21F14.8E7A1C60">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 EAST 49th Street, New York NY 10017

Office: +44 (0) 203 -143 - 4172

Mobile: +44 (0) 7795-027-865

Email: jim.lockard@astorridge.com

Website: www.astorridge.com

This commentary was prepared by Jim Lockard, a Managing Partner at Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and it should be treated as a marketing communication even if it contains a research recommendation. A history of his commentary can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge does not engage in market making or proprietary trading, and has no position in any security discussed in this e-mail. The views in this e-mail are those of the author(s) and are subject to change.. Any recommendations contained herein reflect solely those of the author and were prepared independently of Astor Ridge or its affiliates. This publication does not constitute personal investment advice and may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate recommendations discussed herein. Actual investment returns may fluctuate as a result of changes in economic and market conditions (including market liquidity). Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by us is owned by us.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

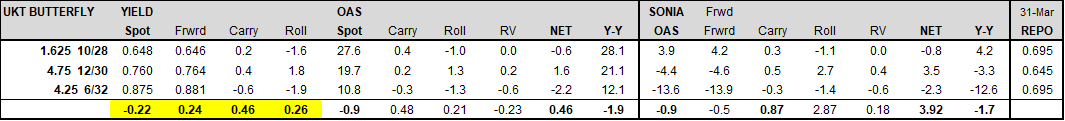

Long belly trade - buy UKT 28s30s32s

(FYI I’ve been able to buy the belly on this fly below -0.5 bps this morning – it has richened 0.3 bps since the open)

There are now attractive opportunities to go long belly of the new CTD 4.75 12/30 – this bond cheapened into the calendar spread as shorts rolled from Dec to Mar (as we also witnessed the richening of the 1.625 10/28 outgoing CTD on ASW) – however this bond has little float and will be CTD for 9 cycles, so should trade with some repo premium, similar to 4q27.

TRADE: Buy belly of UKT 28s30s32s @ -0.5 bps:

ADD: +0.5 bps

STOP: +2.0 bps

TARGET: -4.0 bps

FAIR VALUE VS THE LEVEL OF RATES:

While being long the CTD on bflys can have a directional bias, one can see from the chart below that the 28s30s32s fly looks 2.5 bps cheap to the level of 30s yield:

CARRY: The position enjoys 0.4 bp carry per quarter (assuming 4t30s trade only 5 bps special; the risk is that it trades more special, improving carry).

ROLL: Looking at 2yr wings further in the curve, we see that 26s28s30s is close to flat, while 24s26s28s are much richer:

PREVIOUS HIGH COUPON CTD PERFORMANCE: The 4q27s became CTD in Sep 2017 (vs G Z9); the 25s27s30s fly cheapened Q1 2018 on 1) squeeze of 2 9/25, and 2) Feb 2018 APF (which excluded 4q27).

Thereafter it richened even after it fell out of the futures basket in March 2019:

Best,

Jim

Jim Lockard

Founder / Managing Partner

![]() image001.jpg@01D21F14.8E7A1C60">

image001.jpg@01D21F14.8E7A1C60">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 EAST 49th Street, New York NY 10017

Office: +44 (0) 203 -143 - 4172

Mobile: +44 (0) 7795-027-865

Email: jim.lockard@astorridge.com

Website: www.astorridge.com

This commentary was prepared by Jim Lockard, a Managing Partner at Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and it should be treated as a marketing communication even if it contains a research recommendation. A history of his commentary can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge does not engage in market making or proprietary trading, and has no position in any security discussed in this e-mail. The views in this e-mail are those of the author(s) and are subject to change.. Any recommendations contained herein reflect solely those of the author and were prepared independently of Astor Ridge or its affiliates. This publication does not constitute personal investment advice and may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate recommendations discussed herein. Actual investment returns may fluctuate as a result of changes in economic and market conditions (including market liquidity). Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by us is owned by us.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

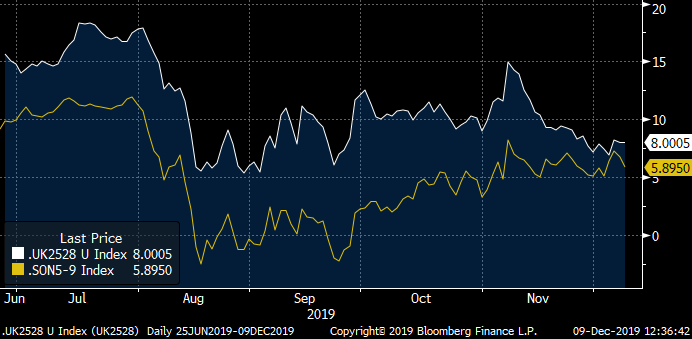

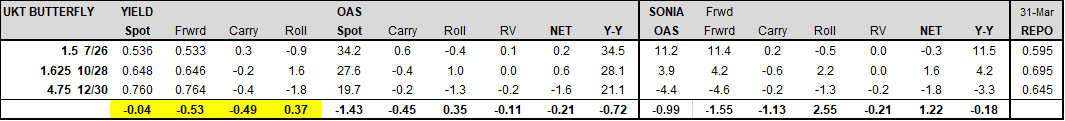

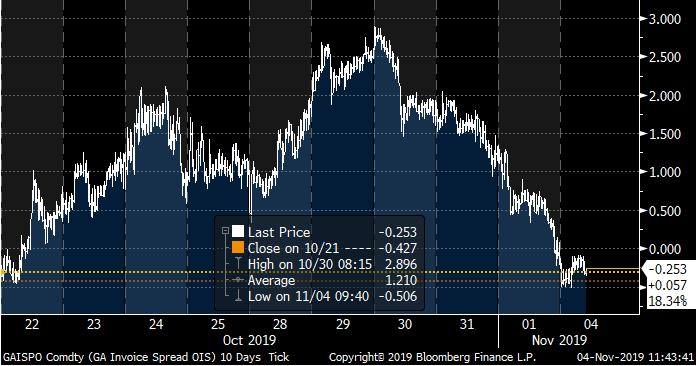

Gilt Spread Update

The Gilt invoice spread has cheapened 3 bps from last week’s highs as polls show Labour closing the gap (and Gilt spreads take over GBP as election risk metric):

https://www.thesun.co.uk/news/10269205/election-boris-johnson-jeremy-corbyn-poll/

Campaign promises from both Labour and Conservative parties call for large fiscal stimulus and deficit spending

(2023-24 spending projections: Conservatives 41.3% GDP / Labour 43.3% GDP, vs long term average of 37.4%):

Parties’ spending plans signal the return of ‘1970s-sized state’

https://www.ft.com/content/cbc2d55a-fccc-11e9-a354-36acbbb0d9b6

Corbyn Scares U.K. Market Hooked on ‘Kindness’ of Strangers

The Monetary Policy Report (which is expected to be dovish) followed by the OBR updated March forecasts on Thursday at 930am (which may highlight the need for more long end supply) could be a potential catalyst for further spread cheapening and curve steepening into year end.

Seasonals could also exert downward pressure on spreads given balance sheet reduction coupled with anticipated swapped corporate issuance in Q1 2020.

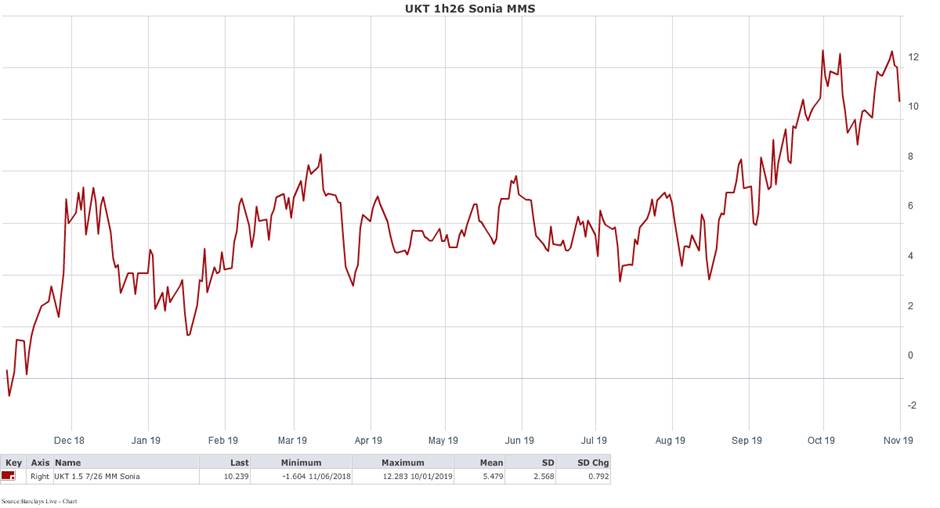

Looking at the Spread curve below (excluding the 2 9/25 which are perennially rich in repo), the 1.5 7/26 represents the peak of the curve:

Short 7yr Sonia MMS rolls and carries positively;

even short Gilt-Sonia invoice spreads are no longer negative carry given their recent convergence to the Sonia-repo spread (~2 bps):

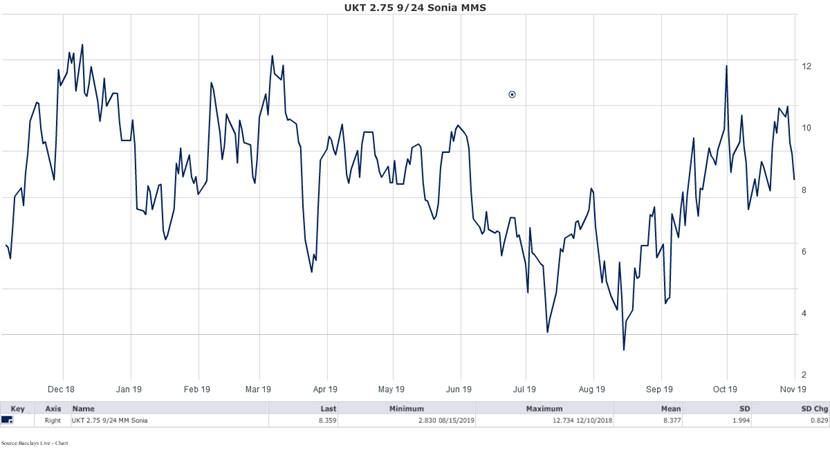

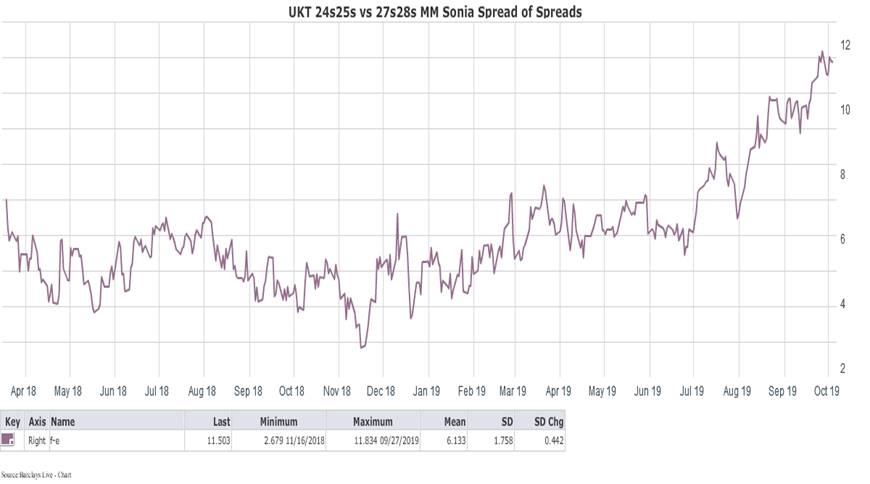

Further in the curve, we see that UKT 2.75 9/24 Sonia MMS has been unable to breach 12 bps – given the spread should ultimately converge to the Sonia-Repo spread:

Richness of the 10yr point on the spread curve:

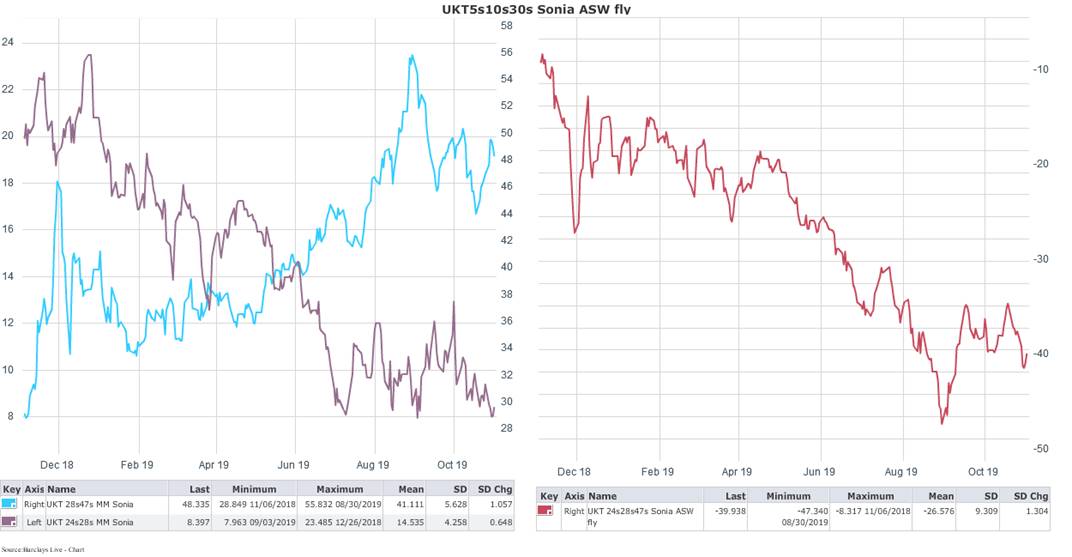

10yr Gilt spreads seem unlikely to retest their recent 40bp peak to trough richening on the 5s10s30s ASW fly in August (caused by distressed convexity driven 30yr receiving):

Left Graph: UKT 5s10s Sonia ASW box (purple / left axis) Right Graph: UKT 5s10s30s Sonia ASW fly

UKT 10s30s Sonia ASW box (blue / right axis)

Over the past year, the 5s10s Sonia ASW box has flattened 14 bps, 8bps more than implied by the ASW roll on 1.625 10/28 (= 6bp/yr).

==============================================================================================================

How did 10yr spreads get here given the recent sell-off in rates and fiscal stimulus on the horizon?

The recent richening in Gilt long end ASWs could be dragging 10yr ASWs richer; typically 10s30s ASW box bull steepens, but in this latest episode, the 10-30yr ASW box has stayed relatively flat:

Gilt Sonia Invoice (red / right axis)

Gilt 10s30s Sonia ASW box (blue / left axis)

The UK government is reviewing the relaxation of Solvency II requirements for UK insurers post Brexit (e.g. this might allow insurers to hedge liabilities with Gilts rather than swaps without incurring a capital charge); insurers are largely hedged in the 20-30yr sector, so some of the recent LDI buying of long end Gilt ASW could be some provisional switching from Sonia into long Gilts, which trade 40-50bps higher in yield. These flows, at the margin, could be suppressing any long end ASW repricing on fiscal easing.

There may also be some short positioning in 10-15yr ASWs by bank treasuries (source: Barclays).

Short Spread Expressions:

- Gilt-Sonia invoice spread – the most liquid and transparent expression – has the disadvantage of punitive roll and less favourable carry given the absolute level is 11bps cheaper than the 7yr point.

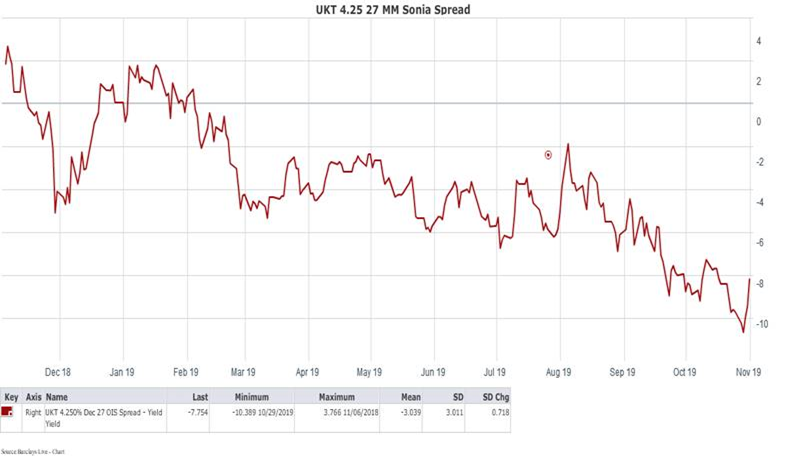

Moreover, the CTD 1.625 10/28 will roll out of the futures basket in Dec. When the UKT 4.25 12/27 rolled out of the basket in March 2019, the spread richened 6 bps into the roll and stayed rich:

With short interest in Gilt futures rising in the latest selloff, the calendar spread could richen into the roll.

- UKT 1.5 7/26 Sonia MMS: Rather than sell the Gilt invoice spread, which rolls up a steep portion of the spread curve, sell spreads further in the curve which are trading closer to the 10-12bps upper boundary. Specifically the UKT 1.5 7/26 are rich on the curve and at Sonia - 11bps are trading near the upper boundary of the Sonia ASW spread curve:

Moreover, the UKT 1.5 7/26 are also rich on the cash curve; the 2T24-1H26 curve = -0.5 bps, while the 1H26-1F28 curve = +14.5 bps, putting the 24s26s28s bfly @ -15.0 bps:

Jim Lockard

Founder / Managing Partner

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 EAST 49th Street, New York NY 10017

Office: +44 (0) 203 -143 - 4172

Mobile: +44 (0) 7795-027-865

Email: jim.lockard@astorridge.com

Website: www.astorridge.com

This commentary was prepared by Jim Lockard, a Managing Partner at Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and it should be treated as a marketing communication even if it contains a research recommendation. A history of his commentary can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge does not engage in market making or proprietary trading, and has no position in any security discussed in this e-mail. The views in this e-mail are those of the author(s) and are subject to change.. Any recommendations contained herein reflect solely those of the author and were prepared independently of Astor Ridge or its affiliates. This publication does not constitute personal investment advice and may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate recommendations discussed herein. Actual investment returns may fluctuate as a result of changes in economic and market conditions (including market liquidity). Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by us is owned by us.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MACROCOSM: UK's OBR to publish NEW FORECASTS on NOV 7th > THOUGHTS

Report shows fiscal deterioration from the OBR budgetary projections made last year; paradoxically Gilt ASW spreads have not reflected this due to FTQ bid on heightened Brexit uncertainty….

*OBR SAYS IT PLANS TO PUBLISH NEW U.K. FORECASTS ON NOV. 7

Comments from our colleague George Whitehead…

To Me Public Finances look around £31.6bn worse than a year ago so new forecast have to show increased borrowing going forward....FWIW...

UK OBR 7th November New UK Forecasts:

• Borrowing (public sector net borrowing excluding public sector banks) in September 2019 was £9.2 billion, £0.4 billion more than in September 2018; this is the first September year-on-year borrowing increase for five years.

• Borrowing in the current financial year-to-date (April 2019 to September 2019) was £39.0 billion, £5.9 billion more than in the same period last year; this is the first April-to-September borrowing increase for five years.

• Debt (public sector net debt excluding public sector banks) at the end of September 2019 was £1,790.9 billion (or 80.3% of gross domestic product (GDP)), an increase of £27.3 billion, or a decrease of 1.2 percentage points, on September 2018.

• Debt at the end of September 2019 excluding the Bank of England (mainly quantitative easing) was £1,611.1 billion or 72.2% of GDP; this is an increase of £38.6 billion, or a decrease of 0.5 percentage points on September 2018.

• Central government net cash requirement was £32.9 billion in the current financial year-to-date; this is £13.5 billion more than in the same period in the previous year.

• Central government net cash requirement excluding both UK Asset Resolution Ltd and Network Rail was £32.7 billion in the current financial year-to-date; this is £12.2 billion more than in the same period last year.

Link to release: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/842880/PSF_bulletin_September_2019_corrected_HMT_V2.pdf

Jim Lockard

Founder / Managing Partner

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 EAST 49th Street, New York NY 10017

Office: +44 (0) 203 -143 - 4172

Mobile: +44 (0) 7795-027-865

Email: jim.lockard@astorridge.com

Website: www.astorridge.com

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

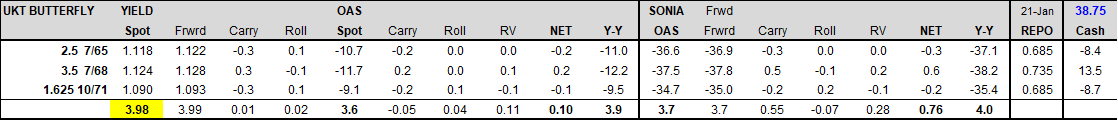

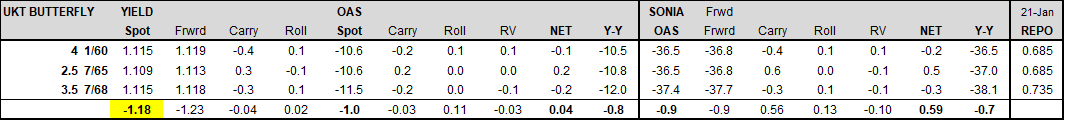

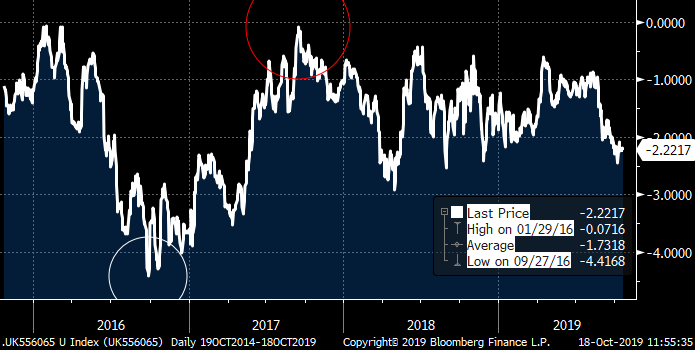

UKT 65s68s71s fly - dislocated belly cheapening

Here’s a stable RV trade with low VAR/beta to Brexit risks:

TRADE: Buy $50k/01 of UKT 65s68s71s at +3.75 bps

TARGET: 1.75 bps (+2bp)

STOP: 4.75 bps (-1bp)

This micro fly 65s68s71s is at extreme levels, and has decoupled from the 30s50s curve (magenta):

Carry is flat vs a 5bp repo spread; £38.75k ($50k/01) position consumes only £31.2mm gross / £3.6mm net notional balance sheet:

The next fly in the curve, 60s65s68s, trades over 5bps richer:

The dislocation is being driven by the 68s71s leg, which has been bull flattening:

Whereas the 65s68s curve (blue) has recently steepened:

71s stand out as very rich on the Sonia ASW curve – they are richer than UKT 1.75 9/37 which are 34 years shorter:

The last time UKT long end micro RV was this dislocated was in 2016, when the 55s60s65s fly traded -4bps, only to correct 4 bps within the year:

Why is the trade there?

- UKT 71s pay a coupon on 10/22, much of which will be reinvested in same issue for passive managers (coupon payment total = £92mm = £411k/01 in risk terms)

- Convexity – we’ve just had a 30bps back up in ultras; the 65s68s71s would have lost 0.3bp in rehedging cost over this move (i.e. 0.1bp per 10bp move in yields)

- There have been several corporate pension buy-ins in (where pensions sell their LDI portfolio to an insurer in exchange for a guaranteed annuity). De-risking activity has picked up in front of Brexit. This is because Insurers are allowed to take more risk than pensions to hedge their liabilities. Last night Walmart/ASDA announced the completion of a £3.8bn deal:

The American owner of Asda has struck a deal to offload nearly £4bn of the UK-based supermarket chain's pension liabilities, removing a hurdle to a standalone stock market listing.

Sky News has learnt that Walmart and Asda's pension trustees have agreed a £3.8bn pension buy-in with Rothesay Life, a specialist insurer of corporate retirement schemes.

https://news.sky.com/story/asda-owner-walmart-clears-path-to-float-with-4bn-pension-deal-11837972

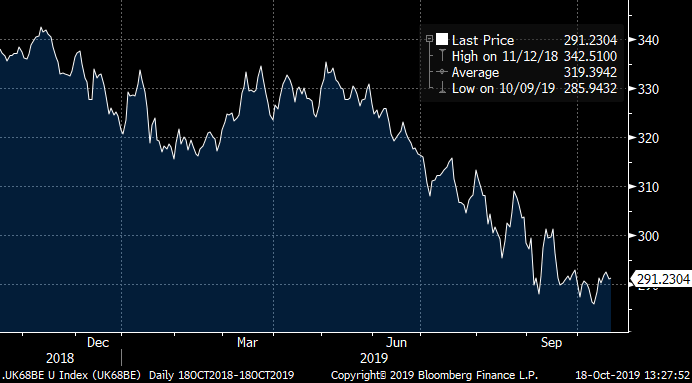

When insurers (who are not required to hedge inflation) take over DB pension assets (who are required), they often sell out of long linkers (which trade at ridiculous real yields near -2%) and replace them with nominals; this could explain the recent narrowing of long end break-evens:

UKT 68s Break-evens

When ultra long nominals are bought, the 71s tend to outperform given they are the current 50yr benchmark and the only 50+ yr Gilt.

Moreover, the 68s might be passed over in LDI programs given their high price and coupon, which makes them more attractive to income investors.

What catalyst will correct the trade?

Either 1) Income investors will come in at month end, recognising the historical cheapness of 68s, or

2) 71s will get sold into the market over time, cleaning up dealer shorts, as LDI needs move toward the 25-40yr sweet spot with the ongoing shift towards DB and flexible drawdown pensions

What happens to the trade in a no deal Brexit?

The fly has bull cheapened, but did not richen in the recent sell-off due to recent LDI activity:

Yellow – UKT 68s yield (inverted)

The fly cheapened 0.7 bps during the Nov 2018 Brexit flareup but then richened 0.85 bps during the March 2019 Brexit countdown, so there doesn’t seem to be a strong correlation to Brexit risk.

The UKT 68s yield bottomed recently at 0.80, near the current base rate; while a no deal Brexit could see ultra rates test 0.50, the curve would likely bull steepen due to the inflation shock caused by GBP weakness, which would cheapen ultras in general and the 71s (50yr benchmark) in particular, arresting further cheapening in the 65s68s71s fly.

Jim Lockard

Founder / Managing Partner

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 EAST 49th Street, New York NY 10017

Office: +44 (0) 203 -143 - 4172

Mobile: +44 (0) 7795-027-865

Email: jim.lockard@astorridge.com

Website: www.astorridge.com

This commentary was prepared by Jim Lockard, a Managing Partner at Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and it should be treated as a marketing communication even if it contains a research recommendation. A history of his commentary can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge does not engage in market making or proprietary trading, and has no position in any security discussed in this e-mail. The views in this e-mail are those of the author(s) and are subject to change.. Any recommendations contained herein reflect solely those of the author and were prepared independently of Astor Ridge or its affiliates. This publication does not constitute personal investment advice and may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate recommendations discussed herein. Actual investment returns may fluctuate as a result of changes in economic and market conditions (including market liquidity). Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by us is owned by us.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

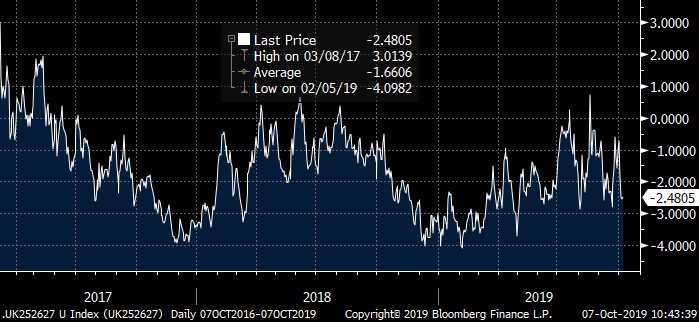

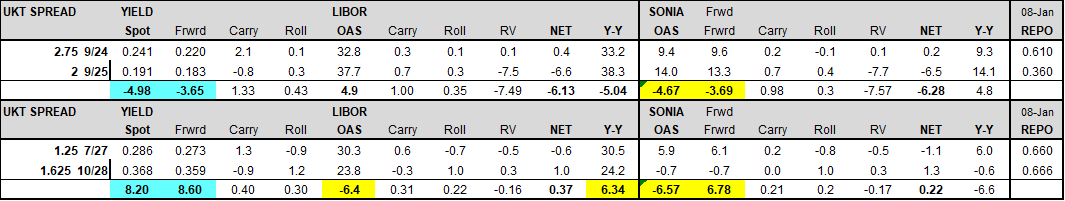

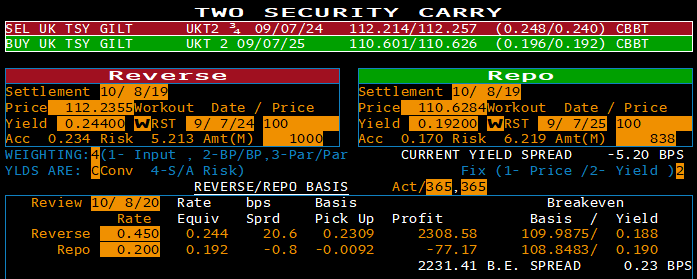

UKT Curve - V deepening to distressed levels

The UKT 6mo-10yr curve is extremely V shaped:

6mo-6yr (4.75 3/20 – 2 9/25): -49 bps

6yr-10yr (2 9/25–0.875 10/29): +25.5 bps

The 2 9/25 yield @ 0.19 (56 bps through base rate) is pricing a distressed Brexit outcome, and even assuming 1yr repo of Sonia – 30bps, can be shorted for flat carry.

As a result, the UKT 1.5 7/26 looks extremely rich on 24s26s28s fly but only modestly rich on the tighter 25s26s27s fly.

UKT 24s26s28s – plumbing new depths:

UKT 25s26s27s – in the middle of its long term range:

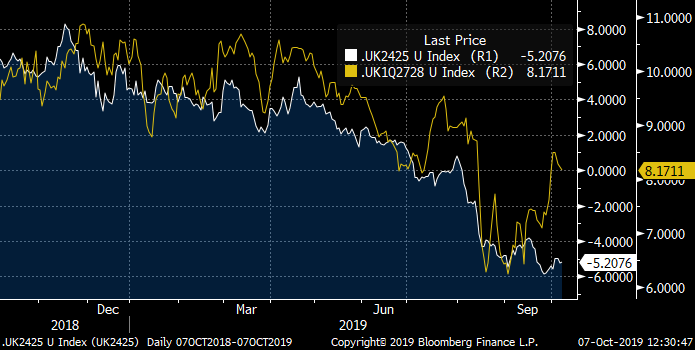

The difference is UKT 24s25s inverting (-5.25 bps) while 27s28s curve steepening (+8.15 bps):

UKT 9/24-9/25 vs 7/27-10/28 overlaid – 27s28s decoupling steeper:

The Sonia 5s6s and 8s9s curves are relatively flat, so the anomaly is strictly on the Gilt curve:

I.e. UKT 24s25s vs 27s28s Sonia box is also at elevated levels:

- UKT 9/24-9/25 steepener vs 7/27-10/28 flattener is an optimal way to fade the V shape of the UKT 2s5s10s curve

=====================================================================================================================================

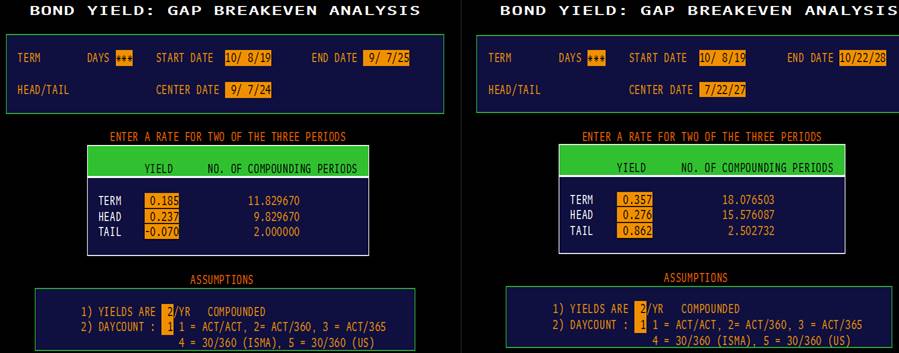

IMPLIED FORWARDS:

UKT 27s28s implied forward yield is 93 bps cheap to 24s25s implied forward:

UKT 24s25s: -.07 implied forward yield UKT 27s28s: +.862 implied forward yield (+93 bps vs 24s25s)

Compare this to similar matched maturity 1yr buckets on the Sonia curve (5y1y vs 8y1y) = +13.7 bps:

- I.e. there is an 80bps gap between 5y1y and 8y1y MM Sonia spreads.

Caveats – UKT 2 9/25 have been trading perennially rich in repo – currently ~ 30bps thru GC for short dates

Assuming the 2 9/25 trades 25bps thru GC for an entire year (unlikely now that it is ineligible for APF), the 9/24-9/25 forward spread is 5.4 bps steeper than spot (i.e. the forward yield spread is close to flat):

The 1yr forward 9/24-9/25 MM Sonia curve = +0.6bps, meaning the forward Sonia ASW box is STILL inverted:

Consensus short positioning is the main risk to being short 2 9/25 or 1.5 7/26…..the latter bond will still be eligible for the March 2020 APF so could stay rich in yield and on repo for an extended period.

Jim Lockard

Founder / Managing Partner

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 EAST 49th Street, New York NY 10017

Office: +44 (0) 203 -143 - 4172

Mobile: +44 (0) 7795-027-865

Email: jim.lockard@astorridge.com

Website: www.astorridge.com

This commentary was prepared by Jim Lockard, a Managing Partner at Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and it should be treated as a marketing communication even if it contains a research recommendation. A history of his commentary can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge does not engage in market making or proprietary trading, and has no position in any security discussed in this e-mail. The views in this e-mail are those of the author(s) and are subject to change.. Any recommendations contained herein reflect solely those of the author and were prepared independently of Astor Ridge or its affiliates. This publication does not constitute personal investment advice and may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate recommendations discussed herein. Actual investment returns may fluctuate as a result of changes in economic and market conditions (including market liquidity). Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by us is owned by us.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796