French 10yr Spreads Expensive - Best Expression - Pay Spread in 5y5yfwd.

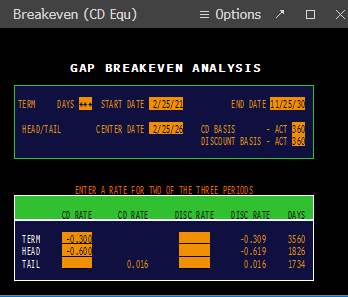

Trade: Buy 2/26 OAT 100m, Sell 11/30 OAT 100m – Net DVO1 Short Risk Eur 48,700

REC 5y5yfwd in OIS(eonia) DV01 Risk Long Eur 48,700

Forward Yield implied on bond side: +0.016bps

Forward Yield of Swap: -0.023bps

Forward Spread implicit 5y5y: +0.039bps

Spot 10y Spread Ref: Invoice OATH1 at -7.0bps

Carry Bond side 1x1 notional: Negative 0.28bps/Month

Carry/Roll Swap: Positive 0.8bps/Month(current 5y5yfwd -0.0265 vs 5y4yfwd -0.133)

Net Carry Positive 0.52bps/Month

Rational:

- 10y French Spreads at long term wides(ie Bonds expensive to OIS)

- 5/10y Curve Flat in both Yield and in ASW spread, move over last 6mos has seen sharp move in Spread curve

- Looking at the trade in forward terms improve funding of the trade from negative to positive.

- French ASW is function of two spreads: a) Bund Spreads, plus b) OAT vs Bund country spread, and while bund

spreads can be volatile in the short run, I believe longer term spreads will go the direction of Deficits. Also

10y OAT vs Bund spread at or near historical lows over the last decade. - Seasonal input from Jan/Feb given large issuance, generally favours lower rates and tighter spreads s/t to be followed by

wider spreads in the second half of the quarter. - France continues to be the largest net issuer of Debt in EGB space for many years running. Also new big competitor in town – EU.

Risk:

* PEPP and continued liquidity push keeps rates low and stable acting as a compressor of all EGB bond yields. More PEPP?

- The DMO looks to shorten the duration of their issuance and we see increased supply in the short end in 2021.

- ECB enters into a period of YCC to suppress long rates from rising and intentionally flattens the curve.

Entry: +0.039bps

Add: 0.00bps

Stop: -0.01bps

Target: +20.0bps

See Supporting Charts Below:

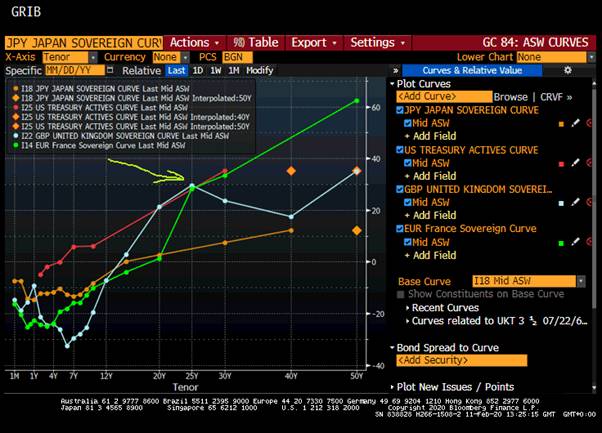

Generic 5y5yfwd France vs 5y5yfwd OIS – Long History as a guide for Trade Specific.

Gap Analysis for Implied Forward rate France 2/26 vs 11/30

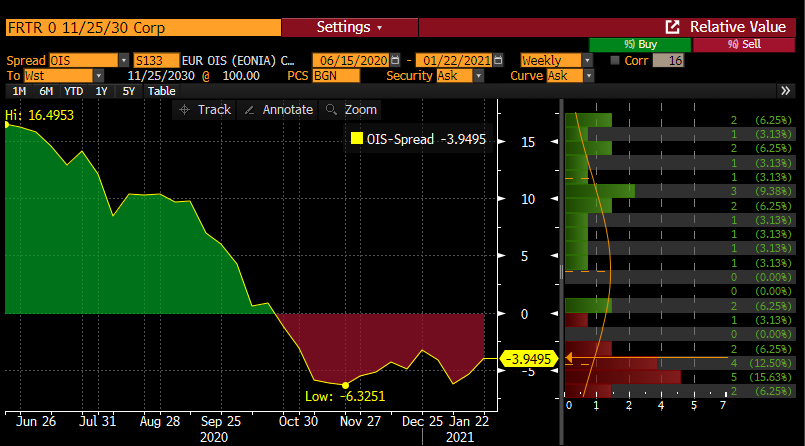

Long Term Level of OAT Invoice Spreads vs OIS

Move in 10y 11/30s vs OIS since June.

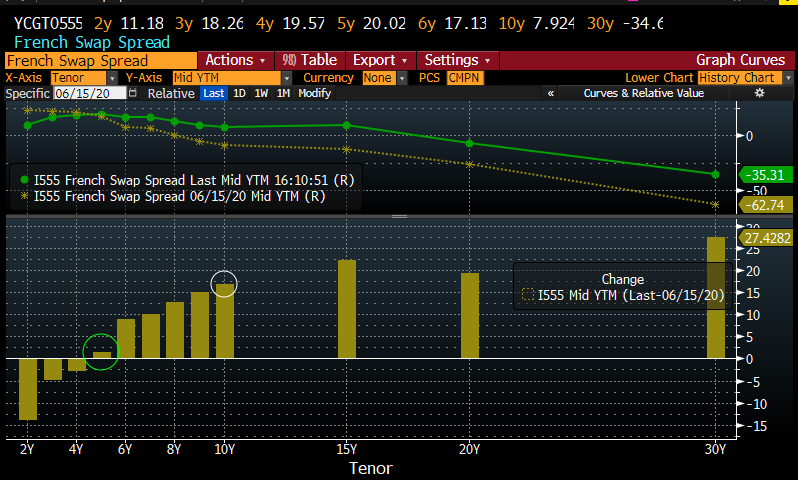

Change in French ASW Spreads over 6mos

Happy to discuss.

Creo

Lagarde/ECB and EUR + Yield Curve

Lagarde Update: My Take

* Went out of her way to highlight persistent low and even lower inflation then they would like to see. In part, a return to target is going to take longer.

* No Targeting of spreads nor any form of YCC, but EPPs flexibility and large unused envelope gives

them lots of room to fight on two fronts: a) unnecessary fragmentation and b) rise in term premium ie supression of long rates and volatility of rates.

* Monetary conditions tightening - it is difficult for Monetary policy alone to respond to the financial condition within Europe right now -

hence - PLEASE HELP MORE ON THE FISCAL FRONT

* The EUR is clearly on their minds right now and a sticky issue because they do not want to be held hostage to its moves, but clearly the

Euros strength has impacted future expectations for growth and INFLATION.

******************************************************************************************************************************

SO what can the ECB do to solve for lifting inflation, weakening the currency(albeit not a vocal strategy) and keeping long yields supressed to benefit long term growth.

Basically how does the ECB sharply lower REAL RATES.

* For me, I would say against all logic, is to lower short rates even more - unimanginable....impact to real rates, lower EUR, Steeper curves while

keeping long bond yields low and stable.

* Bitter pill to swallow and while steepeners may be negative carry, the flip side may not be enough cushion to warrant holding flatteners

while the ECB is faced with such a dilemma.

* Just a thought.

![]()

Stephen Creaturo

O: +44 (0) 203 - 143 – 4175

M: +44 (0) 7 809 575 890

E: stephen.creaturo@AstorRidge.com

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This marketing was prepared by Stephen Creaturo, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

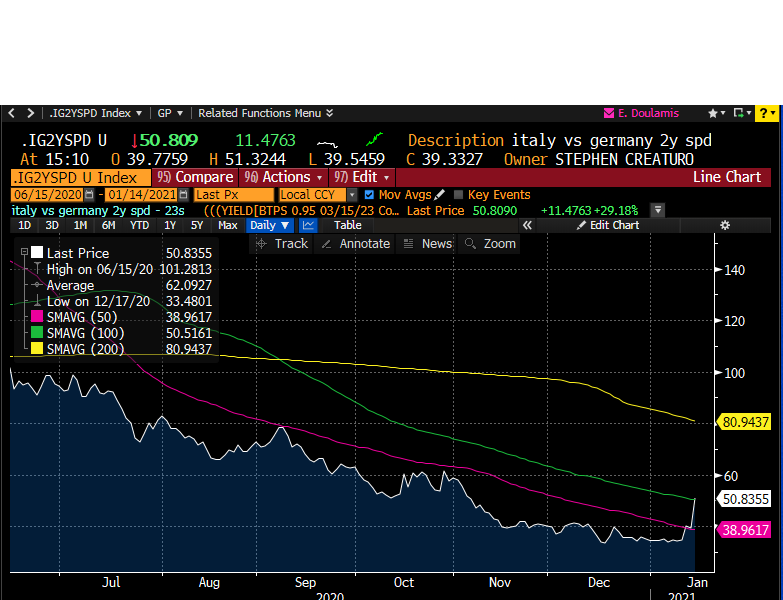

Italy 1/30 Box vs Short 2yr Spread - Unwind 2yr spread portion

2y Spreads has reached first target – near the 100d MA. And is 15bp on sides.

10/30 Box – now 1.5pbs lower.

My thinking is unwind the 2y spread trade as this is the first major bearish move for BTPS in a long while.

Sentiment for the vast majority of traders/investors is to buy the dip(maybe that is a risk itself – crowded)

But while the trade is meant to be contingent – I look at it as – any further blow-up in BTPs and 10/30s reverts back to credit sensitivity and performs

more like a credit curve than a sovereign curve. If this recent move is just a wobble to push out weak longs and the calvary comes to buy the dip, 2y

spreads recover and 10/30 box gives up small.

* the 2y portion of the trade has just allowed you to get into the box trade almost 4bps cheaper than the entry level if you monetise 2y spreads here.

![]()

Stephen Creaturo

O: +44 (0) 203 - 143 – 4175

M: +44 (0) 7 809 575 890

E: stephen.creaturo@AstorRidge.com

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This marketing was prepared by Stephen Creaturo, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

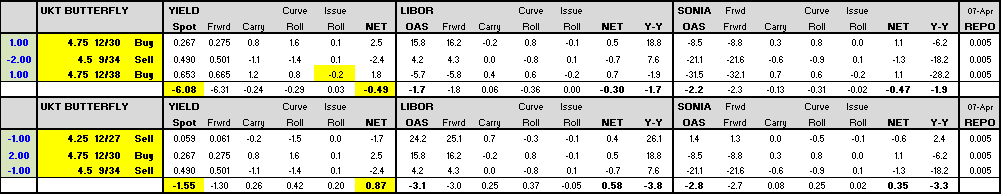

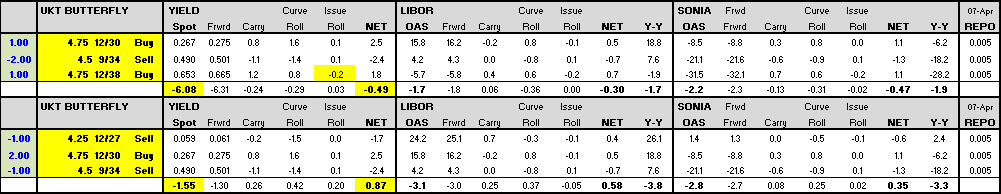

3 HC vs LC Fly's that Solve for DVO1 Neutral, Duration Neutral, Carry Positive to Flat. Two in UK and one in Spain.

Solving for:

* Range trade - spread at or near the highs

* Carry must be neutral to positive, assuming a negative funding differential between longs and shorts

* DVO1 neutral but weights must display symmetrical distribution of duration in both wings to mitigate either direction or curve input

Trades:

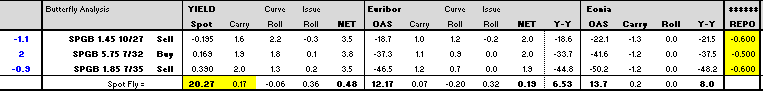

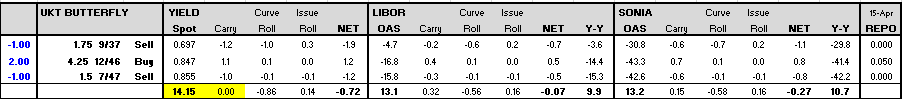

Spain: Buy 5.75% 32 vs selling 1.45% 27 & 1.85% 35 wtd 1.1x2x0.9

UK : Buy 4.75% 30 vs selling 0.125 28 & 0.375% 30 wtd 1x2x1

Buy 4.5% 46 vs selling 1.75% 37 & 1.5% 47 wtd 1x2x1

Rationale:

* markets confined to range trade in 2021 with CBs heavily involved in keeping bond volatility low throughout the year

- Using duration metric for distribution of risk which favours HCs more so in the UK(ie HCs cheap when compared to duration)

- Identifying trades/fly that are either non-correlated to level or slope, and/or those fly's that are mispriced from level and

slope, giving better entry to what is the base assumption that we are in a range trade for most of the year.

Risks:

* Regime shift in rate structure in 2021 whereby we move to significantly higher rates and steeper curve, long belly trades out of favour

* Liquidity for some of the high coupons is poor and/or funding differential overly punitive that produces a negative carry scenario

See Trades below: Charts show: a) Fly vs level and slope, b) Carry metrics, c) duration distribution being symmetrical

Spain: Buy 5.75% 32 vs selling 1.45% 27 & 1.85% 35 wtd 1.1x2x0.9

Entry: Gross +20bps with weights 1.1x.9

Add +23bps

Stop +25bps

Target + 12bps( mid-point of old range prior to Covid)

Carry +0.17bps for 3mos assuming 10bps funding differential

Chart below: Spain Fly 27/32/35 vs Level and Slope

Carry Metrics

Chart below is Duration Distribution in Risk format to include wtd 1.1x0.9

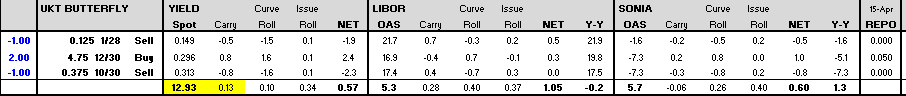

UK : Buy 4.75% 30 vs selling 0.125 28 & 0.375% 30 wtd 1x2x1

Entry: Gross +12.9bps

Add +14bps

Stop +15bps

Target +8bps

Carry: +0.13bps 3mos assuming 5bps negative funding differential

Chart below: Gilt Fly 12/30 vs 1/28 and 10/30 50x50 wtd

vs Level and Slope

Carry Metrics

Duration Distribution Metric

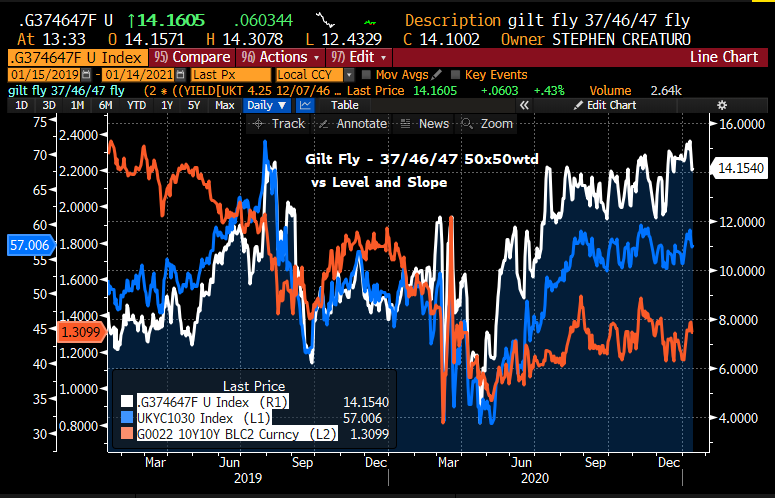

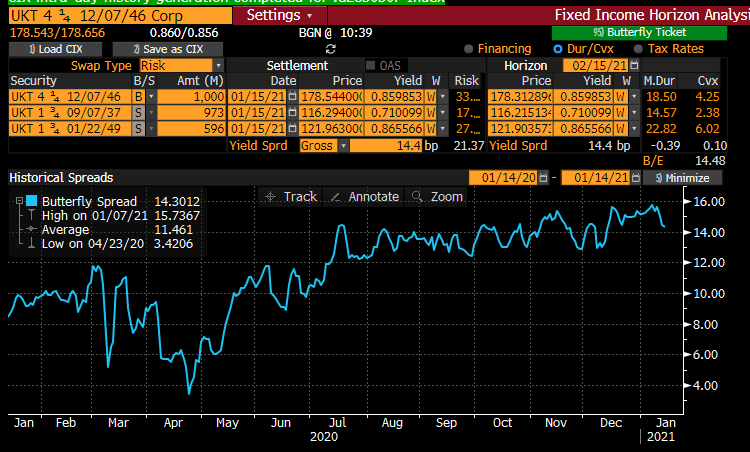

Gilt Trade: Buy 4.5% 46 vs selling 1.75% 37 & 1.5% 47 wtd 1x2x1

Entry: +14.0bps Gross

Add: +15.5bps

Stop: +16.5bps

Target: +9bps

Carry: Flat assuming 5bps negative funding differential

Chart below: UK FLY: 37/46/47

vs Level and Slope

Carry Metrics

Duration Distribution metrics

Happy to discuss.

Creo

![]()

Stephen Creaturo

O: +44 (0) 203 - 143 – 4175

M: +44 (0) 7 809 575 890

E: stephen.creaturo@AstorRidge.com

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This marketing was prepared by Stephen Creaturo, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

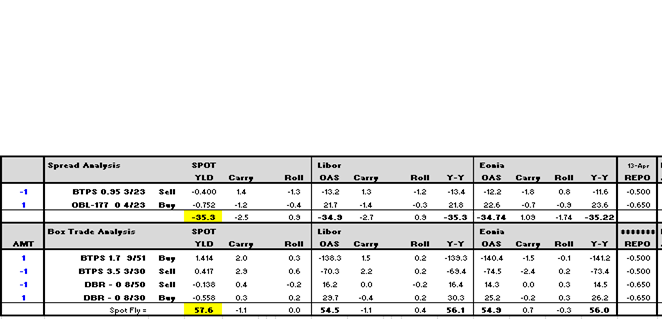

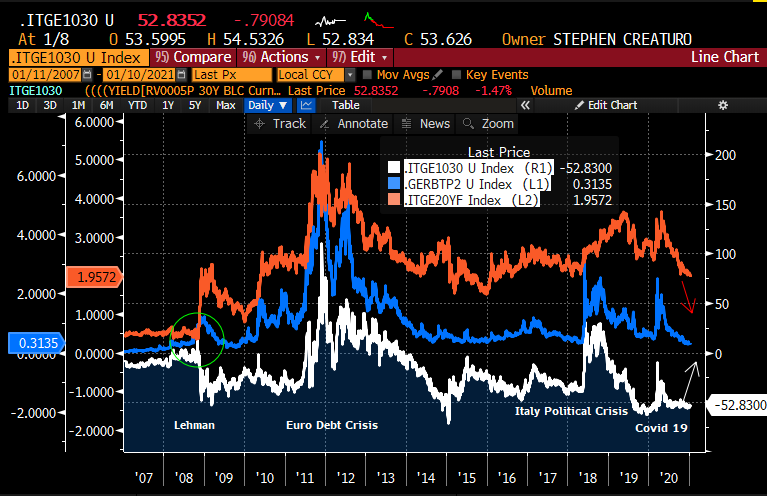

Macro Trade: Italy/ Germany 10-30 box, with 30% short risk in 2y BTP/DBR risk now added.

Trade: 10/30 Flattener Italy vs 10/30 Steeper Germany DVO1 Neutral 100k, plus 30% Short Risk 2yr Italy vs Germany – 30k DVO1

Italy: sell 3/30 vs buying 9/51 +100k

Germany: sell 8/50 vs buying 8/30 -100k

(Have recommended this trade with slightly shorter bonds back in Oct.(75k) – rationale at the time was playing for more of a risk-off trade,

and currently 1.5bps on-side. yet with more ECB support, there is a different dynamic introduced – adding to risk in the event of risk-off, while

introducing partial hedge 2y risk and playing the range(lows) for a slow grind trade that compresses credit risk premium.

Entry: +57bps

Add: +60bps

Stop: +63bps

Target: +30bps

2y Spread Short: sell 3/23 BTPs vs buying OB177 4/23 – -30k(~beta adjusted risk – 2y spd vs 10/30 box)

(contingent)

Entry: -35.5bps

Add: -30.5bps

Stop: -25.0bps

Rationale:

- 10/30 Box has been stable at the higher level amid further tightening of spreads in all tenors from 2yrs to 30yrs

- 20yrFwd 10y spread Italy vs Germany still has room to compress – ie 10/30 flattening Italy relative to 10/30 Germany

(an ~20bps flattening in BTPS in the 10/30y curve will achieve a target in forward 10y spread closer to 155bps) - At each event risk since the Sovg Debt Crisis, Italian spread weakness has proven to be lower and recovery quicker

- ECB and PEPP has produced a new paradigm whereby risk mitigation allows for investors to seek higher returns other than core investments

- With this back-drop we could be embarking on the pre-Lehman levels of lower risk, lower vol. compression, whereby credit term premium

is reduced further out the curve

- Although we may not get back to pre-Lehman levels exactly where there was little in the way of differentiating credit risk, can see a scenario

whereby there is more room for compression further out the curve - Event episodes in the past generally have been favourable to 10/30 flattening in Italy on currency opt-out/default scenario. If no

event risk, then we should see further compression out the curve. If Event risk, 2y spreads will widen and more likely 10/30 box will

flatten as well so a win on both sides.

Risk:

* Supply and benchmark syndication expected for long end Italy sometime over the next month or two will require larger concession in the long end of BTPS

- Market accepts new regime and allow for a permanent adjustment of credit risk premium with sovereign curves, even with spreads overall continuing to compress

Carry&Roll: Here is the rub – negative -0.85bps/mos net overall on the trade. Much of this comes from short 2y Italy vs Germany with a funding differential expected of 15bps.

(hence one of the reasons for not believing we fully go back to pre-Lehman levels when markets were basically funding all sovereigns equally and making no credit adjustment).

If we are in the slow grind tighter with no volatility and/or no risk event, it will be challenging but not impossible to make up C&R on a 3-6mos basis, and will clearly eat into the trade.

But with the potential for more volatility(political event?), C&R will be a fraction of potential upside on the trade.

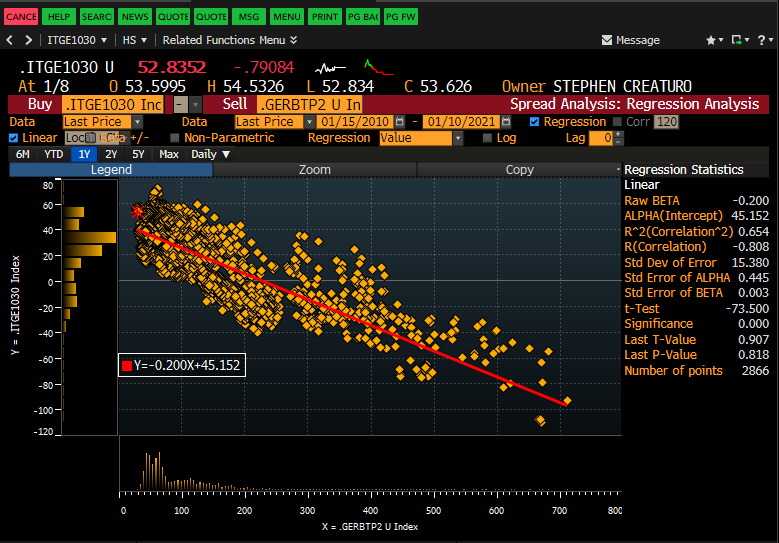

Chart Below: 10/30 Box(Generic Splines) Italy/Germany INVERTED White Line (at the lows(ie cheap on the box)

Italy/Germany 2y Spread – Generic Spline – Blue (at the lows)

Italy/Germany 10y Spread,20y Fwd at +195bps with a target of 155bps

* Basically new paradigm – ECB/PEPP forces lower risk, lower vol trade similar to pre-Lehman levels

Chart Below:

Regression of 2yrs Spreads and 10/30 Italy/Germany Box – 10yrs to capture risk events. – 10/30 cheap.

Using beta+ added risk for 2yrs spreads vs box 30x100 wtd

Happy to discuss.

Creo

![]()

Stephen Creaturo

O: +44 (0) 203 - 143 – 4175

M: +44 (0) 7 809 575 890

E: stephen.creaturo@AstorRidge.com

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This marketing was prepared by Stephen Creaturo, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Gilt Trade - HC Micro RV 30-34-38 - Short Belly

With respect John maybe you're right, but just don't see them as rich as the model suggest. I am trying to put forward and easily symmetric approach to equal weights on 4y gaps to take out of the

equation to some degree level and slope….can look at LC in surrounding bonds as cheaper, but the trade becomes a little bit different ie more directional and more curve bias.

But I appreciate the feed back – and believe me I did take into account your analysis before writing this up, but still came to the conclusion the trade works if you believe we are in a range.

From: John Wentzell <John.wentzell@astorridge.com>;

Sent: 07 January 2021 15:17

To: Stephen Creaturo <stephen.creaturo@astorridge.com>;; Jim Lockard <Jim.lockard@astorridge.com>;; Mark Funsch <mark.funsch@astorridge.com>;; Marc Lamoureux <Marc.Lamoureux@astorridge.com>;; George Whitehead <George.Whitehead@astorridge.com>;; David Sansom <David.Sansom@astorridge.com>;; Robert Baida <robert.baida@astorridge.com>;; Chris Williams <Chris.Williams@astorridge.com>;; James Rice <James.Rice@astorridge.com>;; Will Scott <Will.Scott@astorridge.com>;; Gareth Edwards <gareth.edwards@astorridge.com>;; Peter Joos <Peter.Joos@astorridge.com>;

Cc: Research <research@astorridge.com>;

Subject: RE: Gilt Trade - HC Micro RV 30-34-38 - Short Belly

No one will buy 38's. 2nd richest bond on the curve

John Wentzell

CEO / Founding Partner

Astor Ridge

O: +44 (0) 203 - 143 - 4800

M US: +1 (630) 965 - 3522

M UK: +44 (0) 779 - 505 - 0313

E: John.Wentzell@AstorRidge.com

UK: Dowgate Hill House, 14-16 Dowgate Hill, London, EC4R 2SU

US: 60 Rumson Road, Rumson, NJ, 07760

From: Stephen Creaturo <stephen.creaturo@astorridge.com>

Sent: Thursday, January 7, 2021 9:05 AM

To: Jim Lockard <Jim.lockard@astorridge.com>; John Wentzell <John.wentzell@astorridge.com>; Mark Funsch <mark.funsch@astorridge.com>; Marc Lamoureux <Marc.Lamoureux@astorridge.com>; George Whitehead <George.Whitehead@astorridge.com>; David Sansom <David.Sansom@astorridge.com>; Robert Baida <robert.baida@astorridge.com>; Chris Williams <Chris.Williams@astorridge.com>; James Rice <James.Rice@astorridge.com>; Will Scott <Will.Scott@astorridge.com>; Gareth Edwards <gareth.edwards@astorridge.com>; Peter Joos <Peter.Joos@astorridge.com>

Cc: Research <research@astorridge.com>

Subject: Gilt Trade - HC Micro RV 30-34-38 - Short Belly

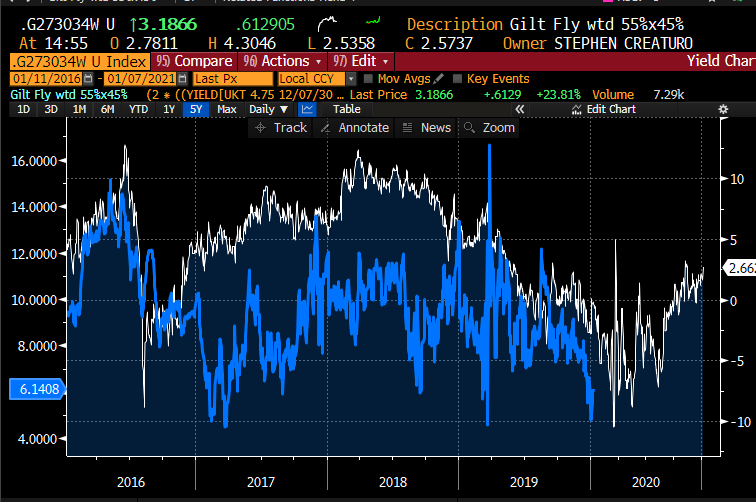

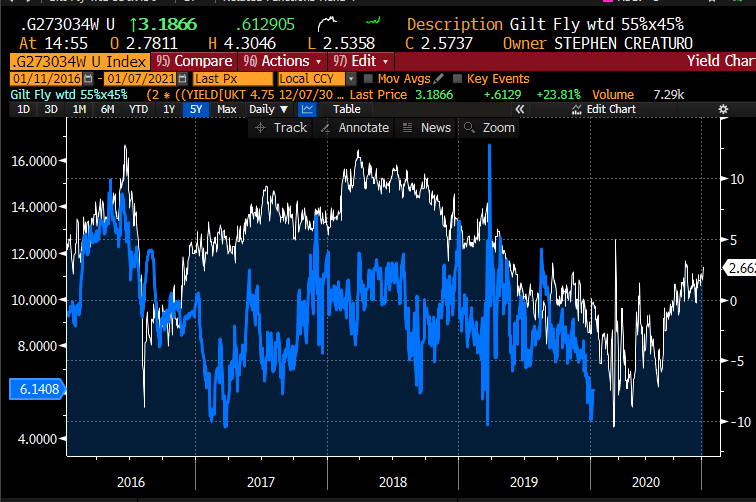

Trade: Sell 4.5% 34 vs buying 4.75% 30(ctd) & 4.75% 38 50x50wtd

Tactical 3mo hold to mitigate carry.

Rationale: Playing the Range – Spread at multi-year lows, currently +6.1bps(range ~4.5 – 15bps)

Curvature of HC rich relative to slope of 10/20 curve generically, but relationship has been less clear post March Covid event

10y CTD 30s underperformer in Q4 – hedge instrument for many locking in rates into year end, should reverse, 10y CTD cheap in curvature relative to level of rates

No imminent impact rolling into and out of DLV Basket, IE long way to go for consideration – range should prevail first before impact of CTD bonds influencing spread

APF has exhausted 30s, but only marginal float remains for both 34s and 38s ~2bl

3x35s taps this qtr will weigh on 34s

Risk: APF exhaust 34s first, similar to pattern of the HC 27s, then 30s.

10/20 curve Flattens on risk event,(but see marginal impact to fly as the level already reflects flatter curve)

AR Model approach suggest 38s from an RV perspective are richer on the curve and begins to adjust 1-2bps for this.

(much of the richness coming from maturity metrics – but when looking at mod duration which we are doing to

achieve a more symmetrical distribution of risk along the curve – this is sharply reduced)

Carry&Roll: Negative -.5bps/3mos – would highlight though half of this is coming from the negative roll-down of models input. Looking

at it another way, we are using 30/34/38s for symmetry in the distribution of risk along the curve, hence 10/20 curve wider

than what Fly implies, if you back out the bond specific roll – you get Neg C&R 1bps/Ann

Entry: +6.15bps(short belly)

Add: +4bps

Stop: +3.25bps

Target: +11.bp

Carry & Roll – 3mos

Spread below: Gilts 30/34/38(HC) vs 10/20 Gilt Curve – Generic Spline

Graph Below: 30/34/38s LAGGED ONE YEAR. vs 27/30/34s wtd 55%x45% to maintain Duration Neutral to assess long term

rolling down of similar structure.

![]()

Stephen Creaturo

O: +44 (0) 203 - 143 – 4175

M: +44 (0) 7 809 575 890

E: stephen.creaturo@AstorRidge.com

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This marketing was prepared by Stephen Creaturo, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Gilt Trade - HC Micro RV 30-34-38 - Short Belly

Trade: Sell 4.5% 34 vs buying 4.75% 30(ctd) & 4.75% 38 50x50wtd

Tactical 3mo hold to mitigate carry.

Rationale: Playing the Range – Spread at multi-year lows, currently +6.1bps(range ~4.5 – 15bps)

Curvature of HC rich relative to slope of 10/20 curve generically, but relationship has been less clear post March Covid event

10y CTD 30s underperformer in Q4 – hedge instrument for many locking in rates into year end, should reverse, 10y CTD cheap in curvature relative to level of rates

No imminent impact rolling into and out of DLV Basket, IE long way to go for consideration – range should prevail first before impact of CTD bonds influencing spread

APF has exhausted 30s, but only marginal float remains for both 34s and 38s ~2bl

3x35s taps this qtr will weigh on 34s

Risk: APF exhaust 34s first, similar to pattern of the HC 27s, then 30s.

10/20 curve Flattens on risk event,(but see marginal impact to fly as the level already reflects flatter curve)

AR Model approach suggest 38s from an RV perspective are richer on the curve and begins to adjust 1-2bps for this.

(much of the richness coming from maturity metrics – but when looking at mod duration which we are doing to

achieve a more symmetrical distribution of risk along the curve – this is sharply reduced)

Carry&Roll: Negative -.5bps/3mos – would highlight though half of this is coming from the negative roll-down of models input. Looking

at it another way, we are using 30/34/38s for symmetry in the distribution of risk along the curve, hence 10/20 curve wider

than what Fly implies, if you back out the bond specific roll – you get Neg C&R 1bps/Ann

Entry: +6.15bps(short belly)

Add: +4bps

Stop: +3.25bps

Target: +11.bp

Carry & Roll – 3mos

Spread below: Gilts 30/34/38(HC) vs 10/20 Gilt Curve – Generic Spline

Graph Below: 30/34/38s LAGGED ONE YEAR. vs 27/30/34s wtd 55%x45% to maintain Duration Neutral to assess long term

rolling down of similar structure.

![]()

Stephen Creaturo

O: +44 (0) 203 - 143 – 4175

M: +44 (0) 7 809 575 890

E: stephen.creaturo@AstorRidge.com

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This marketing was prepared by Stephen Creaturo, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade Idea 5/10 France Steeper vs 75% hedge OE/RX Flattener

Trade: Buy FRTR 0.75% 3/25 vs Selling FRTR 0.75 11/28(CTD OATH0) 100k Risk

Sell DBR 0.5% 2/25(OEM0) vs Buying DBR 0.25% 2/29(RXH0 or M0) 75K Risk

Entry: -10.5bps, add -9.0, Target -16bps

Carry and Roll – Net 0.5bps Positive – 3mos

Rational:

- Level of German rates has been a strong driver for compression of spreads – Not looking for us to revisit of the August 2019 low in yields

- 10yrs currently expensive on the French Curve (5/10/30y) – Bottom Chart

- Next up supply point will be 10y and longer – France will shift to sharply negative NET Funding in March(approx. 14bl)

- Both 5y and 10y Spreads vs core at muli-qtr lows( and only several bps from multi-year lows) – looking for either stabilization of spreads with 10yrs cheapening(supply trade or directional trade)

or risk-off trade where 10yrs widening faster than 5yrs while investors attempt to shorten credit term risk premium profile while maintaining exposure to France.

- 75% Hedge with OE/RX produces less volatility – mitigates to some degree further downside should yields come lower & spreads tighten further.

- Relative ease of executing the trade given ¾ of the trade is done through futures

- Carry + Roll is marginally positive assuming 13bps differential in funding

- RV – taking advantage of Cheap 5yrs in France, and marginally expensive current French CTD falling out of the basket in a couple of weeks time

|

|

Butterfly Analysis |

|

YIELD |

|

|

Curve |

Issue |

|

EURIBOR |

Frwd |

|

Curve |

Issue |

|

|

Eonia |

|

|

|

|

25-May |

Rich Cheap |

R-C |

LIBOR |

|

EONIA |

|

|

|

|

|

Spot |

Frwrd |

Carry |

Roll |

Roll |

NET |

OAS |

AsSwp |

Carry |

Roll |

Roll |

NET |

Y-Y |

OAS |

F OAS |

Carry |

|

Y-Y |

REPO |

Analysis |

NET |

OAS |

Yld |

OAS |

DUR |

|

-1 |

FRTR 0.75 11/28 |

Sell |

-0.296 |

-.29 |

0.5 |

1.6 |

0.0 |

2.1 |

12.6 |

12.6 |

-0.2 |

0.5 |

-0.2 |

0.1 |

13.0 |

-3.1 |

-3.2 |

0.1 |

|

-2.3 |

-0.455 |

FRTR 0.75 11/28 |

0.7 |

0.6 |

0.1 |

0.6 |

2.7 |

|

1 |

FRTR 0 3/25 |

Buy |

-0.509 |

-.51 |

-0.2 |

1.4 |

0.5 |

1.6 |

18.8 |

19.1 |

-0.3 |

0.6 |

0.5 |

0.7 |

18.8 |

3.5 |

3.6 |

-0.1 |

|

4.2 |

-0.455 |

FRTR 0 3/25 |

(1.3) |

(1.4) |

(1.3) |

(1.6) |

(0.6) |

|

0.75 |

DBR - 0.25 2/29 |

Buy |

-0.508 |

-.506 |

0.2 |

1.1 |

0.1 |

1.4 |

34.7 |

35.0 |

-0.2 |

0.0 |

0.0 |

-0.2 |

35.4 |

19.0 |

19.1 |

-0.2 |

|

20.0 |

-0.585 |

DBR - 0.25 2/29 |

0.3 |

0.3 |

(0.0) |

0.3 |

1.2 |

|

-0.75 |

DBR - 0.5 2/25 |

Sell |

-0.653 |

-.656 |

-0.3 |

0.5 |

0.0 |

0.2 |

32.6 |

33.1 |

-0.2 |

-0.3 |

0.0 |

-0.4 |

33.1 |

17.3 |

17.6 |

-0.2 |

|

18.4 |

-0.585 |

DBR - 0.5 2/25 |

0.1 |

0.1 |

0.2 |

0.1 |

(0.3) |

|

|

Spot Fly = |

|

-10.3 |

-10.6 |

-0.3 |

0.2 |

0.5 |

0.5 |

-7.8 |

-8.0 |

-0.1 |

0.3 |

0.6 |

0.8 |

-7.6 |

-7.8 |

-8.0 |

-0.2 |

|

-7.7 |

|

|

1.9 |

1.8 |

1.7 |

2.0 |

2.1 |

Chart Below:(Inverted for ease of graph– Long Term 5/10 Box France vs Germany (Purple Line) – Since 2019 – Lower Rates(10y Bunds – Green Line)

means tighter spread and flatter Credit Term Premium . Bottom Panel – both 5y and 10y French Spreads vs Germany

Chart Below: 5/10/30 Fly 50/50 wtd – Using Generic Rates – CMT Spline curves.

![]()

Stephen Creaturo

O: +44 (0) 203 - 143 – 4175

M: +44 (0) 7 809 575 890

E: stephen.creaturo@AstorRidge.com

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This marketing was prepared by Stephen Creaturo, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

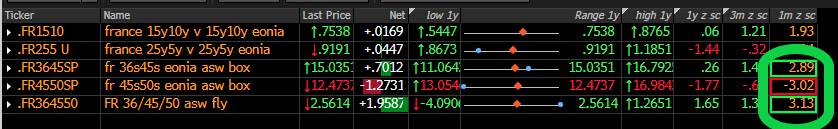

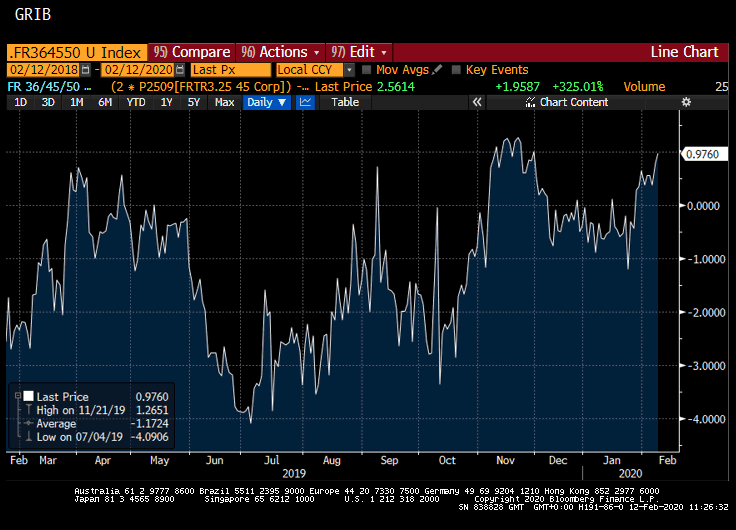

Trade idea: France 36s45s50s eonia YY asw fly, French 45s v cheap

CIX =

(2 * P2509[FRTR3.25 45 Corp]) - P2509[FRTR 1.25 36 Corp] - P2509[FRTR 1.5 50 Corp]

Trade idea: buy belly of 36s45s50s eonia YY asw fly @ 0.8bps or better

I started this exploration by comparing the different asw curves in rates. My thesis is that we’re now already Japan or soon to be Japan.

What stands out is the cheapness of the French (green line) 25yr asw.

1 month z scores at extremes.

ASW Fly Levels are at range extremes:

3m carry and roll = +0.1bps

Buy 45s on the asw fly around here + 0.8bps or better and look to exit around -1.5bps.

The reason I prefer the asw fly is that for me, it’s the best way to capture and isolate the anomaly value.

Please feel free to share any thoughts or feedback. It would be greatly appreciated.

Warm regards,

Mike

![]() image003.jpg@01D57AD2.CB892020">

image003.jpg@01D57AD2.CB892020">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 EAST 49th Street, New York NY 10017

Office: +44 (0) 203 -143 - 4171

Mobile: +44 (0) 7989-854-611

Email: mike.ohr @astorridge.com

Website: www.astorridge.com

This commentary was prepared by Mike Ohr at Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and it should be treated as a marketing communication even if it contains a research recommendation. A history of his commentary can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge does not engage in market making or proprietary trading, and has no position in any security discussed in this e-mail. The views in this e-mail are those of the author(s) and are subject to change.. Any recommendations contained herein reflect solely those of the author and were prepared independently of Astor Ridge or its affiliates. This publication does not constitute personal investment advice and may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate recommendations discussed herein. Actual investment returns may fluctuate as a result of changes in economic and market conditions (including market liquidity). Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by us is owned by us.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

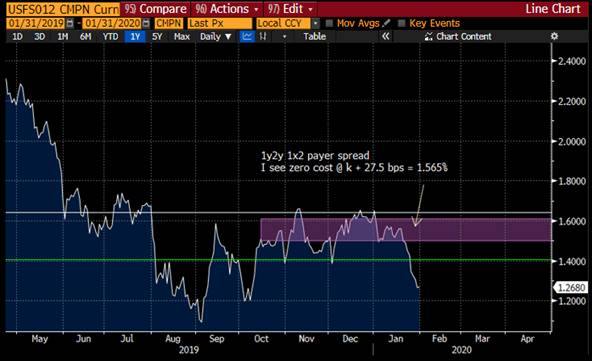

USD Front end: buy 6m2y 1 x 2 payer spread @ zero cost

Here it is again including breakeven rates and vol stats (z-scores)

__________________________________________________________________

So I’ve been racking my brain looking for the best way to make money near term on the back of the Fed’s continuing liquidity operations.

For me, this is the best expression:

- We now know that Fed will continue bill purchases $60bn per month until April, and expect them to taper to $30bn in May and June.

- Fed also announced that they will extend their repo operations (Term OMOs) at least through April to ensure excess supply of reserves beyond their stated $1.5trn floor.

My view is that the Front end is pegged at least til April (3 months) and I would argue for a lot longer than that.

After much consideration, I think that 1x2s payer spreads are the best way to take advantage of this.

I looked at many expiries but 6m2y and 1y2y came out best. (1y2y gives a little extra cushion (higher otm strike) but sacrifices optimal 3m decay)

6m2y 1x2 payer spread

Atm = 1.343%

Otm + 18 bps for zero cost = 1.523%

Trade makes money as long as 2y rate is below 1.703% at expiry

3m decay = +2.7bps for this structure

1y2y 1x2 payer spread

Atm = 1.29%

Otm + 27.5 bps for zero cost = 1.565%

Trade makes money as long as 2y rate is below 1.84% at expiry

3m decay = +2.4bps for this structure

Vol Stats Here:

1m z-scores are elevated for vol and skew (using atm +25bps as a proxy)

Please let us know your thoughts, your feedback is much appreciated.

Best regards,

Mike

![]() image003.jpg@01D57AD2.CB892020">

image003.jpg@01D57AD2.CB892020">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 EAST 49th Street, New York NY 10017

Office: +44 (0) 203 -143 - 4171

Mobile: +44 (0) 7989-854-611

Email: mike.ohr @astorridge.com

Website: www.astorridge.com

This commentary was prepared by Mike Ohr at Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and it should be treated as a marketing communication even if it contains a research recommendation. A history of his commentary can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge does not engage in market making or proprietary trading, and has no position in any security discussed in this e-mail. The views in this e-mail are those of the author(s) and are subject to change.. Any recommendations contained herein reflect solely those of the author and were prepared independently of Astor Ridge or its affiliates. This publication does not constitute personal investment advice and may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate recommendations discussed herein. Actual investment returns may fluctuate as a result of changes in economic and market conditions (including market liquidity). Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by us is owned by us.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796